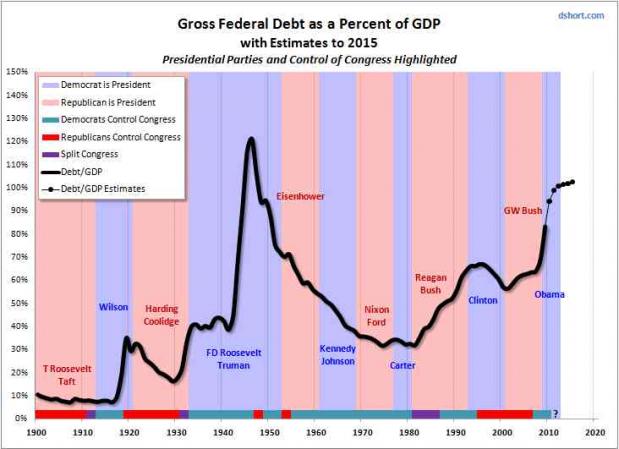

As we consider the Centennial of President Reagan’s birth, it is important to note that while he cut taxes on some taxpayers, he raised taxes on other taxpayers. As the graph, presented by Barry Ritholtz at Business Insider, shows, the deficit shot up under President Reagan, as it did under Presidents Woodrow Wilson, Herbert Hoover, Franklin Roosevelt, George H. W. Bush, and George W. Bush.

See also CNN Money Report.

The deficit shot up under Presidents Wilson and Roosevelt and Truman because of World Wars I and II. The deficit also increased under Roosevelt because GDP dropped during the Depression. The deficit dropped under Truman, Eisenhower, Kennedy, Nixon and Ford because they listened to John Maynard Keynes and used government spending as a tool to lower unemployment and stimulate the economy by building infrastructure. As President Nixon said, “We are all Keynesians now.” (Click here or here).

Under Reagan, the maximum income tax rate dropped from 70% to 28%.The top rate is the rate paid by the people who have the highest incomes – major league baseball, football, and basketball players, musicians, actors, investment bankers, and hedge fund managers. If they pay less taxes, the difference is made up by people with lower incomes. I respect Warren Buffett, Aaron Rodgers, Bruce Springsteen, Michael Douglass, and others. But I don’t understand why I should be compelled to subsidize their lifestyle or the lifestyles of people like Brittney Spears, Lindsay Lohan or Paris Hilton.

Be that as it may, President Reagan didn’t cut spending. He had to raise taxes to cover spending. Despite his tax hikes, however, the deficit climbed. It continued to climb under G. H. W. Bush. It dropped under Clinton, who famously, balanced the budget and presented G. W. Bush with a surplus. The rest, as is said, is history.