When stocks on the Shanghai Securities Exchange, the SSE, “corrected” on August 24, 2015, stocks in US and other markets followed. But nothing has fundamentally changed. None of the “Fundamentals” on any publicly traded U.S. or European companies have significantly changed (other than the Market Capitalization and Price Earnings ratios, which are, of course, functions of the stock price). Earnings per Share, EPS, the existence or lack thereof of what Warren Buffett calls a “moat,” debt to asset ratios, return on income, other financial ratios, were and remain unaffected by day to day fluctuations of stock price.

Stocks that were fundamentally bad investments on Friday, August 21, 2015 were likely to have been bad investments on Tuesday. August 25, 2015. Stocks that were good investments on Friday, August 21, 2015, were fundamentally somewhat better investments on Tuesday. August 25, 2015.

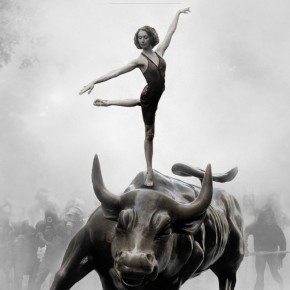

Dancing on the Charging Bull

The SSE Composite is not the S&P 500, or even the Dow. While there are frequent scandals involving insider trading and other financial improprieties, they are the exception and there are regulations designed to keep them that way. China, on the other hand …

The Shanghai Stock Exchange Composite index, the SSE Composite, looks kind of like the S&P 500. However, there are key differences between the indices.

The SSE Composite, defined on Investopedia, here, as, “A market composite made up of all the A-shares and B-shares that trade on the Shanghai Stock Exchange. The index is calculated by using a base period of 100; the first day of reporting was July 15, 1991.”

The S&P 500 is defined on Investopedia, here, as “An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. … Companies included in the index are selected by the S&P Index Committee, a team of analysts and economists at Standard & Poor’s. The S&P 500 is a market value weighted index – each stock’s weight is proportionate to its market value.”

The Dow Jones Industrial Average, defined on Investopedia, here, “is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896.”

The SSE Composite is ALL the shares on the SSE, the S&P 500 is a weighted index of the 500 stocks based on several factors, including size, liquidity, etc. And the Dow is a price-weighted average of 30 “significant stocks” traded on the New York Stock Exchange and the NASDAQ.

But the biggest differences are in a) the underlying markets, the stock exchanges themselves, b) the quality of publicly available data on the companies and c) the existence of independent regulatory agencies.

Companies listed on the stock exchanges in New York, like those listed in European, Canadian and Israeli markets are required to disclose material financial information to regulatory agencies such as the SEC in the US, various provincial authorities in Canada, the ISA in Israel, the Ba Fin in Germany, etc. (Financial regulatory authorities, by country, on Wikipedia, 29 August, 2015, here.)

Companies listed in the Chinese stock markets are either owned in part by the government of the PRC, are run by people well connected to the Politburo in Beijing, or both.

In the U.S., Enron, Global Crossing, World Com, Lehman Brothers and Halliburton were aberrations. There are law enforcement agents dedicated to investigating and prosecuting financial wrongdoing. In China there are no independent auditors. There is no true private sector. There is no difference between the government or law enforcement and these companies.

Therefore, in the U.S. and in countries with regulated markets, people can make investment decisions based on underlying financial data that is available to the public and which can be expected to be reliable. In China people can make what they call “investment desisions” based on what government-run media say about government-run or government-crony-run enterprises – these data can not be expected to be reliable.

–

Recent Financial Scandals in the U. S.

- Enron, 2001, famously cooked the books (Time, CNN, Investopedia).

- Global Crossing, 2002, was 4th Largest U.S. Bankruptcy at the time, in 2002, Investopedia, Blog Post, NY Times)

- MCI / World Com, 2002, at the time the largest bankruptcy in U.S. history (Investopedia). The stock went from $15 per share to $0.20 per share.

- Lehman Brothers, 2008 became the largest bankruptcy in U.S. history. (Investopedia, Yale School of Management).

- Halliburton’s former CEO, Dick Cheney, appears to have been given $34 Million in bonuses (Polifact, here) when he became Vice President. Mr. Cheney has also been accused by U.S. Senator Rand Paul, R., Kentucky, (Informed Comment, here) of giving Halliburton $1 Billion in no-bid contracts at the start of the Iraq war.

- See also How to Smell a Rat, by Ken Fisher, here.

–

An analyst with Popular Logistics, I hold a BS and an MBA in “Managing for Sustainability” from Marlboro College, and over 20 years experience in Information Technology. Available as a speaker and consultant, I can be reached at “L Furman” at Popular Logistics . com”. Investments in equities are risky. I do NOT hold a Series 7 license from the SEC or any other corresponding credential from any other agency. I am NOT a licensed stock broker, investment adviser or financial adviser and this should n0t be considered “Financial Advice” or “Investment Advice.”