On Dec. 21, 2012, with virtual portfolios of 7 sustainable energy and 7 fossil fuel companies, I launched the Popular Logistics Sustainable Energy simulation, here.

On Dec. 21, 2012, with virtual portfolios of 7 sustainable energy and 7 fossil fuel companies, I launched the Popular Logistics Sustainable Energy simulation, here.

On Feb. 8, 2013, after 6 weeks, after exercising virtual options to invest in 2 additional companies at 12/21/12 prices, I reported the results, here.

- The Sustainable Energy portfolio is up 12.6%

- The Fossil Fuel portfolio is up 5.09%.

- The Dow Jones Industrial Average is up 6.52%

- The S&P 500 is up 5.52%.

- The Sustainable Energy Portfolio is up significantly more than the Fossil Fuel Portfolio, and the major indices.

- The Fossil Fuel Portfolio is up, but lags the major indices.

These results are not that surprising. Solar, Wind, Biofuel, and LED lighting are “growth” industries. Coal, oil, and oil service companies are in “mature” industries. As such I expect wide variability in the valuations of the solar, wind, biofuel and LED lighting companies, and stable valuations in the fossil fuel space. However, just as the market capitalization of BP dropped by roughly 30% after the Deepwater Horizon catastrophe, the market capitalizations of fossil fuel companies, while insulated from long term effects of burning carbon, i.e. a changing climate, severe storms, and environmental effects generally, are subject to negative valuation pressures from acute events such as the BP/Transocean/Haliburton Deepwater Horizon disaster or the Shell Kulluk accident (Alaska Dispatch).

Royal Dutch Shell PLC spent $5.4 Billion since 2005 to drill in the Arctic (Reuters, 1/3/13). When Shell announced earnings for the Fourth Quarter of 2012, the company posted profits of $5.6 billion, 15% above Q4 2011, but 11.1% below Wall Street’s consensus estimates for the company. (Michelle Jones, ValueWalk, 1/31/13.)

The problem faced by the fossil fuel companies is that the oil, gas, and coal are deeper and dirtier. It’s not only “Peak Oil,” it’s Peak Oil, Peak Coal, and Peak Carbon, combined with Peak Population, Peak Water, and Climate Change. The fossil fuel companies must spend more to extract each BTU of energy from the ground. And society will have to pay more to deal with the consequences of burning all this carbon. We will see more storms like Katrina, 2005, Sandy, 2012, and Nemo, 2013, more accidents like the Deepwater Horizon and Kulluk, and more coal ash floods like the one in Kingston, Tennessee, 12/24/08.

These systems are fuel and waste based. When we burn fuel we harness some of the energy, and we also release waste into the biosphere. We also allow the coal, oil, and gas companies, or rather their shareholders, to pass on the “externalized” costs of dealing with the waste to society at large, and to our children and grandchildren. The profits declared by the executives of these companies are higher than they would be if clean-up costs would be taken into account.

The key to solar, wind, and marine hydro, what I call “Nega-Fuel-Watts”, is that they are not fuel and waste based. Rather, we place a widget in the path of a moving stream of particles, photons, air, or water, and harness some of the kinetic energy of those particles to generate electricity. Similarly, we can, using geothermal energy systems, harness the temperature differential between the surface of the earth and the crust of the planet to heat or cool our buildings, to run our industrial processes. Once the systems are in place they need to be maintained, but they don’t need fuel. Ongoing operations don’t create waste.

Wood is a biofuel. If we can use wood at the same rate at which it grows, or lower, then we would have a sustainable industry. The key to the nascent biofuels industry is that we are developing methods to grow fuels. When biofuels cost less than fossil fuels, the fossil fuel industry will become fossils.

–

A quick survey of BP’s price history on Google Finance shows the share price of American Depository Receipts, ADRs, went from $60 on April 9, 2010, before the spill to $27 on June 25, 2010, then recovered to $49 on Jan. 14, 2011, which is the highest it has been since the spill. The price at the close of trading Friday, 2/8/13 was $43. The price was on a downward trajectory before the spill, from a peak of 75 on May 15, 2008.

–

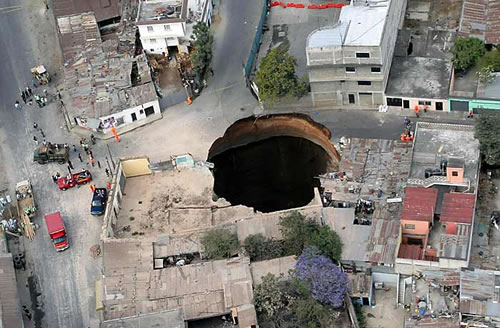

Note that the picture of the “Guatamala City sinkhole, above, is actually not a sinkhole. According to Discovery News, the 100-foot deep, 66-foot wide circular chasm is what Geologist Sam Bonis calls a “piping feature” . “Sinkholes” refer to areas where bedrock is solid but has been eaten away by groundwater, forming a geological Swiss cheese whose contours are nearly impossible to predict. Guatamala City is built on loose fill of volcanic ash. Storm water and other flows of water can dissolve or wash away the loose material, causing events like the one pictured above, which occurred in 2010.

–

An analyst with Popular Logistics, I hold a Bachelor’s in Biology, an MBA in “Managing for Sustainability” from Marlboro College, and experience with information technology. I can be reached at ‘L Furman 97” @ G Mail. I am available for consulting in various domains. Investments in equities are risky. I do NOT hold a “Series 7” license from the SEC. I am NOT a licensed stock broker, investment adviser or financial adviser and this should n0t be considered “Financial Advice” or “Investment Advice.”