“Not for profit, not for charity, but for service.”

– Credit Union motto

“The National Bank at a profit sells road maps for the soul to the old folks home and the college.”

– Bob Dylan, “Tombstone Blues”

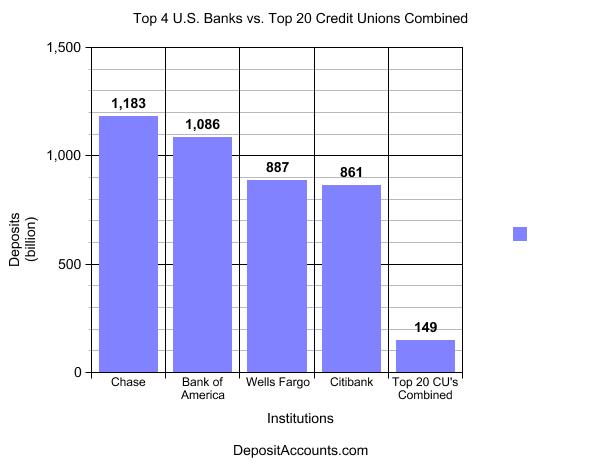

Back in 2010, over 9,000 credit unions in the United States had over $500 Billion in deposits. In November, 2011, the top 20 credit unions had $149 Billion in deposits, while Chase, Bank of America, Wells Fargo, and Citibank, the four largest U.S. banks, had over $4.0 trillion. However, as of the end of the first quarter, 2012, credit unions had over $1.0 trillion in deposits – their deposits doubled since 2010. What happened?

According to Credit Union Access, Consumers flee banks, it was the aborted plans by Bank of America, Chase, and Wells Fargo to charge customers $5.00 per month (B of A) or $3 per month (JP Morgan Chase and Wells Fargo) to use an ATM card (ABC / CBS / CS Monitor 1 / CS Monitor 2 / Daily Finance), and Occupy Wall Street. As noted by Ken Tunin, in Deposit Accounts, in “How Massive are the Largest Banks as Compared to Credit Unions?” on Nov. 7, 2011.

“The official Bank Transfer Day was Saturday November 5th, but the momentum will likely continue. [Credit Union National Association] Reports last week noted that “650,000 new members transferred a total of $4.5 billion in funds into new credit union savings accounts in the month leading up to Bank Transfer Day.”

This $4.5 Billion is about 0.11% of the $4.017 trillion on deposit in the four largest US banks, but it’s a significant sum, and for 650,000 people to each move on average $6,923.08, in a month, seems noteworthy. According to Credit Union Access, here,

“Credit Unions have now topped over $1 trillion in total assets and $100 billion of net worth as membership growth has accelerated rapidly, according to the reports that the 7,000-plus not-for-profit member-owned financial institutions provided to government regulators. As many as 667,000 new credit union members joined in the first quarter of 2012, compared to 1.4 million over the whole year in 2011. Membership is now 92.5 million.”

Credit unions are a non-profit, cooperative financial institution owned and operated by their members and organized to serve their members with a safe place to save and borrow at reasonable rates. Credit unions differ from for-profit financial institutions in that members of a credit union are also owners. The directors are members elected by the members in a democratic one person-one vote system regardless of the amount of money invested in the credit union. While credit unions must pay salaries, and usually pay dividends to their members, their interest rates have been historically favorable for the members.

Yet credit unions have rated No. 1 in customer satisfaction at financial institutions for more than 10 years according to the American Banker Newspaper’s annual customer satisfaction survey. One of the lasting results of the Occupy Wall Street movement may be a shift from investor owned banks to depositor owned credit unions.

According to Credit Union Access, Consumers flee banks,

Big banks may actually welcome the idea that some consumers will flee to credit unions and elsewhere. A JPMorgan Chase official a recent investor conference said that big banks lose money on most customers with less than $100,000 in deposits and investments.

The reasons for this may include advertising costs and the costs of opening and maintaining branches, clearing checks, and the compensation paid to executives and directors.

More Information

Credit Union Access provides more information, including eligibility requirements for the various credit unions. The top 50 are listed here. The top 5 by Deposits and top 6 by Membership are listed below.

Top 5 Credit Unions by Deposits

Navy Federal Federal Credit Union, Merrifield, VA. $36.4 billion in assets.

State Employees Federal Credit Union, Raleigh, NC. $16.7 billion in assets.

Pentagon Federal Federal Credit Union, Alexandria, VA. $13.0 billion in assets.

Boeing Employees Federal Credit Union , Tukwila, WA. $8.6 billion in assets.

Schools First Federal Credit Union, Santa Ana, CA. $7.8 billion in assets.

Navy, State, and PenFed are also the top three by members. The top five by membership also includes Golden 1 and Security Service. Boeing Employees Federal Credit Union is number 6 by members.

Top 6 Credit Unions by Membership

Navy Federal FCU, Merrifield, VA. 3,194,292 members.

State Employees FCU, Raleigh, NC. 1,498,062 members.

Pentagon Federal FCU, Alexandria, VA. 864,803 members.

Golden 1, Sacramento, CA. 694,836 members.

Security Service, San Antonio, TX. 681,353 members.

Boeing Employees Federal Credit Union, Tukwila, WA, 588,755 members.

Disclosure: I joined United Teletech Federal Credit Union back in the late 1990’s when I worked at a lab within Bell Laboratories. I needed a home equity loan for a renovation. United Teletech’s Vision is “To become our members’ premier financial partner.” Their Mission is “To ensure that every person benefits, every time.” Their commitment is “We will strive to insure that every member interaction is one that makes that member want to come back to do business with us.” These are on their “About Us” page.

Popular Logistics Series on Co-ops.

L Furman, Popular Logistics, 6/21/12, Part 1: Co-Ops 101: More than Brown Rice, Granola, and Honey.

L Furman, Popular Logistics, 6/23/12, Part 2: Co-Ops 102: Credit Unions.

Some of the thinking underlying these posts was developed in my work as a student in MBAS 618, “Finance III, Forms, Equity, and Organization,” in the MBA for Managing for Sustainability at the Marlboro College Graduate School in Brattleboro, Vermont. For additional information or original research contact me at L Furman 97 “at” gmail . com.