Tweet On the campaign trail in Iowa, Mitt Romney said, “Corporations are people.” (NY Times, Washington Post)

Tweet On the campaign trail in Iowa, Mitt Romney said, “Corporations are people.” (NY Times, Washington Post)

An argument can be made that Mr. Romney meant that corporations are composed of people, that they magnify the abilities of individuals. However, Ayn Rand might suggest that the candidate made a collectivist statement. Mr. Romney could also have meant that corporate profits eventually wind up in the pockets of investors like himself and Warren Buffett, and their heirs, like his children and Paris Hilton. However, that may be a nuance that may be lost in the political debate.

It could also be that Mr. Romney meant exactly what he said.

But what is closer to the truth, I think, is that corporations are legal mechanisms by which people use to limit their liability and to develop and protect their wealth.

In my courses at the Marlboro MBA in Managing for Sustainability, we discuss corporations as a “nexus of contracts.” That’s not really a definition of a person that a flesh and blood person, a person whos DNA is DNA would use.

People, that is flesh-and-blood-based people, DNA-based people can own corporations. Corporations can own other corporations. But neither people nor corporations can own people.

In “The Divine Right of Capital,” Marjorie Kelly (Amazon, EcoBooks) clearly describes why corporations ought not be considered “persons.”

But that’s not the only issue I have with Mr. Romney’s statements in Iowa.

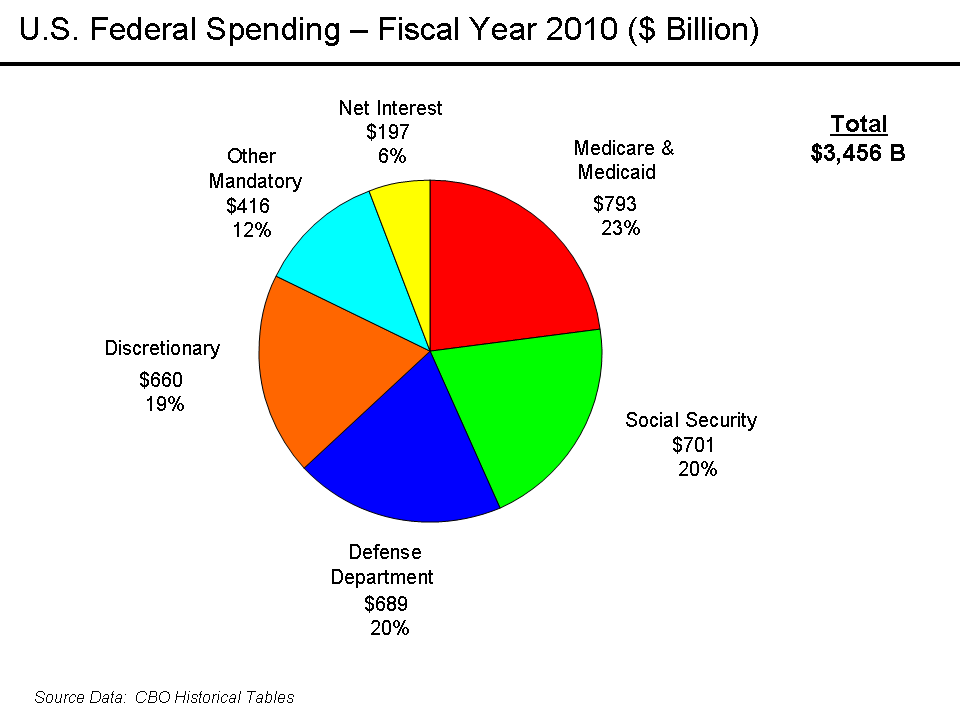

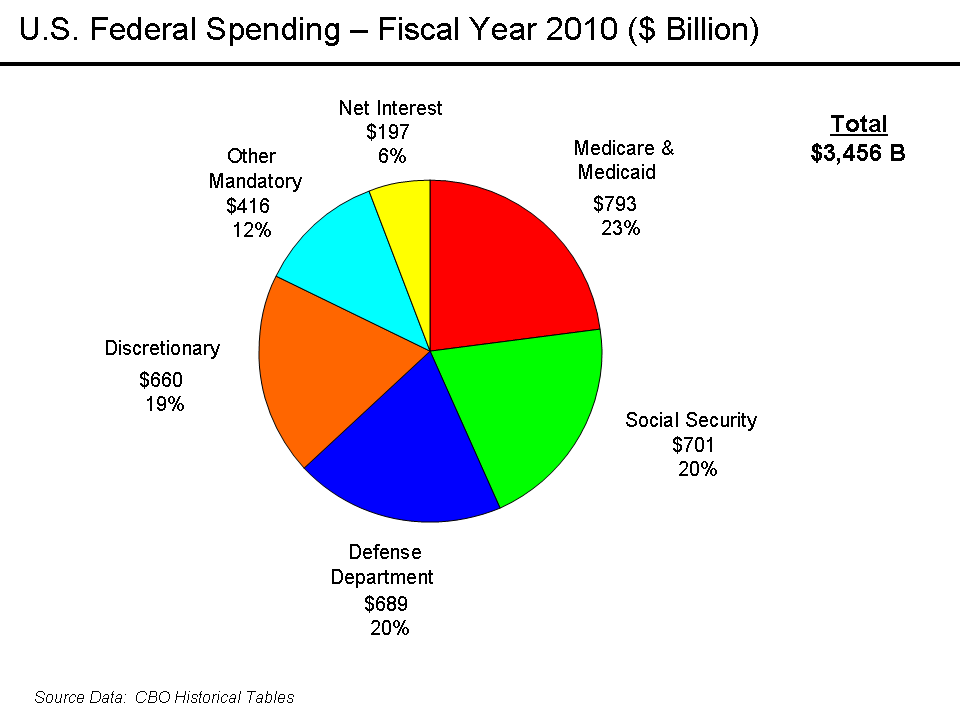

Mr. Romney also said, “Social Security, Medicare, and Medicaid account for about half of Federal Spending.” This seems to be factually incorrect. According to the Congressional Budget Office summarized on Wikipedia, Social Security, Medicare, and Medicaid account for 43% of total federal spending, in fiscal year 2010. (Note that total defense spending is greater than the 20% reported in the figure because certain programs and agencies, such as the CIA, the NSA, and other defense and intelligence agencies are funded, in part, out of the “Discretionary” category.)

Mr. Romney also said, “Social Security, Medicare, and Medicaid account for about half of Federal Spending.” This seems to be factually incorrect. According to the Congressional Budget Office summarized on Wikipedia, Social Security, Medicare, and Medicaid account for 43% of total federal spending, in fiscal year 2010. (Note that total defense spending is greater than the 20% reported in the figure because certain programs and agencies, such as the CIA, the NSA, and other defense and intelligence agencies are funded, in part, out of the “Discretionary” category.)

While $1.491 Trillion, 43%, is $350 Billion less than 50% of the budget of FY 2010, you could argue that Mr. Romney was exaggerating for effect, something politicians do. However, I imagine if we were to raise taxes to 50% on the wealthiest 1% of Americans, people with over, say, $50 Million, Mitt Romney has $284 Million, and say, “It’s only about 43%,” he would at the very least question our understanding of mathematics.

Mr. Romney also said, “You can raise taxes, that’s not the approach I would make.”

That is the approach I would take. As noted here, taxes are “The price we pay for civilization.” They are revenues raised by the people in governments to pay for the things they understand must be paid for; things like education, infrastructure, security. I would raise taxes on people making more than $250,000 per year. And raise them significantly on people, making more than $1,000,000 per year, whether they make their money as actively as salary, or passively as dividends, capital gains, or distributions from trust funds.

I make less. A lot less. My expenses – my health insurance, the costs of food, fuel, etc., are going up. My income, however, is going down. In “real” terms, as inflation is going up, and in actual numbers, as the bonus I used to be given have shrunk or been eliminated because of, it has been said, “the economic conditions faced by the firm.”

The government Lincoln defined as “Of the people, by the people, and for the people” needs money to pay its obligations. It needs money to build infrastructure. And as has been noted, Keynesian economic theory suggests that in an economic conditions such as we face only the government can be willing to act to create jobs. The government can only really raise money by borrowing it or by raising taxes. We should be developing government programs to shift the energy paradigm to clean, renewable, sustainable energy. It will create 2.4 Million jobs, directly cut unemployment from about 9.1% to about 7.3%, indirectly cut unemployment by another 1.0 to 2.0% and generally stimulate the economy in a terrific manner. (Click here).

As we have noted before, and will doubtless do again, Popular Logistics is a POLICY blog, not a POLITICS blog. However, we do think about politics, at least occasionally. And it appears to this blogger that Mr. Romney just lost the election. Whether he has lost to Mr. Obama or to one of the other Republicans remains to be seen.