In “The World Will Not End, and Other Predictions for 2012,” I wrote “Apple and IBM will continue to thrive. Microsoft will grow, slightly. Dell and HP will thrash. A share of Apple, which sold for $11 in December, 2001, and $380 in Dec. 2011, will sell for $480 in Dec. 2012.”

Apple has already spiked to 427.75. If I’m proven wrong it may be because I underestimated Apple’s projected future value.

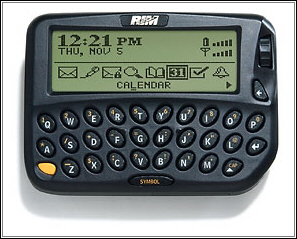

What about Research in Motion, RIMM? They invented mobile e-mail, with the first “Blackberry” in ’98 or ’99. When you got paged, you could write a response, send it, and it would be received almost immediately. It was tied to email, integrated with Microsoft Exchange or Lotus Notes. I remember it well. As a database administrator on Wall Street I carried one for two years. In my current professional role I have carried one for six and managed a Blackberry Enterprise Server, along with other servers. In the late 90’s it was basically a pager with a keyboard and software that did e-mail. Today, you can also take pictures, browse the web – gives new meaning to the word ‘crawl’- listen to music, make phone calls.

But what will be the value of Research in Motion next year? Still around $8.5 B? Down to $6.2 B? Back up to about $30 B? If they don’t change, I imagine the value will be $4.0 to $6.0 B, or they will be a division of another company, such as AT&T, NorTel, Winstream, HP, or a private equity firm.

Here’s the basic financial data on the companies:

| Basic Data on Apple and Research in Motion |

| Stock |

Price |

Mkt Cap |

EPS |

P/E |

52 Wk Low |

52 Wk High |

| AAPL |

419.81 |

390.18 |

27.67 |

15.17 |

310.5 |

427.75 |

| RIMM |

16.17 |

8.47 |

4.24 |

3.81 |

12.45 |

70.54 |

| Table 1 |

At first glance the company looks like a tremendous investment: RIMM is a $8.7 Billion company with no debt, earns $4.24 per share (EPS), has a Net Profit Margin of 17.13, and the stock only costs $16.17 per share (as of close of trading Friday, January 13, 2012). The ratio of stock price to earnings (P/E) is 3.81. Their network is secure and robust. A Blackberry handheld should be on the belt of every first responder. They are lighter and probably as secure, more reliable, more robust than the Motorola units carried today, and they also do instant messaging, virtually instant e-mail, and come with a built-in camera. They don’t belong in your “go-bag;” they belong on your belt.

At second glance, an analyst put the intrinsic value at $22.00 per share or $12 billion (up from $16 per share and $8.7 Billion) saying “the network is worth $12.50 per share, their patents are worth $7.50 per share, and they have $2.00 per share in the bank.

Compare this to Apple. A $390 Billion company, Apple has no debt, EPS of 27.67, NPM of 23.95, and the stock only costs 419.81 per share. The P/E is 15.17. Apple also makes an instant communications device, but it doesn’t have it’s own network. Research in Motion does. So if the AT&T, Verizon, or other network is down you will still be able to send a “PIN to PIN,” “BBM” or E-Mail with a Blackberry, but not with an iPhone. On the other hand, there is an iPhone app that turns the camera flash into a flashlight.

These are summarized in Table 1, “Basic Data,” above and Table 2 “Other Financial Information,” below. (Note: all data are from Google).

| Other Financial Information |

|

Debt to Assets |

Return on Avg Assets |

Net Profit Margin |

| AAPL |

0 |

27.06 |

23.95 |

| RIMM |

0 |

29.56 |

17.13 |

| Table 2 |

The data also show that Apple, with a price of $419.81 is close to it’s historic 52-week high of $427.75, while, at $16.17 RIMM is close to it’s historic 52-week low of $12.45. Looking at the chart from last year, Apple was steady from January to July (and you could have lost money by investing in it at $360 in January and selling at $310 in July) but increased after July. Research in Motion, on the other hand, dropped pretty steadily from February 17, 2011 to December 20, 2011.

What’s next for APPLE and Research in Motion? What was it that Newton said? “A body in motion tends to stay in motion unless acted upon by an outside force.” I have a lot of confidence in Apple. It’s in motion. Rumors about the iPad 3 are that it will be lighter, faster, and have better graphics. They will make improvements on the iPads, iPhones, iPods, iMacs, Mac Books, iOS, OS X, the applications software, and who knows, they may even get Apple TV right this year. (They will, sooner or later.) As far as Research In Motion; some of their products – the Blackberry hand-helds and Blackberry Enterprise Server software are terrific. However, I would have a lot more confidence in the company’s future if I was an “Outside force” hired to act upon the body. (I would also kill to work at APPLE.)

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.