“Taxes are the price we pay for civilization.” – Oliver Wendell Holmes.

Progressive tax structures are not about punishing the rich. They are a recognition that wealthy people – like everyone else – derive benefits from being in society. Warren Buffett, Steve Jobs, Bill Gates, Michael Jordan, Oprah, for example, got rich because people buy their products or watched them play basketball or on TV. Paris Hilton is wealthy because her great-grandfather built a successful business. Their successes are wonderful. But their success should not require me to subsidize their lifestyles.

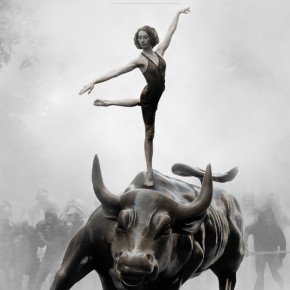

My coverage of Occupy Wall Street started on Sept. 22, 2011, with “Protesting Marked Cards and a Stacked Deck.” I called for repeal of the “Bush Tax Cuts” on the wealthy, and for passage of Obama’s American Jobs, the so-called Buffett Rule. It referenced an earlier post I quoted Warren Buffett’s op-ed in the NY Times, “Stop Coddling the Super-Rich,” and quoted President Obama’s statement about the American Jobs Act – which the Republicans subsequently filibustered in the Senate. Mr. Buffett, who we now know pays significantly higher percentage of his taxes than Mitt Romney, said,

I paid … only 17.4 percent of my taxable income — and that’s actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent.

If you make money with money, as some of my super-rich friends do, your percentage may be a bit lower than mine. But if you earn money from a job, your percentage will surely exceed mine — most likely by a lot.

My post concluded,

…we should use tax policy to develop infrastructure. One idea is to build a 40 kilowatt photovoltaic solar array on each of the 92,000 public schools in the United States. Solar only generates power during the day; schools need most of their power during the day. This would use tax revenues to pay for infrastructure upgrade – and tax revenues pay public schools electric bills. PV Solar systems provide energy without pollution, without toxic wastes, without greenhouse gases. And in the event of an emergency, if disconnected from the grid, we would have a network of 92,000 local emergency shelters with power during the day, when the sun is shining.

In Progressive Tax Policy, 10/28/11, here, I also wrote

This tax structure can be implemented by October 31, 2012, and effective January 1, 2013, if not by Congress, then by Executive Order.Income is income. A hedge fund operator who receives compensation for his or her work is paid. That work is not interest. The funds are not the operator’s. He or she doesn’t risk his or her own money. Thus the compensation should be taxed at the rate of Income, not Capital Gains.

Wages, Salaries, and Tips

- Over $100 Million, 57.5%. Plus 5.0% Social Security Insurance & Medicare.

- Between $10 Million and $100 Million: 52.5%. Plus 5.0% SSI & M.

- Between $5 Million and $10 Million: 42.5%. Plus 5.0% SSI & M.

- Between $1 Million and $5 Million: 32.5%. Plus 5.0% SSI & M.

- Between $100,000 and $1 Million: 22.5%. Plus 5.0% SSI & M.

- Below $100,000: 17.5%. Plus 4.0% SSI & M.

- Royalty income should be taxed at the same rates as wages and salary.

- Income in the form of unsold stock options is tax-deferred and taxed when sold.

Royalties and Capital Gains Taxes – To spur investment by taxing capital gains in a manner that would stimulate savings and investment,

- A 4% tax on all losses on all trades of equities, securities and real estate, excluding sale of primary residence.

- A 50% tax on the gains of short sales, plus 4% sales tax,

- A 50% tax on the gains from the sales of derivatives, plus 4% sales tax,

- A 60% tax on gains from day trades, plus 4% sales tax,

- A 50% income tax on very short term capital gains accruing from the sale of assets held for less than or equal to 7 calendar days, plus 4% sales tax,

- A 30% income tax on short term capital gains greater than 7 days but less than 12 months, plus 4% sales tax,

- A 25% income tax on long term capital gains of instruments held between 1 and 10 years, plus 3% sales tax,

- A 20% income tax on very long term capital gains of instruments held for longer than 10 years, plus 2% sales tax.

Inheritances, Windfalls, Lotteries, Poker and Other Gambling Winnings

The first $1.0 Million of Inherited wealth from a parent, partner, sibling, or child ought not be subject to tax in order to compensate for the loss. Such inheritances above $1.0 Million, and all other inheritances, windfalls, lottery and gambling winnings should be taxed at the rates described above.

Energy

Tax waste producing energy systems, such as coal, oil, methane, and nuclear power and use the money to clean up the wastes and build a fuel free energy infrastructure built on clean, renewables such as solar, wind, geothermal, hydro, and efficiency and non-fossil sources of fuel such as waste. The tax rate must be based on the costs to clean up the wastes.

Index to the original series on Occupy Wall Street and related posts.

- Saving the Economy, Numero Uno, 9/12/11, here,

- Nuclear Power: Present Tense, 9/12/11, here,

- Saving the Economy, Part Deux, 9/12/11, here,

- Protesting Marked Cards and a Stacked Deck, 9/22/11, here,

- Corporations Are NOT People, 10/13/11, here,

- Occupy Wall Street – Why are They There?, 10/19/11, here,

- Progressive Tax Policy, 10/28/11, here,

- Occupy Wall Street – Demands, 10/28/11, here,

- Occupy Wall Street News is Fit To Print, 10/30/11, here.

- It’s The Feedback; It’s Always The Feedback, 11/3/11, here

- Zuccotti, the song, unmixed mp3, lyrics in pdf,

–

As an analyst with Popular Logistics, I am available for research and analysis on a per project or a per diem basis. I can be reached at ‘L Furman 97” @ G Mail . com.

–