Marilyn Monroe

Scarlett Johansson

Relational Databases, RDBMSs, circa 1999, such as DB2, MS SQL Server, Oracle, Informix and Sybase, implementations of E. F. Codd‘s work at IBM and built according to Codd’s 12 Rules, are effective for solving OnLine Transaction Processing, or OLTP problems. These might be termed “Blue Quadrant” problems, if you consider Stonebraker’s Matrix, 1, below.

Broken arm, courtesy C. Bethel, MD, and A. Dean, MD.

They are billing systems, trading systems – accounting systems. Relational databases are useful for tracking widgets and money, as long as those widgets can be described with words or numbers. Processing simple data, even with a high volume of transactions.

Relational databases could also be used to store images, such as those of Scarlett Johansson or Marilyn Monroe, above, or X-Rays, left. However, these are stored in the database as Binary Large Objects, aka “BLOBs.” While RDBMSs could operate on large volumes of data in various ways, there are just two operations they could do on on BLOBs: store and retrieve. They could not query on intrinsic properties of a BLOB. They could query on data that describe a BLOB, but not the BLOB itself. There is no other processing in a traditional RDBMS. And they could not search on images, only on text describing images.

Continue reading →

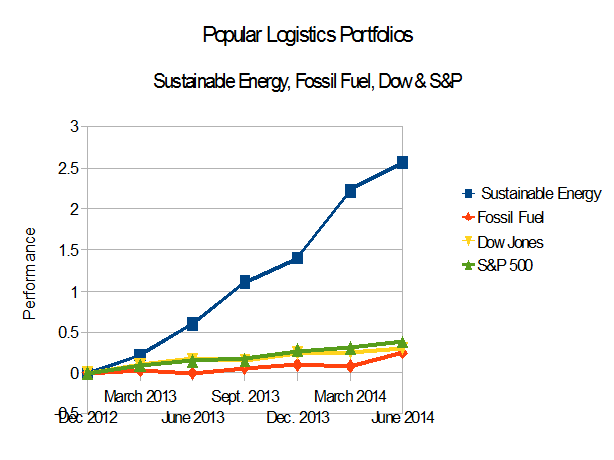

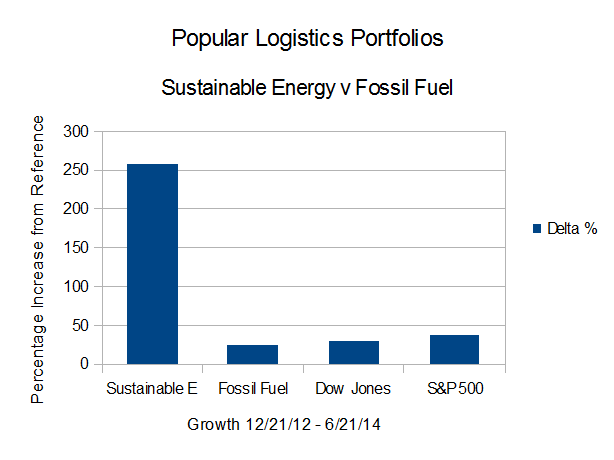

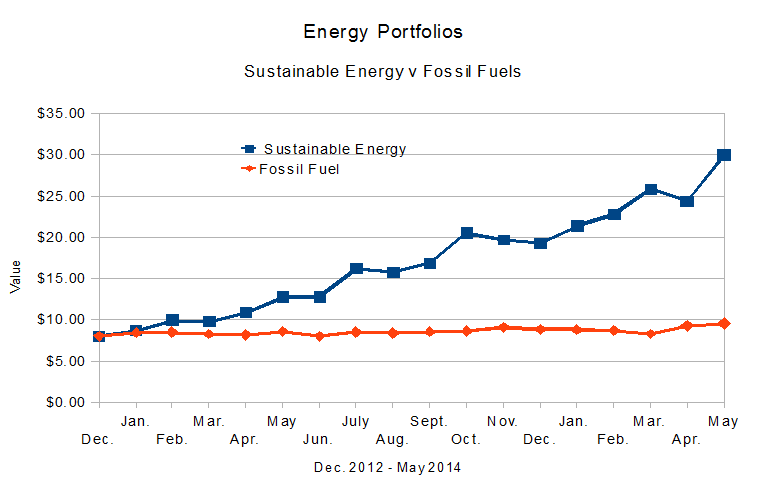

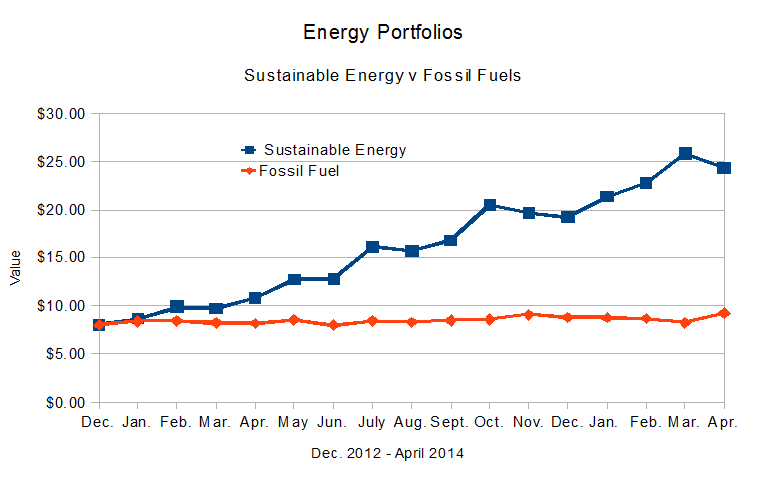

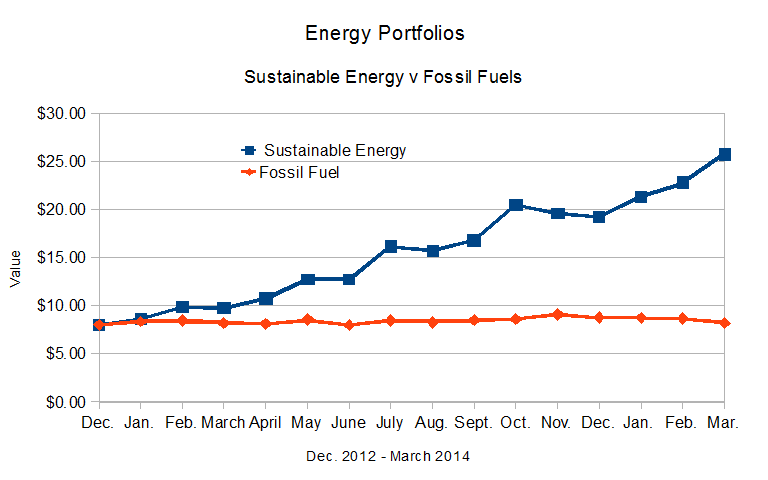

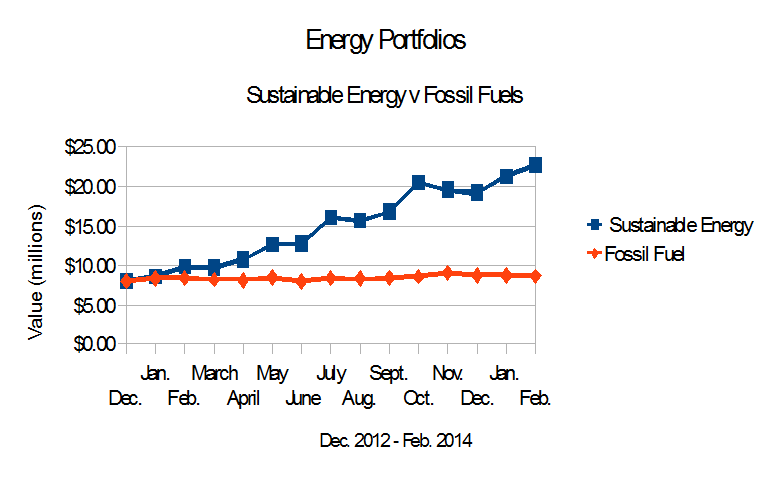

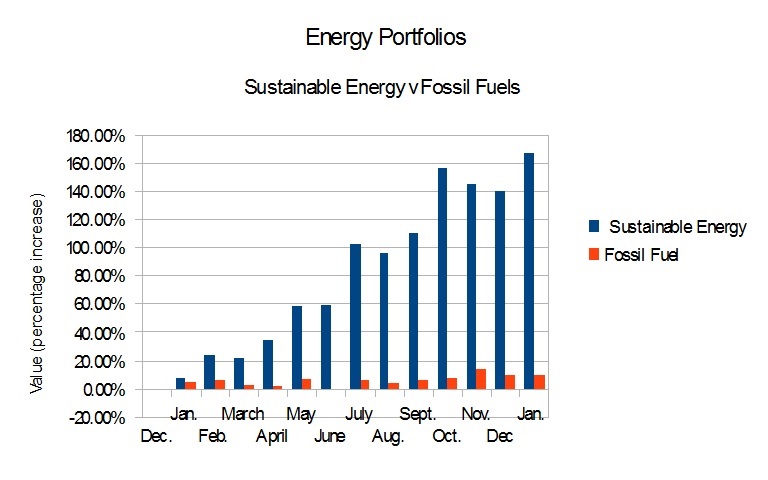

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; Eight in the Sustainable Energy space and eight in the fossil fuel space. Here are the results since Dec. 21, 2012:

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; Eight in the Sustainable Energy space and eight in the fossil fuel space. Here are the results since Dec. 21, 2012: