Back in December, 2012 I started this experiment in sustainable investing. I took $16 million imaginary dollars and invested them, in imaginary $1.0 Million chunks, in 8 sustainable energy companies and 8 fossil fuel companies. The results are:

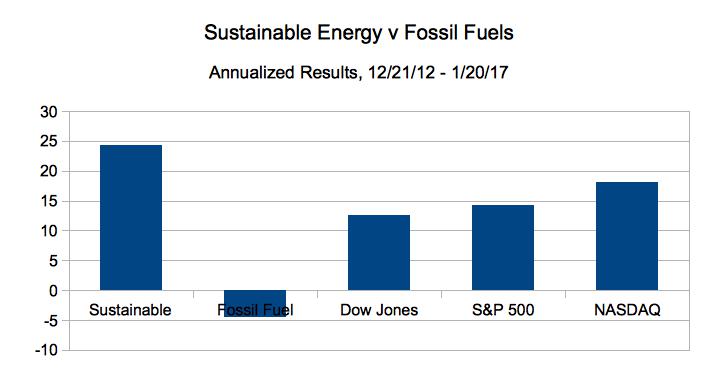

- The Fossil Fuel portfolio is down 18.29% overall, from $8.0 Million to $6.54 Million. This is a collapse of -4.48% on an annualized basis. However, please note that my model does not account for dividends.

- The Market Capitalization of the five big oil companies of the Fossil Fuel portfolio has decreased by 4.95%

- The Sustainable Energy portfolio has essentially doubled in stock price since Dec. 2012. Up 98.98% overall and 24.24% on an annualized basis, from $8 Million to $15.92 Million.

- The Market Capitalization of the Sustainable Energy portfolio has increased by 87.21% in this period.

- The Dow Jones Industrial Average is up 51.43% overall and 12.60% on an annualized basis from 13.091 on Dec. 21, 2012 to 19,824 on Jan. 20, 2017.

- The S&P 500 is up 57.97% overall and 14.20% on an annualized basis, from 1,430 to 2,259.

- The NASDAQ is up 74.54% overall and 18.20% on an annualized basis, from 3,021 to 5,251.