![]() Tweet Writing in the NY Times, Adam Davidson of Planet Money, asks “Can Politicians Really Create Jobs? Davidson says “No.”

Tweet Writing in the NY Times, Adam Davidson of Planet Money, asks “Can Politicians Really Create Jobs? Davidson says “No.”

But with all due respect to Mr. Davidson, as Barack – The Candidate – Obama said, “Yes, We Can!”

And yes, Presidential candidates can create jobs – presidential campaigns are staffed by people. So obviously, the President can create jobs. Anyone can. All it takes is a need for something to get done. Whether you do it yourself or you pay someone else to do it, it’s a job. So the real question for the President, the Presidential Candidates, our elected Representatives in Washington and in State and Local Government, and for us ourselves, is not “Can we create jobs?” The real question is “How do we create 10 or 15 million good new jobs?”

Davidson talks about Keynes and the Chicagoans.

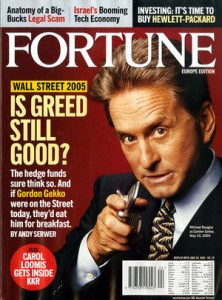

Chicagoans believe that economies can only truly recover on their own and that policy interventions only slow the recovery. It’s a puzzle of modern politics that Republicans have had electoral success with a policy that fundamentally asserts there is nothing the government can do to create jobs any time soon…. Romney, Perry, Herman Cain and the rest won’t come out and say, “If elected, I will tell you to wait this thing out.”

This is what Herbert Hoover said and why Franklin Delano Roosevelt won the election in 1932.

Instead, Republican candidates fill their jobs plans with Chicagoan ideas that have nothing to do with the current crisis, like permanent cuts in taxes and regulation. These policies may (or may not) make the economy healthier in 5 years or 10, but the immediate impact would require firing a large number of America’s roughly 23 million government workers.

What John Maynard Keynes said is less that “government can create jobs” but is more along the lines of

“in economic times such as these, when there is high unemployment because business will not hire people to create inventory that is likely to remain unsold, government is the only entity that has both the means and the will to create jobs.”

Less “government can” and more “Government Must!”

What is our government, after all? Lincoln said it best:

– “Government of the people, by the people and for the people.”

And there is much work to be done. We need to rebuild our infrastructure. This includes our crumbling current infrastructure of schools, roads, mass transit, etc. This will create jobs. We also know that domestic energy production peaked in 1971. International oil production seems to be peaking now, altho given the state of the world economy, and the state of infrastructure in Iran, Iraq, and Libya, the international peak may be a few years off. However, we should build a sustainable energy infrastructure. We will need it eventually. It is good for the environment, it will strengthen our economy and our state of national security. But rather than by using a simple program to provide loan guarantees to various corporations; the government should mandate that all government buildings should be well insulated, efficient, heated and cooled with geothermal, and powered with a mix of solar, wind, local hydro, biofuel (from waste, sewage, manure, etc., not food crops).

Just as police and courts exist to protect people from those who would point a gun at their heads and say “Your money or your life,” enforcement agencies must protect people from those who would discard toxic substances into the air we breathe, the water we drink, the food we eat, and the ground from which we farm. We need to regulate banks and other financial firms. This too will create jobs. We need to provide health care to all our citizens, not just 5 out of 6, or 265 million out of 307 million, leaving 1 out of 6, or 45 out of 307 million without access to health care.

Davidson is wrong about one other thing. It’s not either go into debt to create jobs or fire people to cut taxes. Government has two sources of revenue: debt and taxes. It seems fair to me that a progressive tax policy, can be used to generate the revenues needed to pay for the jobs society needs to be done. Wealth, after all, is not created in a vacuum. Wealth is created by people buying things that other people are selling. People want to buy Apple computers, music players, cell phones. The people who design and build them get wealthy. The wealthy benefit by living in society; therefore demanding that all, including the wealthy, pay a fair share, as illustrated here, in my post on Progressive Tax Policy is fair, balanced, reasonable, and smart.

- Over $100 Million, 57.5%. Plus 5.0% Social Security Insurance & Medicare.

- Between $10 Million and $100 Million: 52.5%. Plus 5.0% SSI & M.

- Between $5 Million and $10 Million: 42.5%. Plus 5.0% SSI & M.

- Between $1 Million and $5 Million: 32.5%. Plus 5.0% SSI & M.

- Between $100,000 and $1 Million: 22.5%. Plus 5.0% SSI & M.

- Below $100,000: 17.5%. Plus 4.0% SSI & M.

- Royalty income should be taxed at the same rates as wages and salary.

- Income in the form of unsold stock options is tax-deferred and taxed when sold.

- Inheritances of $1.0 million and under from a grandparent, parent, partner, or child should not be taxed. Inheritances from distant relatives, or that portion above $1.0 million should be taxed as indicated above.

So can anyone create jobs? The answer is a resounding ‘Yes, We Can!’

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.