Newt Gingrich says, “I have a plan to set gasoline prices at $2.50 per gallon. We have 1.4 trillion barrels of potentially recoverable oil in the United States. Join us to make it happen.” on YouTube, here.

Newt Gingrich says, “I have a plan to set gasoline prices at $2.50 per gallon. We have 1.4 trillion barrels of potentially recoverable oil in the United States. Join us to make it happen.” on YouTube, here.

At a rally in Dalton, Georgia, reported here on CNN, he said, “Just tell all your friends we’re setting it up so you can go online at newt.org and you can give one Newt-gallon which is $2.50, or you can give 10 Newt gallons which is $25, or 100 Newt gallons which is $250 or a thousand Newt gallons which is $2500.”

I wonder who’s picture he wants on those “Newt Dollars.”

The Jane Dough blog describes “Today in Improbable Campaign Promises: Gingrich Bus Advertises $2.50/Gallon Gas,” here.

The Jane Dough blog describes “Today in Improbable Campaign Promises: Gingrich Bus Advertises $2.50/Gallon Gas,” here.

Talking Points Memo, here, says “Newt Gingrich Running On Bitterness and $2.50 Gas.”

Newt doesn’t offer the details, which brings to mind the so-called “investment strategies” of Bernard Madoff and R. Allen Stanford, recently convicted of the largest Ponzi schemes in history. Both consistently refused to explain how they made money;  “It’s complicated,” they said, “You wouldn’t understand. But I guarantee that I will make you money. And look at these pictures of me with important people”

“It’s complicated,” they said, “You wouldn’t understand. But I guarantee that I will make you money. And look at these pictures of me with important people”

In “How to Smell A Rat,” Ken Fisher, of Ken Fisher Investments, with co-author Lara Hoffmans, says, “If a so-called ‘Investment Strategy’ is ‘too complicated to explain’ it’s probably a scam.”

The Chairman of the Communist Party in China can set the value of the currency and price of any commodities in China – because China has a command economy not free markets. The President of the United States, who’s authority, responsibilities, and limits are described in the Constitution, has a lot of power. As Commander In Chief, the President can wage war. But the President can not set the price of commodities traded on free markets.

I don’t believe that Mr. Gingrich has a realistic plan to set the price of gas to $2.50 per gallon. However, I can think of several ways to appear to cut the price of gasoline from $3.73 to $2.50 per gallon:

- Devalue the dollar by about 1/3, so that $2.50 “new dollars,” or “Newt Dollars,” as Mr. Gingrich calls them, buys $3.73 worth of gasoline, or other stuff.

- Use tax subsidies to pay people the difference between $2.50 and the price at the pump. Then, of course, you would have to raise taxes by $1.23 per gallon.

- Drill Baby Drill.

- Ration gasoline to artificially cut the demand.

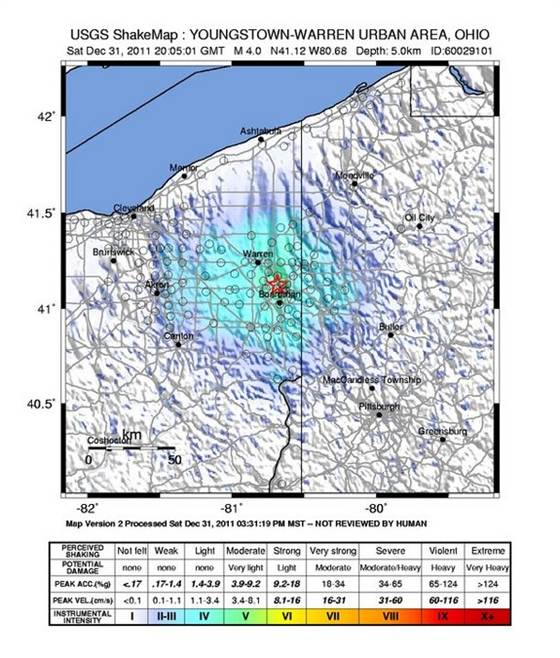

The first two are smoke and mirrors. The third requires massive amounts of clean water and would create massive amounts of toxic by-products. The fourth would work in time of war or disaster. All require what might be termed “Big Government.” All would pour tons of carbon dioxide into the atmosphere, contributing to mile winters such as the winter of 2012, climate change, storms like Hurricanes Katrina and Irene, and acidification of the oceans.

There’s one other thing we could try:

Develop fuels derived from sustainably grown plants to legitimately cut demand on fossil fuels.

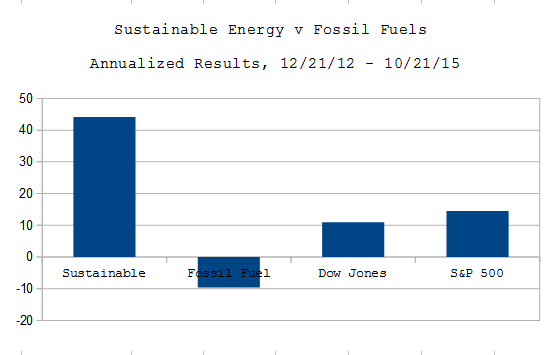

While this would require “Big Government” to fund research this seems to me to make sense. It is also the mid-term to long term plan of Continental / United, Virgin, Alaska Air, Horizon Air, other carriers, and Boeing (click here for Gizmag or here for Bio-JetFuel Blog). Solazyme (SZYM) and General Electric (GE) are working on the technology. The US Navy is also working with Solazyme for fuels derived from algae (Business Wire). However, based on Mr. Gingrich’s statement that “We have 1.4 trillion barrels of potentially recoverable oil in the United States,” I suspect that he is playing fast and loose with facts and ginning up support for “Drill, Baby, Drill.”

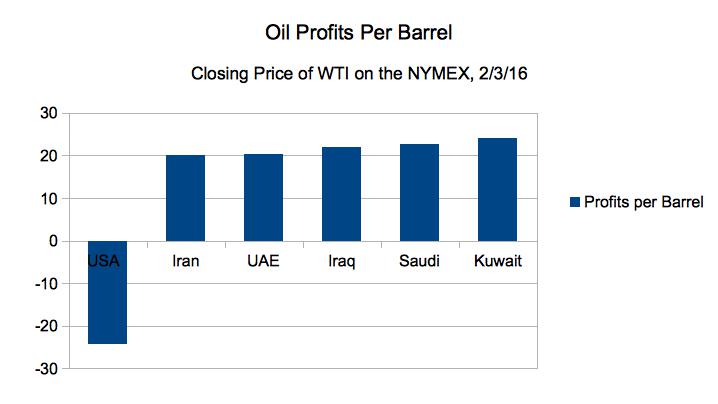

Deepwater Drilling Offshore of the US yields oil at $57 per barrel (see

Deepwater Drilling Offshore of the US yields oil at $57 per barrel (see