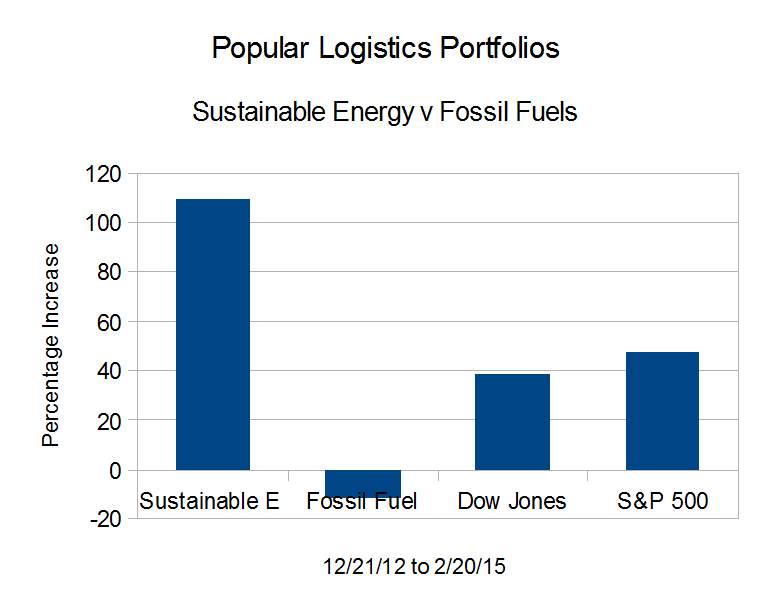

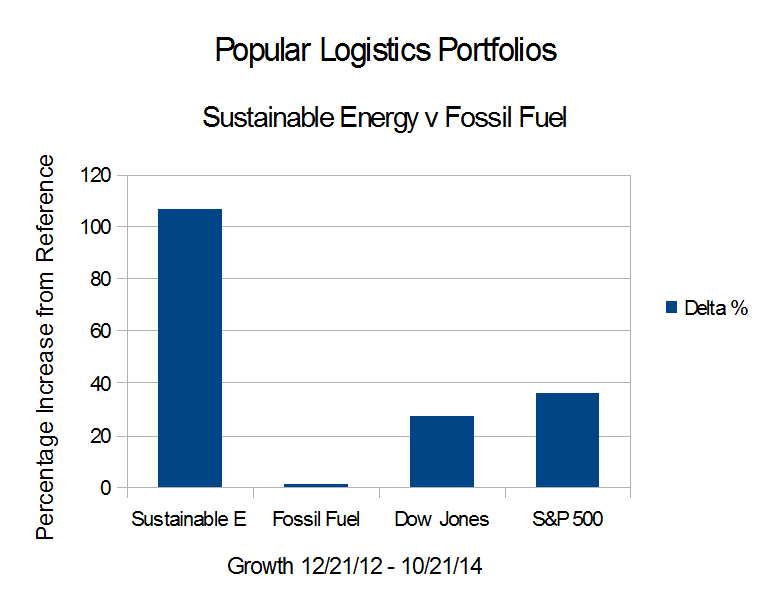

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space.

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space.

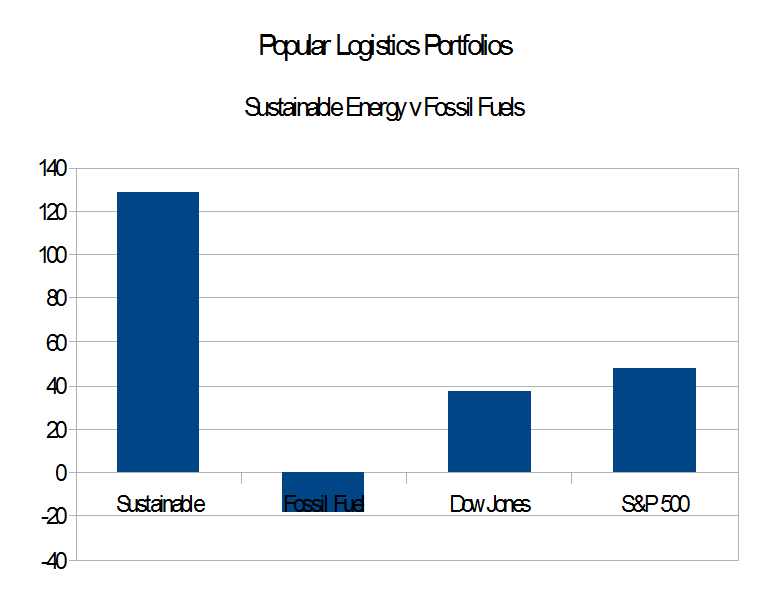

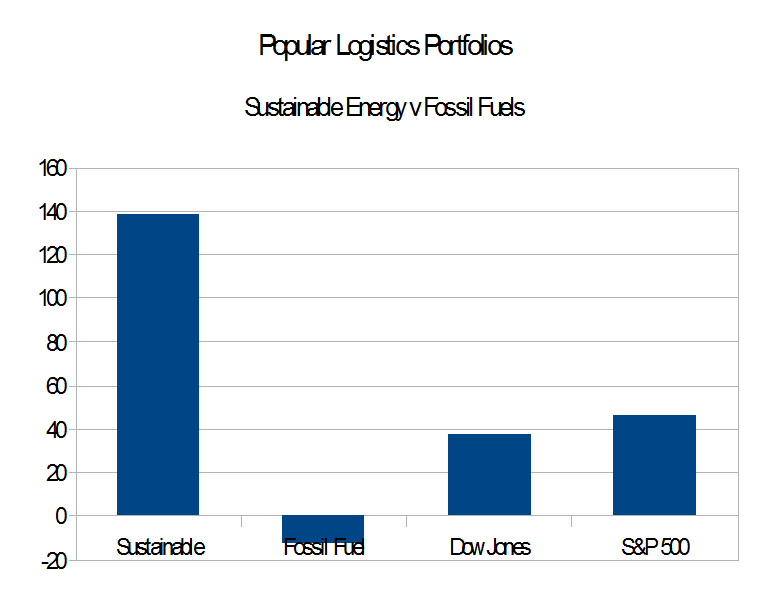

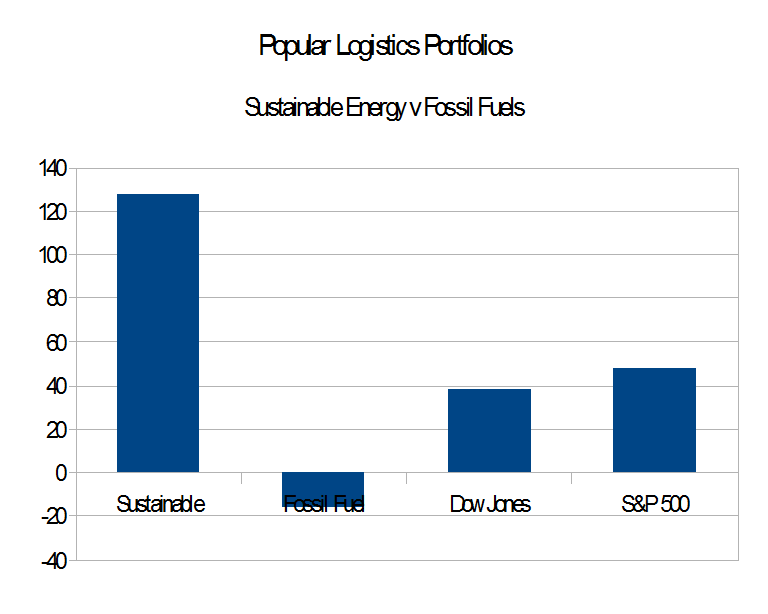

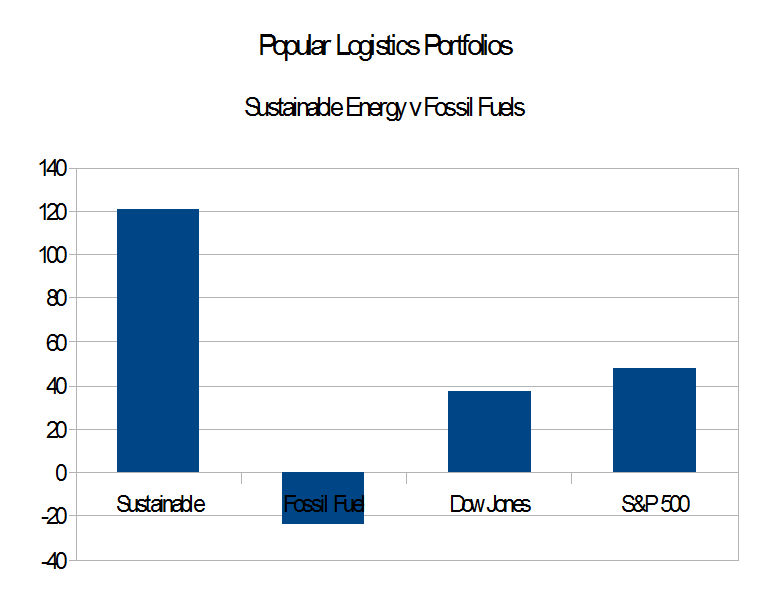

- The Fossil Fuel portfolio is now worth $6.09 Million, down 23.93%.

- The Sustainable Energy portfolio is now worth $17.64 Million, up 120.54%.

- Both Fossil Fuel and Sustainable Energy are down slightly in the last month.

- The Dow Jones Industrial Average is up 37.6%, from 13,091 on 12/21/12 to close at 18,016 on 7/21/15.

- The S&P 500 is up 47.6%, from 1,430 to close at 2,110 on 7/21/15.