![]() Tweet I thought the market would crash in the wake of the Earthquake / Tsunami / Nuclear Meltdowns at Fukushima. It didn’t. However, something much less serious may be bringing the market – and the economy – to it’s knees. Politics. The Voice of America reported here that Standard & Poors downgraded US debt from AAA to AA+. Click here for the S&P’s Special Report and here for the full report.

Tweet I thought the market would crash in the wake of the Earthquake / Tsunami / Nuclear Meltdowns at Fukushima. It didn’t. However, something much less serious may be bringing the market – and the economy – to it’s knees. Politics. The Voice of America reported here that Standard & Poors downgraded US debt from AAA to AA+. Click here for the S&P’s Special Report and here for the full report.

S&P’s analysts wrote:

The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.

In the discussions over the debt ceiling, John Boehner said something to the effect that if a family or a business is borrowing too much it simply must tighten it’s belt.

This may be true. It also may be true that a family has tightened it’s belts so much that there is no room left to cut. What do you cut when you have to choose between food and medications? Sure you can quit smoking and stop eating meat – you’ll save money and be healthier – but what if you’ve already quit smoking, quit eating meat and now you’re down to one meal a day, and it’s either dog food and stone soup? What do you do when it’s food or rent? Or food or medication?

This may be true. It also may be true that a family has tightened it’s belts so much that there is no room left to cut. What do you cut when you have to choose between food and medications? Sure you can quit smoking and stop eating meat – you’ll save money and be healthier – but what if you’ve already quit smoking, quit eating meat and now you’re down to one meal a day, and it’s either dog food and stone soup? What do you do when it’s food or rent? Or food or medication?

And if a family needs more income one solution to go out and work. The Republicans want to shrink government – are shrinking government – which means firing government workers – teachers, FAA workers, construction workers. This is the equivalent of quitting your job and telling your husband / wife and kids to stay home and quit school because you didn’t get a raise and can’t afford pencils and notebooks.

And if a family needs more income one solution to go out and work. The Republicans want to shrink government – are shrinking government – which means firing government workers – teachers, FAA workers, construction workers. This is the equivalent of quitting your job and telling your husband / wife and kids to stay home and quit school because you didn’t get a raise and can’t afford pencils and notebooks.

In strict economic terms it’s bad on the micro-economic level for the people who get fired, and bad on the macro-economic level for everyone.

John Boehner, Eric Cantor, and other members of the Tea and Republican parties may label themselves “Job Creators,” but this is like Nicole Polizzi, who plays “Snookie” on the MTV program “Jersey Shore,” calling herself a “serious actor.” She may be effective as “Snookie,” but I don’t think she’d be effective as Juliet. Boehner, Cantor, and Ms. Polizzi can call themselves whatever they want. Reality may differ. Steve Benen, writing in Washington Monthly, here, noted:

Fed Chairman Ben Bernanke projects 200,000 job losses; Moody’s Analytics chief economist Mark Zandi puts the number at 700,000 job losses; the Economic Policy Institute projects job losses of just over 800,000; and data from the Center for American Progress found the proposal would force roughly 975,000 Americans from their jobs. Goldman Sachs didn’t offer specific numbers on job losses, but it believes the GOP plan would cost us up to 2% of GDP, pushing the U.S. economy closer to a recession.

All of these projects have one thing in common: experts agree that the Republican plan would make the economy and unemployment much worse. GOP leaders don’t care, but consensus is hard to avoid.

Boehner seems to have forgotten, however, that the government is not a business. If it is, then it’s a monopoly. There is, after all only one Federal government. It can simply raise prices – or taxes – “The price we pay for civilization,” according to Justice Oliver Wendell Holmes. President Bush cut $100 Billion per year in taxes from the wealthiest Americans, like Paris Hilton, Mike Tyson, Warren Buffett, other business leaders, athletes, and celebrities. I have great respect for Ms. Hilton, Mr. Tyson, and Mr. Buffett. But I don’t understand why I should subsidize their lifestyles or why they should not pay their fair share of taxes. Uncut those taxes and we would see $1 trillion in 10 years.

Boehner seems to have forgotten, however, that the government is not a business. If it is, then it’s a monopoly. There is, after all only one Federal government. It can simply raise prices – or taxes – “The price we pay for civilization,” according to Justice Oliver Wendell Holmes. President Bush cut $100 Billion per year in taxes from the wealthiest Americans, like Paris Hilton, Mike Tyson, Warren Buffett, other business leaders, athletes, and celebrities. I have great respect for Ms. Hilton, Mr. Tyson, and Mr. Buffett. But I don’t understand why I should subsidize their lifestyles or why they should not pay their fair share of taxes. Uncut those taxes and we would see $1 trillion in 10 years.

Mr. Buffett has noted, several times, including the Daily Finance, that he pays taxes at a lower rate than his secretary. “I think there should be tax increases for people in the high income levels,”Buffett, the “Oracle of Omaha,” said.

The economy is in bad shape. Unemployment is over 9%. As Paul Krugman notes, in “The Wrong Worries,” the New York Times, people in Washington are “Obsessing over deficits while the economy is crumbling.” Krugman continues:

In June, 2007, around 63 percent of adults were employed. In June 2009, the official end of the recession, that number went down to 59.4. As of June 2011, two years into the alleged recovery, the number was: 58.2.

These may sound like dry statistics, but they reflect a truly terrible reality. No only are vast numbers of Americans unemployed or underemployed, for the first time since the Great Depression many American workers are facing the prospect of very-long-term – maybe permanent – unemployment. Among other things, the rise in long-term unemployment will reduce future government revenues, so we’re not even acting sensibly in purely fiscal terms. But, more important, it’s a human catastrophe.

And why should we be surprised at this catastrophe? Where was growth supposed to come from? Consumers, still burdened by the debt that they ran up during the housing bubble, aren’t ready to spend. Businesses see no reason to expand given the lack of consumer demand. And thanks to that deficit obsession, government, which could and should be supporting the economy in its time of need, has been pulling back.

I agree with Krugman, as would John Maynard Keynes and Franklin Delano Roosevelt. We need to invest in infrastructure and education, to plan for the long term.

I agree with Krugman, as would John Maynard Keynes and Franklin Delano Roosevelt. We need to invest in infrastructure and education, to plan for the long term.

For example, investing in a clean, renewable, sustainable energy infrastructure. Bruce Katz, at the Brookings Institution, says the transformation to a clean, renewable energy infrastructure would create 2.7 million jobs (here). That would lower unemployment from 9.1% to 7.3%. It would also stimulate housing and other sectors – further reducing the unemployment rate. And the power would be clean – no arsenic, lead, mercury, uranium, zinc, or carbon dioxide. It would be good for the environment as well as the economy. In 1961 we put in motion a plan to send Americans to the moon, and brought them back safely in 10 years. We met our goal. We can change the energy paradigm for $1.2 Trillion and do it within 25 years.

On a side note, the simplest, if least elegant and least poetic definition of “managing for sustainability” is “long term thinking.” Other definitions include

John Ehrenfeld’s “flourishing forever.”

The Brundlandt Commission’s “meeting the needs of the present without jeopardizing the abilities of future generations to meet their needs.”

My “Harnessing natural processes rather than consuming natural resources.”

But how badly did the stock market crash? The Dow Jones Industrial Average dropped 512 points on 8/4/11. It is 1434 points off the recent high of 12,810, reached on April 29, 2011. It is also 2616 points below the peak of the high of 14060 reached on Oct. 5, 2007. But, the index is 4818 points above the low of 6627 reached on May 9, 2009. The stimulus President Obama put is place may not have been adequate, but the economy is marginally stronger.

In the 521 day slide from 10/5/07 to 3/9/9 the Dow dropped by 53%. In the 98 day slide from April 29 to August 5 the Dow dropped by 11%.

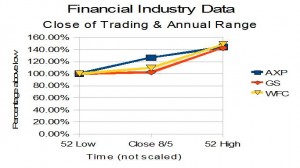

This graph is constructed from the prices of American Express, Goldman Sachs, and Wells Fargo, as indicated on the Internet. American Express is 10 points and 26.7% above the lowest it’s been in the past 52 weeks. 6 points below the high. Goldman is 2.55% above this point, and Wells Fargo is 9.51% above it. Similarly Berkshire Hathaway, managed by Warren Buffett, is about 19.8% below the high, and less than 2% above its 52 week low point.

This graph is constructed from the prices of American Express, Goldman Sachs, and Wells Fargo, as indicated on the Internet. American Express is 10 points and 26.7% above the lowest it’s been in the past 52 weeks. 6 points below the high. Goldman is 2.55% above this point, and Wells Fargo is 9.51% above it. Similarly Berkshire Hathaway, managed by Warren Buffett, is about 19.8% below the high, and less than 2% above its 52 week low point.

The same holds for various technology stocks. Apple is 140 points above the low, 30 points below the high, and, perhaps, at the lowest it will be for the next 12 months, or 12 years. Google, a technology saavy data company, is about 65% between the low and high. IBM is close to the highest it’s been, Intel is in the middle, Microsoft is close to the low, Research in Motion, the Canadian based company that makes and programs Blackberries, is basically at the lowest it’s been in the last 12 months. It will either recover or fade into oblivion.

| Company | Symbol | Close 8/5 | 52 Low | 52 High |

| American Express | AXP | 47.29 | 37.33 | 53.8 |

| Goldman Sachs | GS | 125.47 | 122.35 | 17534 |

| Wells Fargo | WFC | 25.21 | 23.02 | 34.25 |

| Berkshire Hathaway | BRK.A | 107,300 | 105,220 | 131,463 |

| Apple | AAPL | 373.62 | 235 | 404.5 |

| GOOG | 579.04 | 447.65 | 642.96 | |

| IBM | IBM | 173.3 | 122.28 | 185.63 |

| Intel | INTC | 20.79 | 17.6 | 23.96 |

| Microsoft | MSFT | 25.68 | 23.32 | 29.49 |

| Research in Motion | RIMM | 23.39 | 22.54 | 70.54 |

Adding in the Earnings per Share data and Price Earnings Ratios and looking at other companies believed to be well managed reinforces these conclusions.

| Company | Symbol | Close 8/5 | 52 Low | 52 High | EPS | P/E |

| American Express | AXP | 47.29 | 37.33 | 53.8 | 12.34 | 3.82 |

| Goldman Sachs | GS | 125.47 | 122.35 | 17534 | 10.18 | 12.3 |

| Wells Fargo | WFC | 25.21 | 23.02 | 34.25 | 2.58 | 9.78 |

| Berkshire Hathaway | BRK.A | 107,300 | 105,220 | 131,463 | 6,580 | 16.31 |

| Apple | AAPL | 373.62 | 235 | 404.5 | 25.26 | 14.69 |

| Abovenet | ABVT | 58.01 | 48.19 | 78.07 | 2.67 | 21.96 |

| Brocade | BRCD | 3.52 | 3.28 | 7.3 | 0.2 | 17.09 |

| CommVault | CVLT | 40.21 | 18.78 | 47.55 | 0.53 | 76.18 |

| GOOG | 579.04 | 447.65 | 642.96 | 27.73 | 20.88 | |

| IBM | IBM | 173.3 | 122.28 | 185.63 | 12.28 | 14.09 |

| Intel | INTC | 20.79 | 17.6 | 23.96 | 2.18 | 9.52 |

| Microsoft | MSFT | 25.68 | 23.32 | 29.49 | 2.7 | 9.52 |

| Paetec | PAET | 4.98 | 3 | 5.39 | -0.42 | undef |

| Research in Motion | RIMM | 23.39 | 22.54 | 70.54 | 6.3 | 3.68 |

(Disclosure: If I had cash I would invest in some of these companies.)

The question of whether the market will go up is really whether the economy will recover. Goldman will thrive regardless of the state of the economy. It proved that by selling credit default swaps and instruments betting on foreclosures. American Express will profit if people use their credit cards. Wells Fargo will thrive if people have jobs, get paid, save money, and pay off their debts. Apple will sell computers, phones, tablets, music players, music, video, software, and services – as long as people can afford to buy them. AboveNet sells telecommunications services with a cool fiber network that spans the globe. It’s success is dependent on a strong global economy. Brocade makes really cool network gizmos. CommVault writes software to backup and restore data. Google, as noted, sells advertising. It is more like ABC, CBS, and NBC, rolled into one, in the days before cable. IBM, Intel, Microsoft are household names. Paetec, like Abovenet, is a small telecommunications company. They have good products and good service.

And as noted above, Research in Motion will either recover or fade. In that it is, while Canadian, Research in Motion is a metaphor for the US economy. Given the first ever downgrade by a ratings agency of US bonds, it looks like fade is a real possibility. We can tell ourselves that we’re riding a magic carpet, but as Arthur C. Clarke said, in Profiles of the Future, “Any sufficiently advanced technology is indistinguishable from magic.”