“FEDERAL RESERVE NOTE”

“THIS NOTE IS LEGAL TENDER FOR ALL DEBTS PUBLIC AND PRIVATE”

Two intertwined events took place between the end of World War II and the dawn of the 21St Century.

“FEDERAL RESERVE NOTE”

“THIS NOTE IS LEGAL TENDER FOR ALL DEBTS PUBLIC AND PRIVATE”

Two intertwined events took place between the end of World War II and the dawn of the 21St Century.

Back in 1999, I was walking down a hall to the data center of a US Navy base in Virginia, when I noticed a sign that said “Cell Phones Prohibited. Deadly Force Is Authorized in this Area.” Fortunately my cellphone didn’t ring.

Back in 1999, I was walking down a hall to the data center of a US Navy base in Virginia, when I noticed a sign that said “Cell Phones Prohibited. Deadly Force Is Authorized in this Area.” Fortunately my cellphone didn’t ring.

One of my colleagues had an Apple Newton. Just as the Osborne and Kaypro led to the Compaq and the laptops, PDAs running the Newton operating system and PDAs from Go Computers led to the Palm Pilot, and ultimately to the iPod, iPhone, and iPad, but that’s another story.

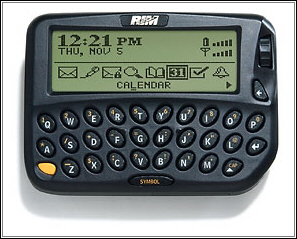

Research In Motion had just introduced the Blackberry 850 handheld. My colleagues in the financial industry had them. I understood the potential and wanted one. That too is another story.

Facebook went public on Friday, May 18, 2012. Trading for FB opened at $42.025 per share, giving the company a market capitalization of $72.76 Billion. However, Facebook closed it’s first day as a publicly traded stock down 9.3% at $38.105 per share. On it’s second day, Monday, May 21, it opened at $36.53 per share and closed at $34.03 per share, dropping another 6.8%, and 19% from the opening price. It’s sliding is raising eyebrows in the financial media (Business Week, Chicago Tribune, Reuters).

But the question may be less “Why is Facebook’s stock price dropping?” or “Who’s to blame?” than “What should be it’s price?“

GMO‘s Jeremy Grantham talks about “Reversion to the Mean.” The mean, however, for a stock with 2 days of history is not statistically meaningful. So I compared it to Apple, Google, IBM, Microsoft, and Oracle, pulling data off of the Internet at Finance.Google.Com after the close of trading on Monday, May 21, 2012.

(Image Links: Soap Bubble & Bubble Pop)