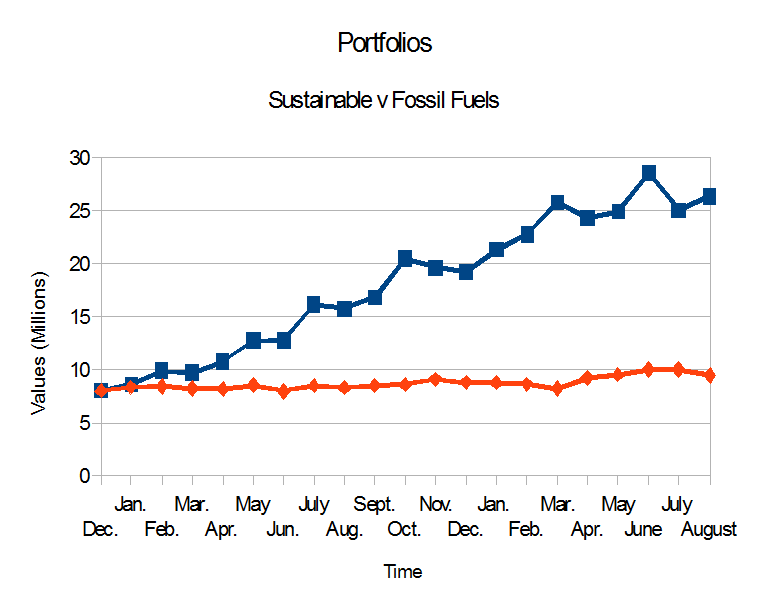

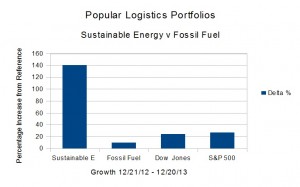

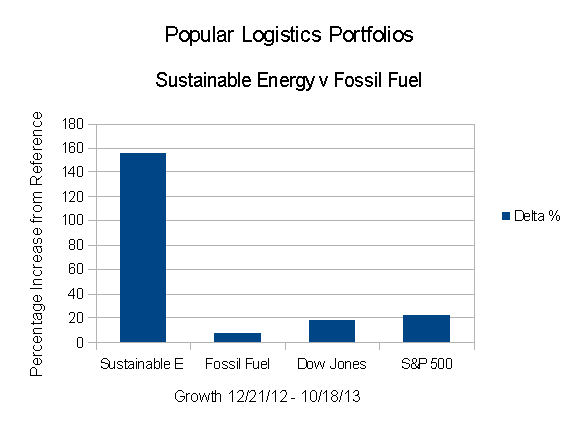

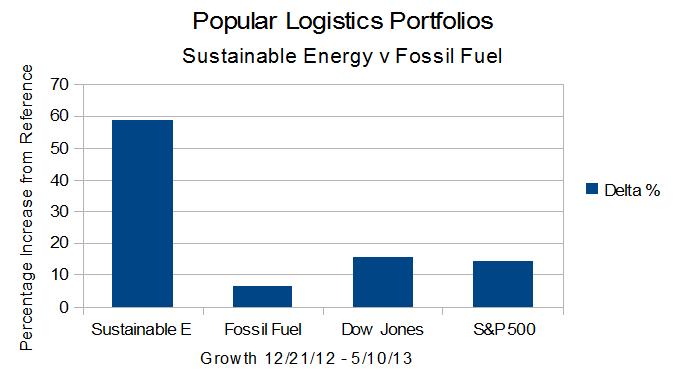

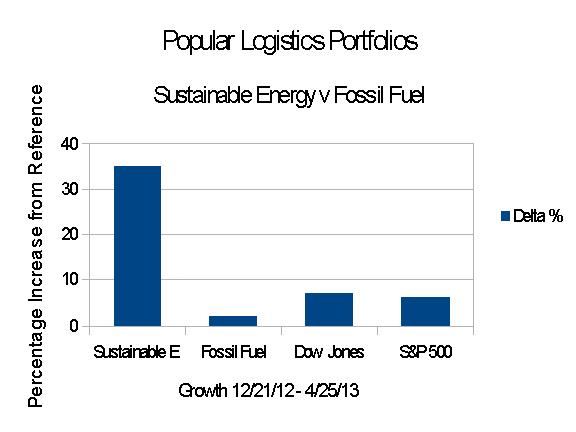

- The performance of most of the companies in these portfolios supports the hypothesis that a paradigm shift away from fossil fuels and toward renewable energy systems is underway.

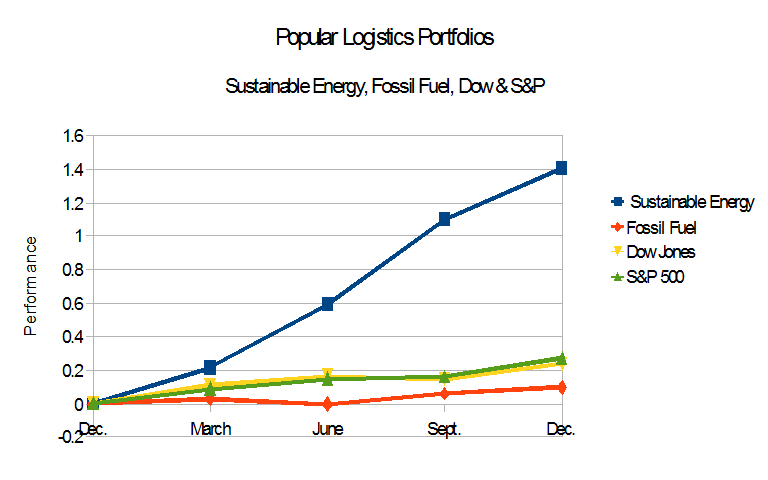

- Investing in an index fund may have been more lucrative – and less stressful – than investing in the Fossil Fuel portfolio.

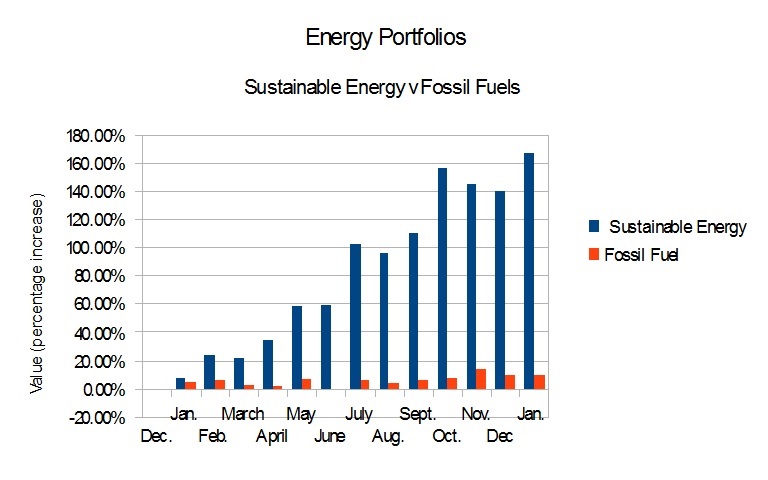

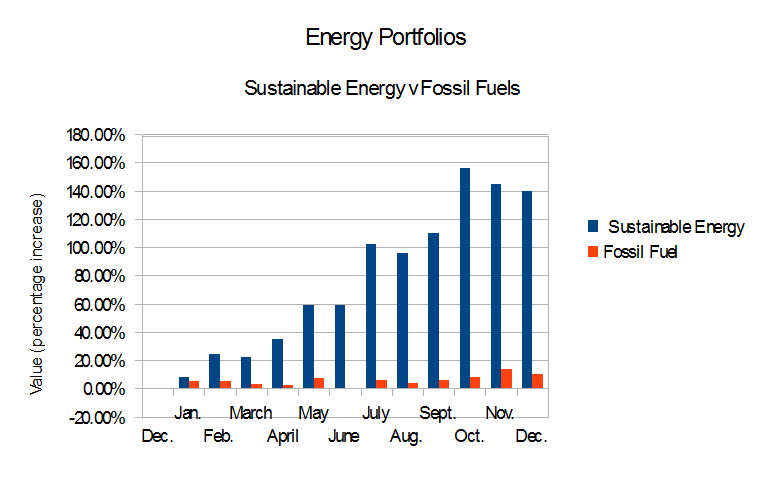

- Investing in paradigm shifting technology, i.e., First Solar, Sunpower, GT Advanced Technology and Vestas may be very lucrative.

- A diversified portfolio in paradigm shifting technology may also be effective. The “home runs” will more than make up for the “strike-outs.”

- Investing in a well-run, or well-connected, company, i.e., Haliburton, in a declining industry may also be lucrative.

Observations:

- The long term trend appears to be that investments in Sustainable Energy are likely to pay off in the long term and also, probably, the short term.

- Investments in Fossil Fuels, however do not appear likely to appreciate in the near future, even in a “Bull Market,” such as we appear to be in. However, a speculator, i.e., a gambler, may be able to play various fossil fuel stocks, buying at lows and selling at highs. While I am not an investment professional, I personally, don’t know if this is worth the risk. I prefer to do my gambling in Atlantic City, New Jersey and Las Vegas, Nevada.

- When considered against the backdrop of global geopolitics, i.e., Russia, which exports oil and methane, invading Ukraine, ISIS in Iraq and Syria threatening to take over Iraqi oil operations, other turmoil in the Middle East, a paradigm shift away from fossil fuels seems likely to insulate energy flows from remote geopolitical events and strengthen economies that have executed this paradigm shift. Therefore, investments supporting such a paradigm shift may do well, while investments supporting the existing paradigm may not.