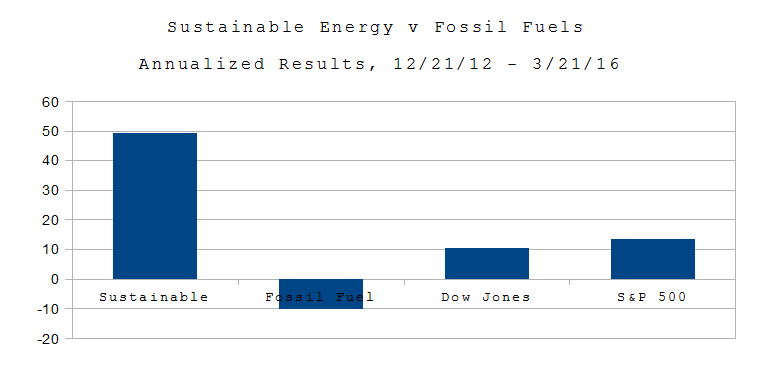

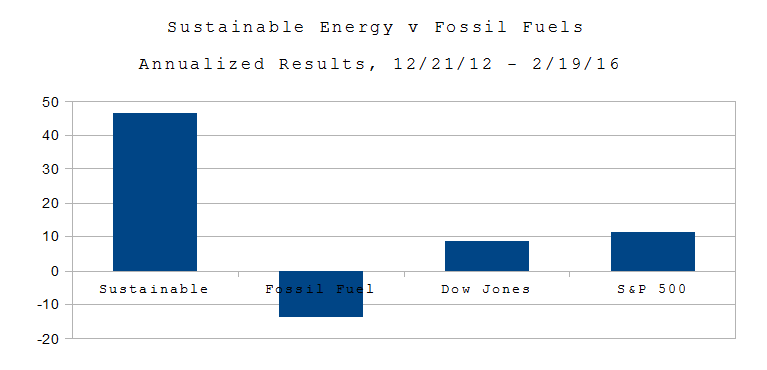

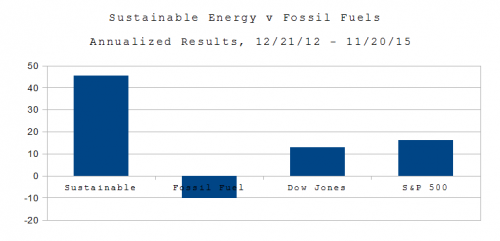

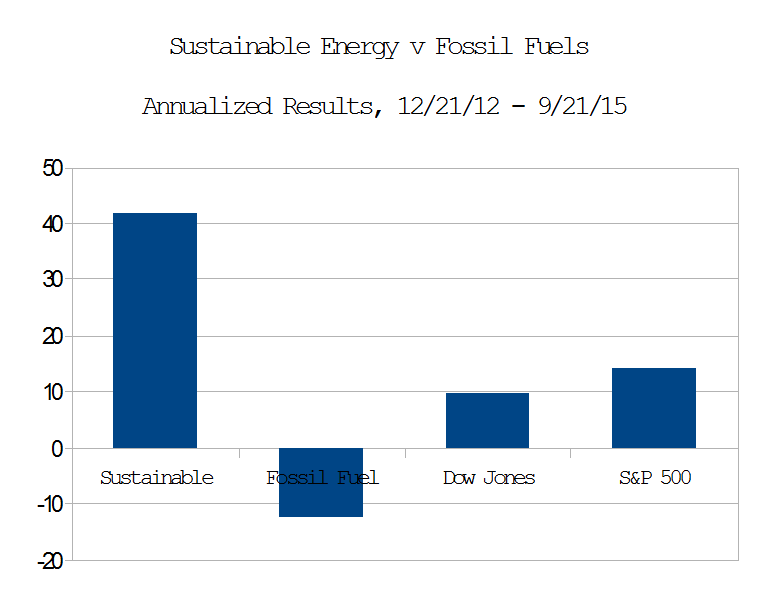

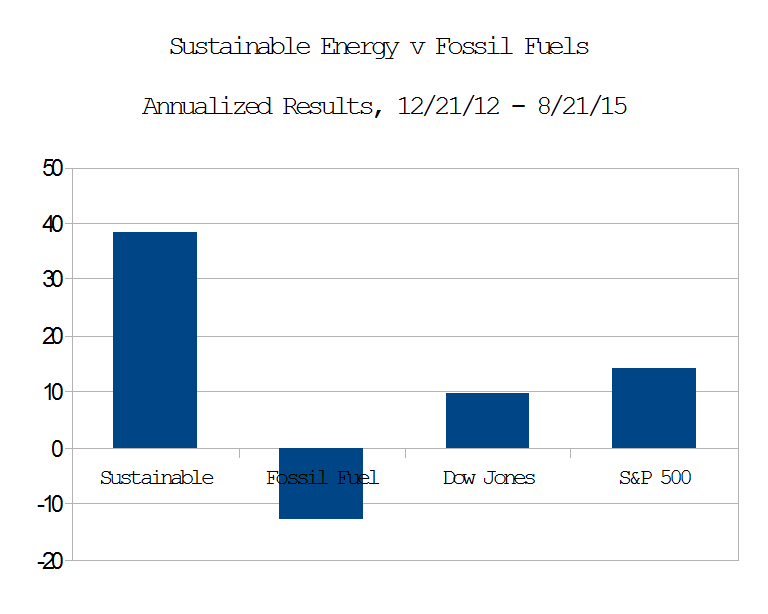

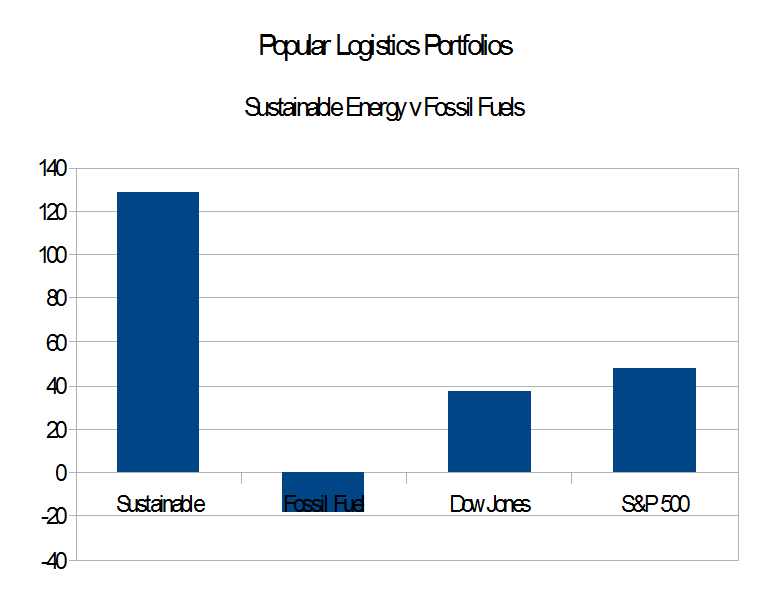

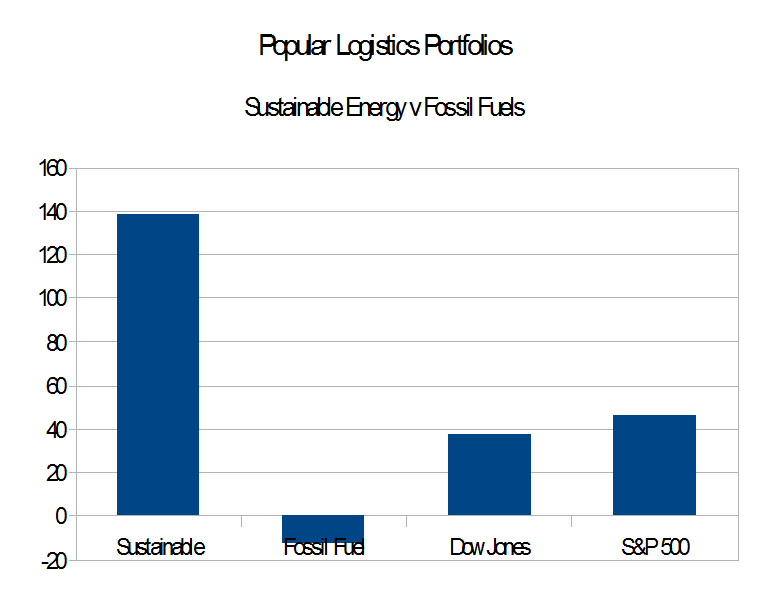

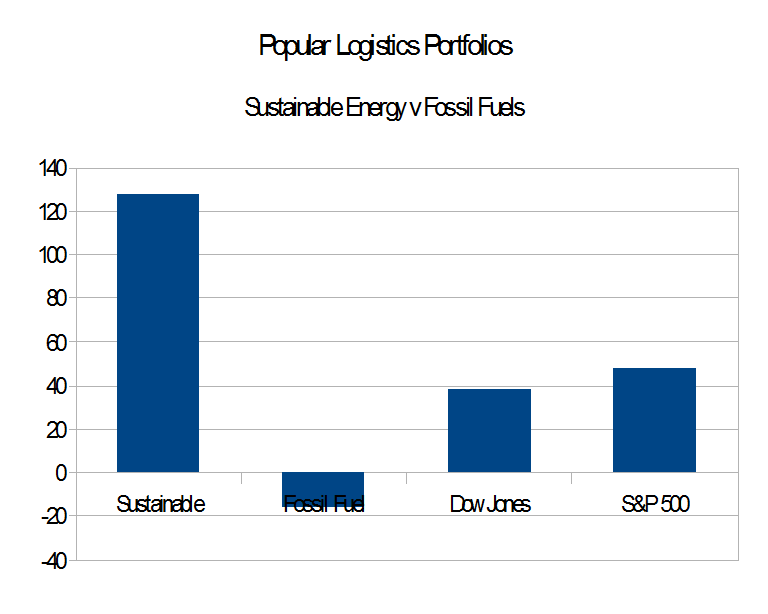

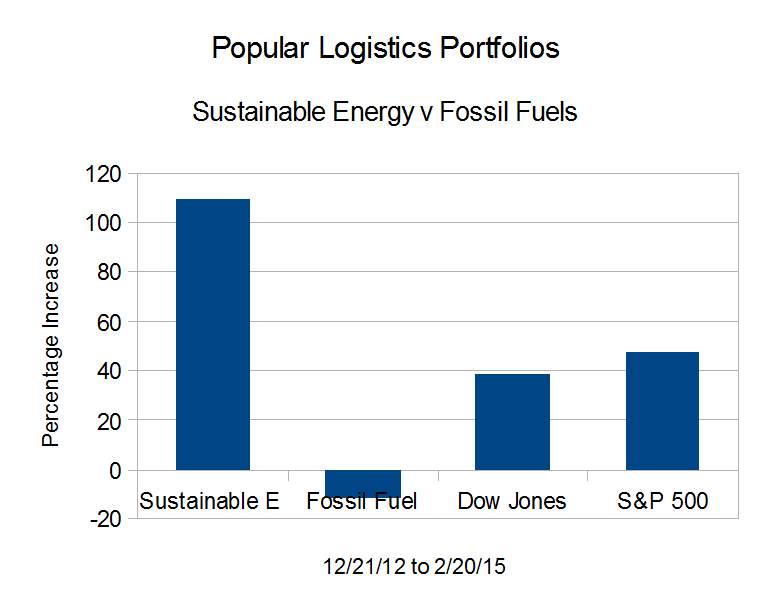

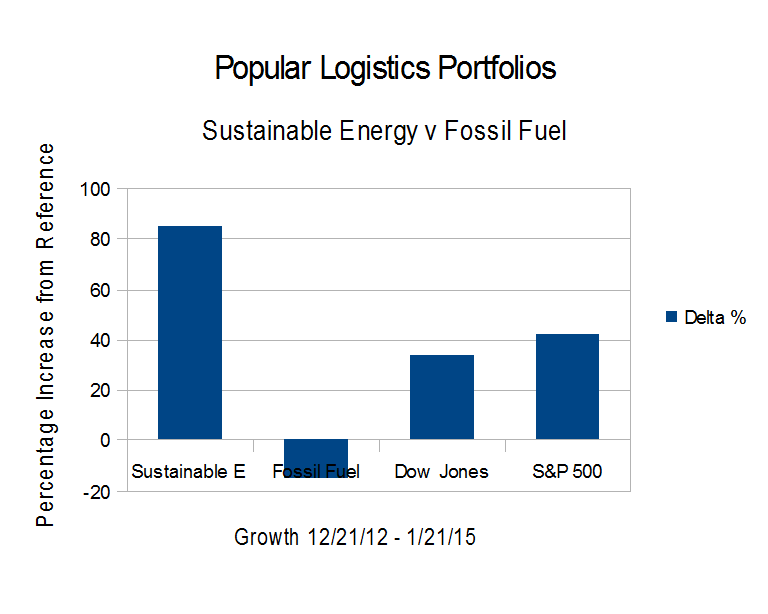

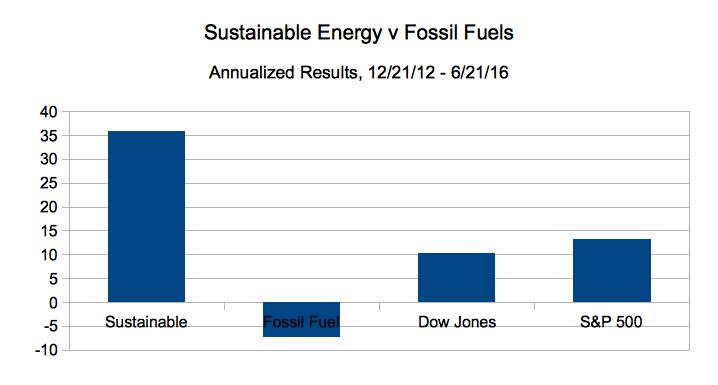

On Dec. 21, 2012, I imagined $16 Million dollars in equal investments in 16 real energy companies; $1.0 M in each company in each of eight companies in the Sustainable Energy space and $1.0 M each of eight companies in the fossil fuel space. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of various companies in the sustainable energy space and coal industry.

As of the close of trading on June 21, 2016:

- The Fossil Fuel portfolio went from $8.0 Million to $5.92 Million, down 25.98% overall, and 7.4% on an annualized basis.

- The Sustainable Energy portfolio went from $8 Million to $18.019 Million, up 125.24%, overall and 35.8% on an annualized basis.

- The Dow Jones Industrial Average is up 36.2% overall and 10.3% on an annualized basis, went from 13.091 on 12/21/12 to 17,501 on 6/21/16.

- The S&P 500 is up 446.08% overall and 13.2% on an annualized basis, from 1,430 on 12/21/12 to close at 2089 on 6/21/16.