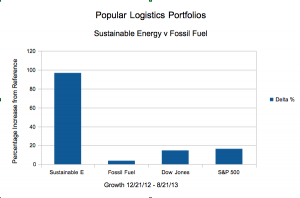

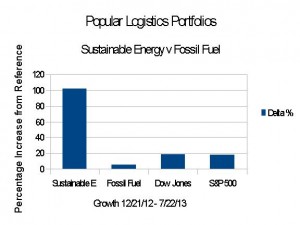

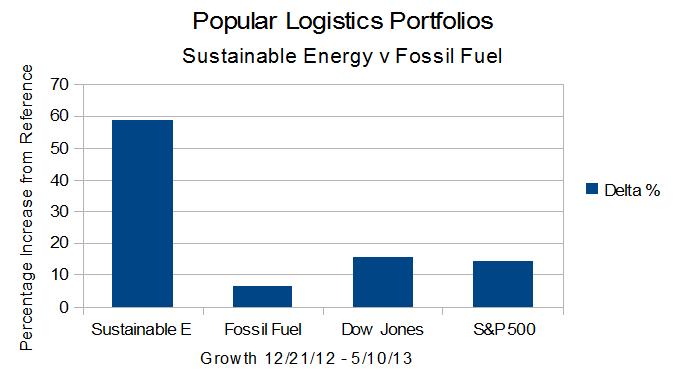

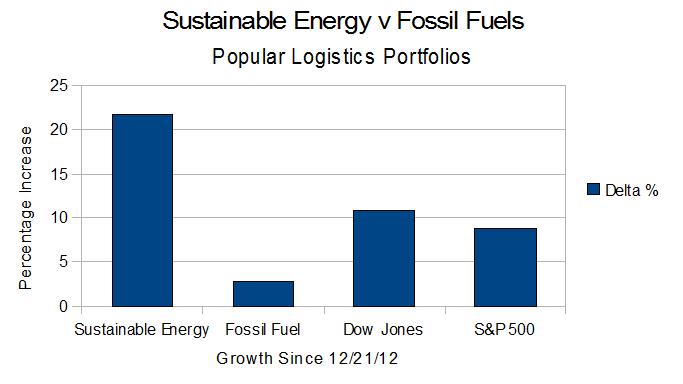

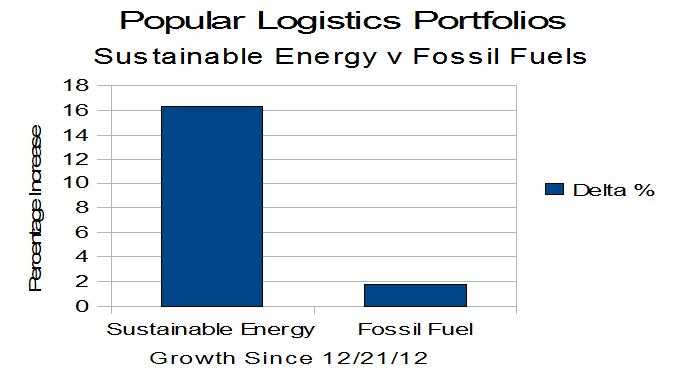

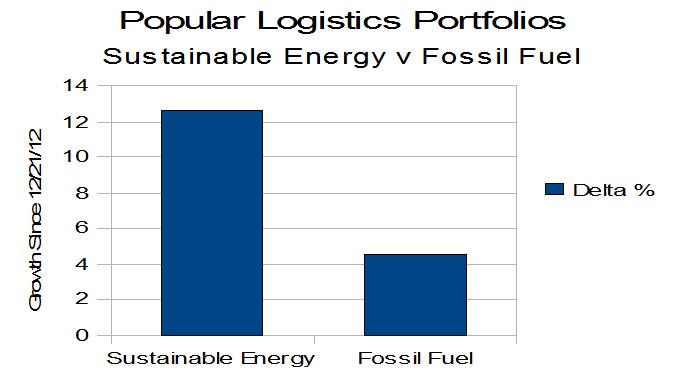

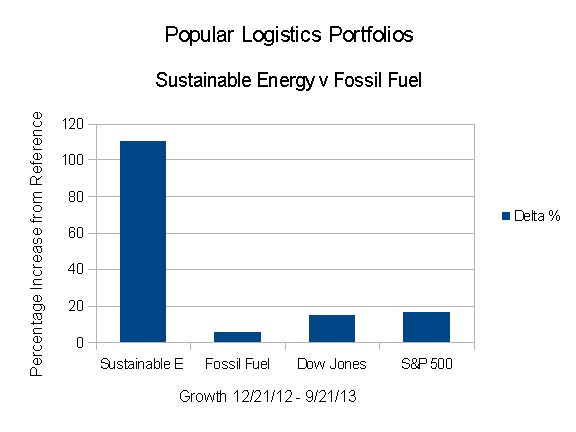

As of the close of trading Friday, Sept. 20, 2013, the trend, clearly evident by February 9, 2012 continues.

- The Dow Jones Industrial Average is up 14.66% from 12/21/12.

- The S&P 500 is up 16.36%.

- The Fossil Fuel Portfolio, significantly underperforming the reference indices, is up 5.95%.

- The Popular Logistics Sustainable Energy portfolio is up 110.10%.

The important question is: Is this a trend or a bubble?

The important question is: Is this a trend or a bubble?

I think it’s a trend. While I want to think it’s a trend, utility scale solar is at or below $4.00 per watt and getting cheaper. Solar also scales from the 10 watts on a backpack to 10,000 watts or 10 KW on a rooftop to 500 million watts, 500 MW utilities are building. Wind is less expensive. Wind and solar are predictable. Continue reading