![]() Tweet The 18¢ per gallon tax on gasoline is scheduled to expire on Sept. 30, 2011. Will it expire? Will it be renewed? Will that immediately lower gasoline prices by 18¢? Will state or local governments add 18¢ to state or local taxes (or both)? Will gas station owners pocket some or all of the difference?

Tweet The 18¢ per gallon tax on gasoline is scheduled to expire on Sept. 30, 2011. Will it expire? Will it be renewed? Will that immediately lower gasoline prices by 18¢? Will state or local governments add 18¢ to state or local taxes (or both)? Will gas station owners pocket some or all of the difference?

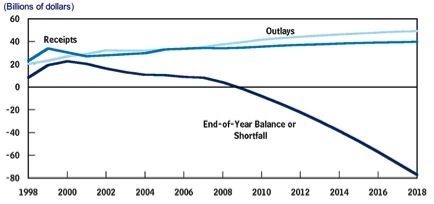

And what are the monies used for? The answer is roads and other transportation projects.

If the revenue disappears then new roads won’t be built and existing roads won’t be maintained.

In the long run, we may drive less. In the long run there may be less air pollution. And, as Keynes once said, “In the long run we are all dead.”

Links: Treehugger, DC Streets Blog, Antiplanner.