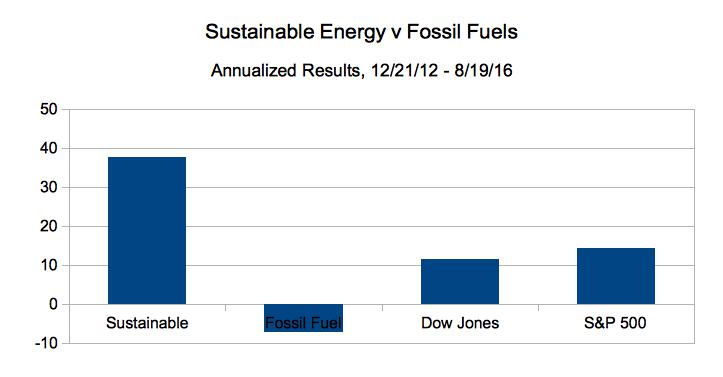

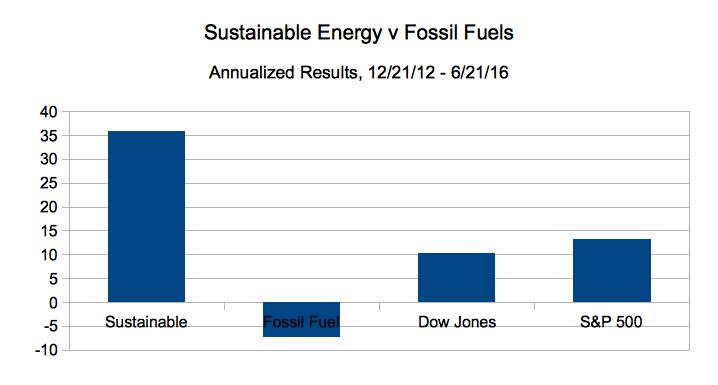

On Dec. 21, 2012, I imagined $16 Million dollars in equal investments in 16 real energy companies; eight Sustainable Energy companies and eight fossil fuel companies. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space and a coal company, at the close of trading on August 19, 2016:

- The Fossil Fuel portfolio went from $8.0 Million to $5.85 Million, down 25.85% overall, down 7.3% on an annualized basis.

- The Sustainable Energy portfolio went from $8 Million to $19.1 Million, up 138.414%, overall and 37.75% on an annualized basis.

- The Dow Jones Industrial Average is up 41.72% overall and 11.38% on an annualized basis, went from 13.091 on 12/21/12 to 18,553 on 8/21/16.

- The S&P 500 is up 52.73% overall and 14.38% on an annualized basis, from 1,430 on 12/21/12 to close at 2,165 on 8/21/16.

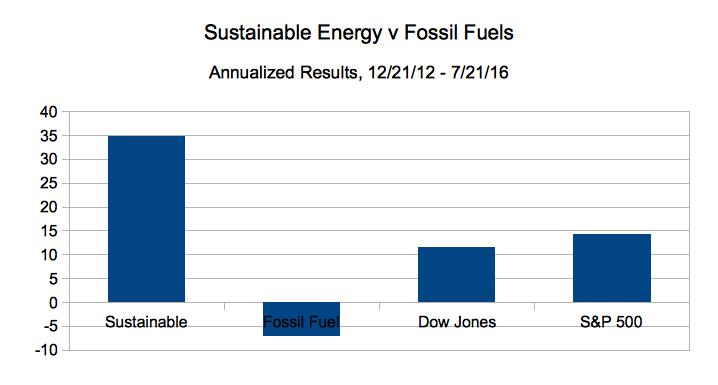

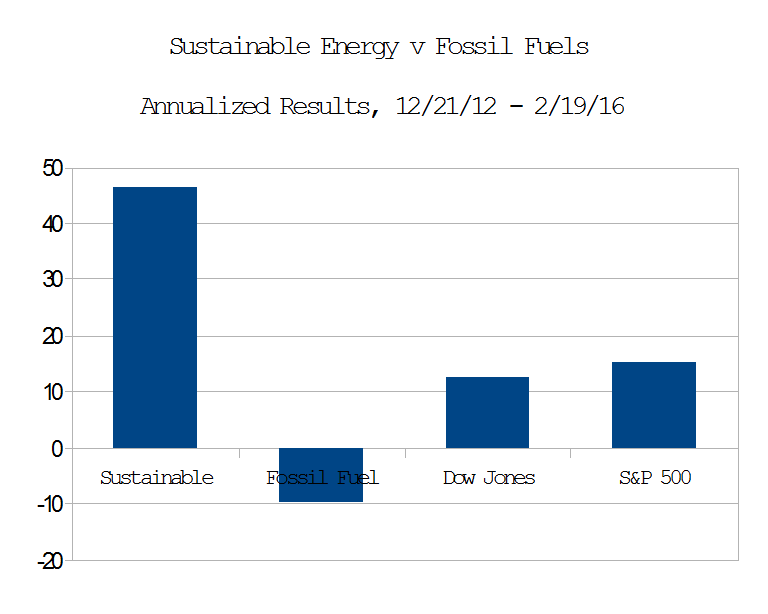

On Dec. 21, 2012, I imagined $16 Million dollars in equal investments in 16 real energy companies; eight Sustainable Energy companies and eight fossil fuel companies. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space.

On Dec. 21, 2012, I imagined $16 Million dollars in equal investments in 16 real energy companies; eight Sustainable Energy companies and eight fossil fuel companies. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space.

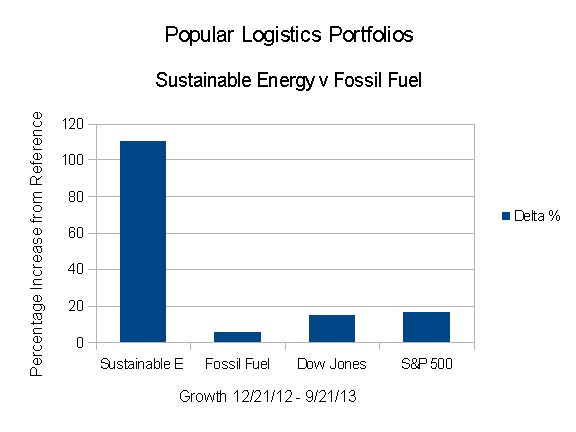

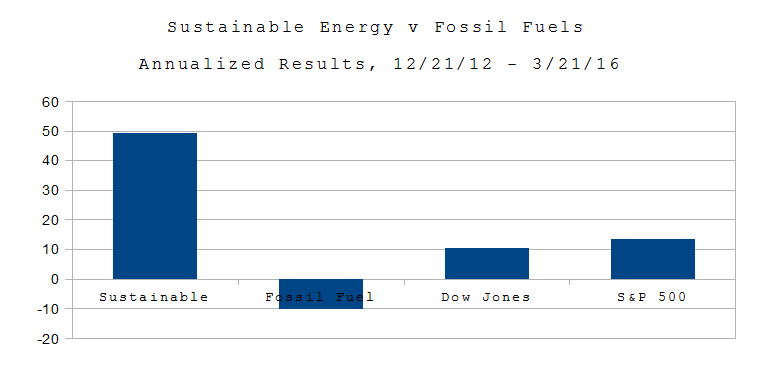

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space, and one company in the fossil fuel space.

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space. Excluding the value of dividends and transaction costs, but including the bankruptcy or crash of three companies in the sustainable energy space, and one company in the fossil fuel space.

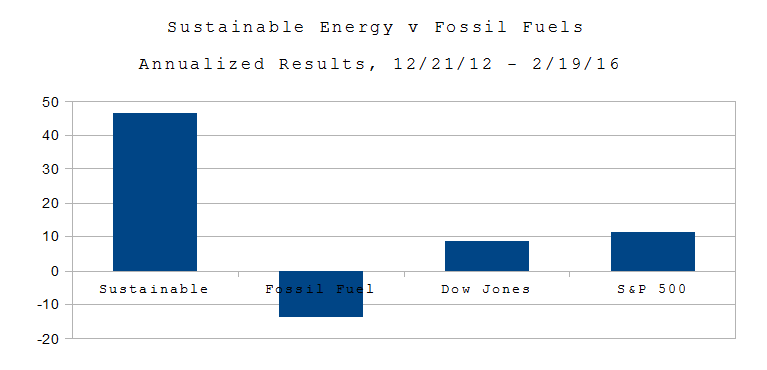

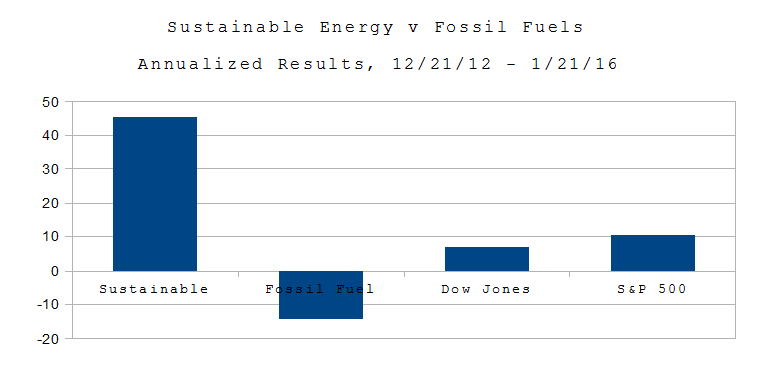

Wall St. 1/21/16. On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space.

Wall St. 1/21/16. On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space.