Popular Logistics announces the Popular Logistics Sustainable Energy Portfolio Simulation.

This portfolio is composed of companies in the solar, biofuel and LED lighting industries.

I think these are disruptive technologies, like personal computers and workstations and client server software architecture in the 1980s and aircraft in the mid-20th and automobiles in the early 20th Century. We may be approaching, or may have recently crossed a “tipping point” in the Wind, Solar, LED lighting and Bio Fuel industries.

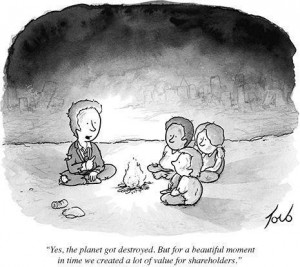

As points of reference, this “Sustainable Energy Portfolio” will be compared to an “UnSustainable Energy Portfolio,” composed of oil industry stocks, and the Dow Jones Industrial Average and the S&P 500.