Apple, if it can be compared to Google, IBM, Intel, Microsoft, and Oracle, should be priced at 665 per share. This analysis is simply based on Stock Price, Earnings per Share (EPS) and the Price Earnings ratio. or P/E. The average P/E of these companies is 15.08. If Apple’s stock was 15.08 times earnings, it would be 665. If you take Apple out of the mix, the average P/E becomes 16.01. At 16.01 times earnings, Apple’s stock price would be 705. And if priced like Google, $1077. Continue reading

Category Archives: Apple

Apple: Worms Eating the Core or Golden?

Apple stock closed on October 9, 2012 at $635. While up $247, or 64%, for the year, the stock price has dropped 70 points, 10%, from the peak of $705 reached on Sept. 21, 2012. Where will it go next? What caused this 10% drop? And what about Amazon, Google, Microsoft, & Research in Motion?

Here’s what I think:

- Apple (AAPL) will announce earnings on October 25, 2012. I expect $46.79 to $48.9 per share on an annualized basis, up 10 to 15% from the current $42.54 per share.

- Apple’s share price will increase back to $700, and then to $750 by year-end, 2012.

- Amazon (AMZN), Google (GOOG) and Microsoft (MSFT) will be stable thru to year-end, 2012.

- Research In Motion (RIMM) will be acquired by June 2013.

Apple & Blackberry – Yesterday, Today, & Tomorrow

Back in 1999, I was walking down a hall to the data center of a US Navy base in Virginia, when I noticed a sign that said “Cell Phones Prohibited. Deadly Force Is Authorized in this Area.” Fortunately my cellphone didn’t ring.

Back in 1999, I was walking down a hall to the data center of a US Navy base in Virginia, when I noticed a sign that said “Cell Phones Prohibited. Deadly Force Is Authorized in this Area.” Fortunately my cellphone didn’t ring.

One of my colleagues had an Apple Newton. Just as the Osborne and Kaypro led to the Compaq and the laptops, PDAs running the Newton operating system and PDAs from Go Computers led to the Palm Pilot, and ultimately to the iPod, iPhone, and iPad, but that’s another story.

Research In Motion had just introduced the Blackberry 850 handheld. My colleagues in the financial industry had them. I understood the potential and wanted one. That too is another story.

Apple, Google, IBM – the way forward

Back in 1965, IBM CEO Thomas J. Watson, Jr, wrote, in IBM’s Basic Beliefs & Principles,

“We accept our responsibilities as a corporate citizen in community, national, and world affairs; we serve our interests best when we serve the public interest…. We want to be at the forefront of those companies which are working to make the world a better place.”

Today, IBM says “Sustainability is no longer an option. Sustainability is an imperative.” IBM is focused on making data centers and supply chains more efficient, and providing their customers with tools to become less unsustainable (IBM green blog). The European Commission awarded IBM for energy efficiency at 27 data centers (IBM Press Release).

However, it looks to me that Google and Apple are one or two steps ahead of IBM. Google has invested $915 Million in solar arrays, which should be 1.0 to 1.5 MW. Apple is putting a 5MW solar array on the roof of it’s headquarters in Cupertino, pictured above, and described here on Treehugger and here on 9to5mac. Apple is also using solar and biofuel to power it’s new data center in South Carolina (article in Renewable Energy World). Essentially:

- A 100-acre, 20 megawatt (MW) solar array, supplying 42 million kWh of energy each year.

- A 5 MW biogas system to come online later this year, providing another 40 million kWh of 24×7 baseload renewable energy annually. Apple claims this will be the largest non-utility-owned fuel cell installation in the US.

- Combined, that’s 82 million kWh/year of onsite renewable energy generation at the facility.

For more details, see the 2012 Apple Facilities Report.

Apple’s building may be a derivative design of the Widex headquarters, in Allerød, Denmark, described on Widex home page, here. The Widex building is a ring that surrounds a large atrium courtyard to be planted with grass, flowers and trees and is according to Widex,”designed to be both pleasant to look at and be in…. and environmentally friendly

Heat for the building will be supplied by a geothermal system, where groundwater is used like a heat reservoir; excess heat in summer can be stored and used when needed during winter. Our ambition is to reduce energy consumption by 75 percent compared to traditional technology.

Apple, Google, and IBM report high profits. Their stock prices are also high, perhaps demonstrating the correlation between doing well and doing good.

Outsourcing – A Communist Plot? Remember Khrushchev?

Mark Landler and Edward Wong, covering Chinese Vice President Xi Jinping’s trip to the US, in the New York Times, Feb 14, With Edge, U.S. Greets China’s Heir Apparent, wrote,

“On the list of American concerns, Mr. Biden said, were China’s artificially depressed currency and conditions imposed by the Chinese that require foreign companies to turn over technology in return for doing business in China. He raised the issue of jailed Chinese dissidents and … Syria”

In Inflaming Trademark Dispute, Second City in China Halts Sales of the iPad, published in the NY Times, Feb. 14, 2012, Michael Wines wrote:

“The authorities in a second Chinese city have begun seizing iPads from local retailers in an escalating trademark dispute between Apple and Proview Technology. … The seizures follow a ruling in December in which a court in Shenzhen dismissed Apple’s contention that it owned the iPad name in China. … Proview has also made a filing with the General Administration of Customs in China putting Apple on notice that the company could seek to block the export of iPads, should Proview’s ownership claims be upheld. … the seizures and the filing are warnings by Proview of the havoc it could wreak unless Apple agrees to pay a large fee to settle the trademark fight. … Paradoxically, China’s intellectual property laws are so sweeping that they allow the government to ban the worldwide sale of any made-in-China product that is found to violate a Chinese patent, trademark or other protection.”

Remember back during the cold war, when Soviet Premier Nikita Krushchev said “Whether you like it or not, history is on our side. We will bury you.” ( various quotes by Kruschev).

And later when the American computer company DEC, in response to reverse engineering of VAX computers by Soviet computer scientists inscribed, in Russian,“CVAX, … When you care enough to steal the very best” on the CVAX microprocessors. (Links: TRAILING EDGE.com, CNET, FSU.edu.)

Suppose Khrushchev had called John Kennedy, on the occasion of John Glenn’s orbit in the Friendship 7, February 20, 1962, here, or Leonid Brezhnev had called Richard Nixon, after Neil Armstrong, Buzz Aldrin, and Michael Collins returned from the moon in Apollo 11, July 24, 1969, Apollo 11, or Mikhail Gorbachev had answered Ronald Reagan’s call to “tear down this wall,” and said

“Mister President, I have business proposition for you: Let us to build your consumer goods. We have factories with skilled laborers. Our workers are like children, so eager to please. (Ok, they are children.) We can more or less match your quality control. We can deliver on time. And we do this for pennies on the dollar – pennie!

“All we ask is you give us designs for the products, and computer software source code for computers and telecommunications de-wices we assemble. It will be great Soviet / American partnership.”

Presidents Kennedy, Nixon, and Reagan would have said

“Give you our designs? Our software? That’s our intellectual property? Are you nuts? That would be crazy!”

Premiers Khrushchev, Brezhnev, and Gorbachev might have answered,

“But our labor costs are much lower than yours. We have workers in factories, happy workers in the ‘Worker’s Paradise.’ Why. workers in our factories in Siberia work 7 days a week. And for little more than food and water. Go on strike? Never! (If they did we would shoot them.) You won’t have to pay them union scale or retirement benefits.”

Presidents Kennedy, Nixon, and Reagan would still have said

“Give you our designs? Our software? Our intellectual property? So you can use children and slave labor to build our consumer goods? That would destroy our middle class. That would be nuts.”

And they would have been right.

So how exactly are the Chinese communists different from the Soviet communists?

We wouldn’t outsource to the Soviet Union. Why are we outsourcing to China?

Apple, Blackberry, and Classical Physics

In “The World Will Not End, and Other Predictions for 2012,” I wrote “Apple and IBM will continue to thrive. Microsoft will grow, slightly. Dell and HP will thrash. A share of Apple, which sold for $11 in December, 2001, and $380 in Dec. 2011, will sell for $480 in Dec. 2012.”

Apple has already spiked to 427.75. If I’m proven wrong it may be because I underestimated Apple’s projected future value.

What about Research in Motion, RIMM? They invented mobile e-mail, with the first “Blackberry” in ’98 or ’99. When you got paged, you could write a response, send it, and it would be received almost immediately. It was tied to email, integrated with Microsoft Exchange or Lotus Notes. I remember it well. As a database administrator on Wall Street I carried one for two years. In my current professional role I have carried one for six and managed a Blackberry Enterprise Server, along with other servers. In the late 90’s it was basically a pager with a keyboard and software that did e-mail. Today, you can also take pictures, browse the web – gives new meaning to the word ‘crawl’- listen to music, make phone calls.

But what will be the value of Research in Motion next year? Still around $8.5 B? Down to $6.2 B? Back up to about $30 B? If they don’t change, I imagine the value will be $4.0 to $6.0 B, or they will be a division of another company, such as AT&T, NorTel, Winstream, HP, or a private equity firm.

Here’s the basic financial data on the companies:

| Basic Data on Apple and Research in Motion | ||||||

| Stock | Price | Mkt Cap | EPS | P/E | 52 Wk Low | 52 Wk High |

| AAPL | 419.81 | 390.18 | 27.67 | 15.17 | 310.5 | 427.75 |

| RIMM | 16.17 | 8.47 | 4.24 | 3.81 | 12.45 | 70.54 |

| Table 1 | ||||||

At first glance the company looks like a tremendous investment: RIMM is a $8.7 Billion company with no debt, earns $4.24 per share (EPS), has a Net Profit Margin of 17.13, and the stock only costs $16.17 per share (as of close of trading Friday, January 13, 2012). The ratio of stock price to earnings (P/E) is 3.81. Their network is secure and robust. A Blackberry handheld should be on the belt of every first responder. They are lighter and probably as secure, more reliable, more robust than the Motorola units carried today, and they also do instant messaging, virtually instant e-mail, and come with a built-in camera. They don’t belong in your “go-bag;” they belong on your belt.

At second glance, an analyst put the intrinsic value at $22.00 per share or $12 billion (up from $16 per share and $8.7 Billion) saying “the network is worth $12.50 per share, their patents are worth $7.50 per share, and they have $2.00 per share in the bank.

Compare this to Apple. A $390 Billion company, Apple has no debt, EPS of 27.67, NPM of 23.95, and the stock only costs 419.81 per share. The P/E is 15.17. Apple also makes an instant communications device, but it doesn’t have it’s own network. Research in Motion does. So if the AT&T, Verizon, or other network is down you will still be able to send a “PIN to PIN,” “BBM” or E-Mail with a Blackberry, but not with an iPhone. On the other hand, there is an iPhone app that turns the camera flash into a flashlight.

These are summarized in Table 1, “Basic Data,” above and Table 2 “Other Financial Information,” below. (Note: all data are from Google).

| Other Financial Information | |||

| Debt to Assets | Return on Avg Assets | Net Profit Margin | |

| AAPL | 0 | 27.06 | 23.95 |

| RIMM | 0 | 29.56 | 17.13 |

| Table 2 | |||

The data also show that Apple, with a price of $419.81 is close to it’s historic 52-week high of $427.75, while, at $16.17 RIMM is close to it’s historic 52-week low of $12.45. Looking at the chart from last year, Apple was steady from January to July (and you could have lost money by investing in it at $360 in January and selling at $310 in July) but increased after July. Research in Motion, on the other hand, dropped pretty steadily from February 17, 2011 to December 20, 2011.

What’s next for APPLE and Research in Motion? What was it that Newton said? “A body in motion tends to stay in motion unless acted upon by an outside force.” I have a lot of confidence in Apple. It’s in motion. Rumors about the iPad 3 are that it will be lighter, faster, and have better graphics. They will make improvements on the iPads, iPhones, iPods, iMacs, Mac Books, iOS, OS X, the applications software, and who knows, they may even get Apple TV right this year. (They will, sooner or later.) As far as Research In Motion; some of their products – the Blackberry hand-helds and Blackberry Enterprise Server software are terrific. However, I would have a lot more confidence in the company’s future if I was an “Outside force” hired to act upon the body. (I would also kill to work at APPLE.)

The World Will Not End & Other Predictions for 2012

Here are my top 10 predictions for 2012. These are less readings of the tea leaves or the entrails of goats and chickens and more simple extrapolations of patterns in progress. Altho that may be the way effective oracles. They just masked their observations with hocus pocus, mumbo-jumbo, and guts.

This list runs a gamut from business and technology to energy, instability in the Middle East, micro-economics in the United States, politics, and not-yet-pop culture.

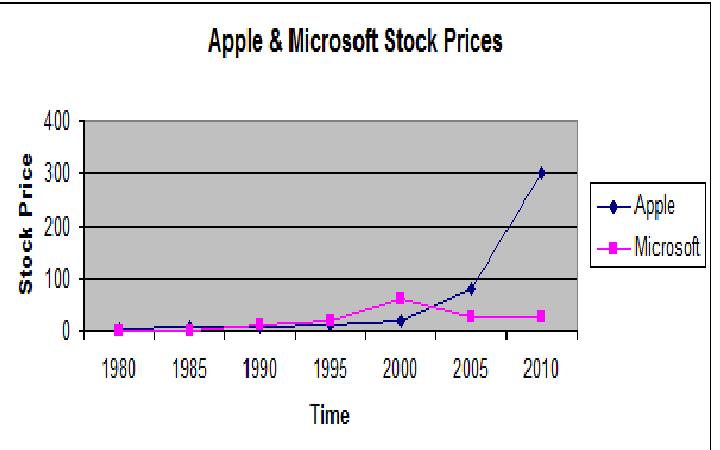

- Apple and IBM will continue to thrive. Microsoft will grow, slightly. Dell and HP will thrash. A share of Apple, which sold for $11 in December, 2001, and $380 in Dec. 2011, will sell for $480 in Dec. 2012.

- The Price of oil will be at $150 to $170 per barrel in Dec., 2012. The price of gasoline will hit $6.00 per gallon in NYC and California.

- There will be another two or three tragic accidents in China. 20,000 people will die.

- There will be a disaster at a nuclear power plant in India, Pakistan, Russia, China, or North Korea.

- Wal-Mart will stop growing. Credit Unions, insurance co-ops and Food co-ops, however, will grow 10% to 25%.

- The amount of wind and solar energy deployed in the United States will continue to dramatically increase.

- The government of Bashar Al Assad will fall.

- Foreclosures will continue in the United States.

- Arizona Sheriff Joe Arpaio will resign. Calls for Clarence Thomas to recuse himself from matters involving his wife’s clients will become louder, but Justice Thomas will ignore them. A prominent politician who says “Marriage is between a man and a woman,” or her husband, will be “outed” as gay. President Obama will be re-elected.

- The authors of Vapor Trails will not win a Nobel Prize for literature. They will not win a “MacArthur Genius Award.” Nor will I despite my work on this blog or “Sunbathing in Siberia” and the XBColdFingers project.

Here are the details … Continue reading

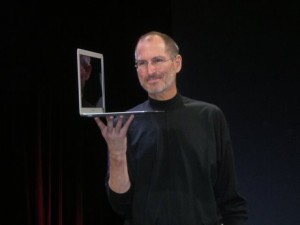

Steve Jobs, 1955 – 2011

Many of us want to change the world. And we all to to varying extents. Some for the better, some for the worse, some significantly and dramatically, others less so.

Many of us want to change the world. And we all to to varying extents. Some for the better, some for the worse, some significantly and dramatically, others less so.

Steve Jobs changed the world significantly, dramatically and in many ways for the better.

Because of their focus on “Computers for the rest of us” he and Steve Wozniak could have called the company they built “Prometheus Computers.” The Apple II, Lisa, Mac, Newton, iPod, iTunes store, iPod Touch, iPhone, iPad, are, in a sense, like the fire ‘stolen’ in the myth by Prometheus and given to man. Jobs, however, while known for being tough, was not known for being pompous.

He will be missed by his family and friends. His ideas will be missed by the rest of us.

Goodbye Steve, and thanks.

Apple v Microsoft, 2011.

At a seminar on June 9, 2011, on securing the mobile worker, Apple‘s representative said “We truly did not understand what we built.” That’s a direct quote. He went on to say “Here’s how they use it at GE, and Hyatt, and in the pharmaceutical industry.” A few minutes later he said “When users tell us what they can’t do, what they need to do, we listen, so tell us what you need.” At seminars on Microsoft‘s products, their consultants describe their software by saying “This is what we built, this is what it does, and here are our best practices – this is how you should use our software.”

At a seminar on June 9, 2011, on securing the mobile worker, Apple‘s representative said “We truly did not understand what we built.” That’s a direct quote. He went on to say “Here’s how they use it at GE, and Hyatt, and in the pharmaceutical industry.” A few minutes later he said “When users tell us what they can’t do, what they need to do, we listen, so tell us what you need.” At seminars on Microsoft‘s products, their consultants describe their software by saying “This is what we built, this is what it does, and here are our best practices – this is how you should use our software.”

This is it. Apple’s “We truly did not understand what we built,” versus Microsoft’s “This is what we built, this is what it does, and here are our best practices – this is how you should use our software.” These statements define the corporate cultures.

Apple, at $325 per share, is a $300 billion company. With earnings of 21 per share, it has a price earnings ratio of 15.8. It has no debt. It is down slightly from it’s high of around $350 per share, reached a few weeks ago. There are 46,000 employees. Net income of 5.99 Billion on $24.67 Billion. Microsoft, at $24 per share, is a $200 billion company. With earnings of $2.92 per share it has a P/E of 9.44. There are 89,000 employees, $16.4 billion revenue and $5.2 billion net income.

Microsoft’s income per dollar of revenue is higher – but they don’t make hardware. Revenue per employee at Microsoft is $184,000. Revenue per Employee at Apple is $536,000. Income per Employee at Microsoft is $58,000. Income per Employee at Apple is $130,000.

These data are summarized below,

| Employees | Net Income | Revenues | Inc / Emp | Rev / Emp | |

| (Millions) | (Millions) | ||||

| Apple | 46,000 | $5,990 | $24,670 | $130,217 | $536,304 |

| Microsoft | 89,000 | $5,200 | $16,400 | $58,427 | $184,270 |

When I last looked at Apple and Microsoft, October 30, 2010, here, Apple was 305.24 per share, with an EPS, of $15.15 and a P/E of 20.147. It’s market capitalization was $279.59 Billion. Microsoft was $26.28, with an EPS of 2.11, P/E ratio of 12.48 and market capitalization of $227.42 Billion, $52 Billion less than that of Apple. Today Apple’s market capitalization is up 25% to $300 billion and Microsoft’s market capitalization is down about 12% to $200 billion. Apple’s market capitalization is $100 billion higher than Microsoft’s. Apple’s all time high stock price was a few weeks ago, and I expect it will bounce back and keep climbing as long as they keep selling hardware and software that shifts the paradigm. Microsoft’s was in 1999. I don’t expect Microsoft to go out of business, but it’s days of shifting the paradigm and tremendous growth are gone.

The iPad (Apple site, here) is a paradigm shifting device. It has a dual core A5 processor, 16, 32, or 64 GB of flash memory, and no moving parts (other than electrons, which are hard to keep still). Treated properly, it should last for 10 or 20 years. It adds a layer of durability and obsolescence resistance to personal electronics. It puts us on the road from “disposable” consumer electronics back to durable, sustainable consumer electronics (click here).

The iPad (Apple site, here) is a paradigm shifting device. It has a dual core A5 processor, 16, 32, or 64 GB of flash memory, and no moving parts (other than electrons, which are hard to keep still). Treated properly, it should last for 10 or 20 years. It adds a layer of durability and obsolescence resistance to personal electronics. It puts us on the road from “disposable” consumer electronics back to durable, sustainable consumer electronics (click here).

And it’s selling by the millions. Apple has sold 200 million iOS devices – iPhones, iPads, iPods Touch, that’s one for two out of three Americans. It’s sold 25 Million iPads, 14 million in 2010 and 11 million in the first half of 2011. The sales projections from Wall Street are tremendous, (Florin at UnWired, Schonfeld at Tech Crunch, Elmer-DeWitt at Fortune). People buy multiple devices, e.g., iPhone and iPad or iPod Touch and iPad. These are driving sales of music, apps – by the billions – and the Mac. Microsoft is buying SKYPE, which is a great company with a great product but it doesn’t know how to make money. Apple is going up, both in terms of market capitalization and earnings. Microsoft is going nowhere.