“FEDERAL RESERVE NOTE”

“THIS NOTE IS LEGAL TENDER FOR ALL DEBTS PUBLIC AND PRIVATE”

Two intertwined events took place between the end of World War II and the dawn of the 21St Century.

“FEDERAL RESERVE NOTE”

“THIS NOTE IS LEGAL TENDER FOR ALL DEBTS PUBLIC AND PRIVATE”

Two intertwined events took place between the end of World War II and the dawn of the 21St Century.

“Think Global, Act Local,” – Anonymous.

“Re-localization is a critical step in moving toward sustainability. The “global economy” is one of the culprits of our present mess,” – John Ehrenfeld.

“Sustainability is the possibility that human and other life will flourish on the planet forever,” – John Ehrenfeld.

Ehrenfeld, author of “Sustainability by Design,” here, lectures at Marlboro College in its MBA in Managing for Sustainability.

In “Italy’s accordion Industry: Tiny and Thriving“, NPR’s Morning Edition, on 1/9/12, discussed globalization in the context of the accordion industry in Italy. The piece began: “More than 70% of Italy’s gross domestic product comes from small businesses – and they’re not growing. Economists are worried that this will make it impossible for Italy to climb out of it’s massive $2.6 Trillion debt.”It concluded “But until more small companies [coalesce into giants like Prada] things in … Italy will stay out of tune with the global eonomy.”

But the piece also reported that the Italian accordion makers focus on quality. They don’t make many instruments – make about 20% of what they made in their heyday, one company makes 180 to 200 per month, but they make the Ferraris of the accordion world. More accordions are made today are by China, Inc., but those are cheap, low quality things. The Italian instruments sell for up to $50,000 each, to professional musicians such as Bjork and “The Decemberists.”

The story also asks about the long term consequences of 70% of a nation’s GDP coming from small businesses?

But it doesn’t ask:

As noted, the piece ended with “But until more small companies [coalesce into giants like Prada] things in … Italy will stay out of tune with the global eonomy.” This leads me to my final unanswered questions:

Is it a bad thing for Italy to be out of tune with the global economy? and

Is Italy really out of tune with the global economy?

The first two things that come to my mind when I think of “The Global Economy” are China, Inc. / WalMart, and oil. (I see China, Inc. and WalMart as one thing, but that’s another story). I see environmental degredation, poverty of mind, body, and spirit, and working conditions that equate to slavery.Personally, I’d rather be making accordions for a living wage in Italy, where I have a chance to open my own shop, than in China where conditions are equivalent to slavery.

Bjork, a singer from Reykjavík, Iceland, and the Decemberists, from Portland, Oregon, are buying Italian accordions. They would rather spend $50,000 on accordions from Italy than $399 on accordions from China. This suggests that the Italian accordion makers are, in fact, in the global economy, albeit on a different scale of that of the Chinese and one that economists don’t understand.

This brings me to the olive trees pictured above. Olive trees take a long time to mature – 35 to 150 years. But they live, thrive, and produce olives – for a very long time – hundreds of years, thousands of years with luck and proper cultivation. (Achaia Olive Groves).

And just as I would rather be making accordions that sell for $50,000 than those that sell for $399, I would rather sell 200 units for $50,000 each than 25,063 units for $399.

![]() Tweet “The United States,” according to Robert Barro, who teaches economics at Harvard and is a “fellow” at the Hoover Institution, “is in the third year of a grand experiment by the Obama administration.” This is inaccurate. Obama is the President, but the US Constitution provides a framework in which power is divided into three branches of the Federal government, and the power of the each of the branches is checked and balanced by the others, and “all power not expressly granted to the federal government is held by the states and the citizens. It would be more accurate to say that the United States is in the third year of a grand experiment by the Obama administration, the Congress, the Judiciary, the Republican Party, various special interests, and the citizens.

Tweet “The United States,” according to Robert Barro, who teaches economics at Harvard and is a “fellow” at the Hoover Institution, “is in the third year of a grand experiment by the Obama administration.” This is inaccurate. Obama is the President, but the US Constitution provides a framework in which power is divided into three branches of the Federal government, and the power of the each of the branches is checked and balanced by the others, and “all power not expressly granted to the federal government is held by the states and the citizens. It would be more accurate to say that the United States is in the third year of a grand experiment by the Obama administration, the Congress, the Judiciary, the Republican Party, various special interests, and the citizens.

Barro published this flawed analysis in “How to Really Save the Economy, “an op-ed in the New York Times, published Sept. 10, 2011.

“How is the experiment going?” Barro asks rhetorically. “Not well,” he answers.

How could it? On January 16, 2009, a week before the Inauguration, Rush Limbaugh, one of the leaders of the right wing of the United States said, “I hope Obama fails.” (The text is on Limbaugh’s site. An audio is on You Tube.) As I wrote, on Popular Logistics, here, a hope that the President fails is hope that the United States fails.

As was reported, here, in the Washington Post on August 6, 2011, and here on Popular Logistics, on August 8, 2011, John Boehner, Eric Cantor, Paul Ryan, and the “Young Guns,” their Republican comrades in the House of Representatives, PLANNED as far back as January, 2009 to use the debt ceiling to create a political crisis. The Republicans have been trying to actualize Mr. Limbaugh’s hopes.

Barro is a professor of neoclassical economics, and a fellow of the Hoover Institution. What he doesn’t understand, and what President Herbert Hoover didn’t understand, is that under economic conditions such as we see today, while businesses and government are able to create jobs, business owners are risk averse, and won’t risk capital. The government MUST create jobs, because businesses won’t. Everyone who has a job and a 10 year old car, and is hesitant with regards to buying a new car, understands this. John Maynard Keynes understood this. Franklin Delano Roosevelt understood this. Herbert Hoover didn’t – which is why he lost to Mr. Roosevelt in 1932, and why, 36 years later, President Nixon said “We are all Keynesians now.” (Note that Mr. Nixon has been called many things. However, “Liberal” is not one of them.)

So how do we really save the economy? See Part Deux.

One of the best kept secrets in New York City is the existence of a 40 kilowatt (KW) photovoltaic solar array on the Whitehall Street terminal of the Staten Island Ferry, pictured above, and first covered in Popular Logistics in 2007, here.

There are 90,000 public schools in the United States. Suppose we were to install a 40 KW solar energy system on each of them. PV solar modules require very little maintenance over their 35 to 45 year life expectancy. At a cost of $5,000 per kilowatt of nameplate capacity, each of these 90,000 systems would cost $200,000. This 3.6 gigawatts of distributed daylight-only capacity would cost about $14.4 billion. The total costs would probably be less because PV Solar is subject to economic forces like Moore’s Law.

It seems to make sense to use taxpayer monies to finance these systems; taxpayer monies pay the electric bills for public schools and other public infrastructure.

Every public school in the country would have a power plant that generates power, during the day, with no fuel cost and no waste. And with no associated mining, processing, transportation, fuel costs and no waste management costs. At $5.00 per watt, or $5 billion per gigawatt, the capital costs are lower than the costs of new nuclear and significantly lower than the costs of coal with carbon sequestration, with none of the risks or hazards associated with the systems: no arsenic, mercury, lead, thorium, uranium, zinc, or carbon.

But what are the other implications? What would it give us? Again. see Part Deux

![]() Tweet I am presenting “Beyond Fuel: From Consuming Natural Resources to Harnessing Natural Processes,” a discussion of the hidden costs, or “economic externalities,” of nuclear power, coal, and oil, and the non-obvious benefits of wind, solar, marine hydro and efficiency at the Space Coast Green Living Festival, Cocoa Beach, Florida, Sept 17, 2011.

Tweet I am presenting “Beyond Fuel: From Consuming Natural Resources to Harnessing Natural Processes,” a discussion of the hidden costs, or “economic externalities,” of nuclear power, coal, and oil, and the non-obvious benefits of wind, solar, marine hydro and efficiency at the Space Coast Green Living Festival, Cocoa Beach, Florida, Sept 17, 2011.

The festival is sponsored by the Cocoa Beach Surfrider Foundation and the Sierra Club Turtle Coast Group. It will be at the Cocoa Beach Courtyard by Marriott.

![]() Tweet I thought the market would crash in the wake of the Earthquake / Tsunami / Nuclear Meltdowns at Fukushima. It didn’t. However, something much less serious may be bringing the market – and the economy – to it’s knees. Politics. The Voice of America reported here that Standard & Poors downgraded US debt from AAA to AA+. Click here for the S&P’s Special Report and here for the full report.

Tweet I thought the market would crash in the wake of the Earthquake / Tsunami / Nuclear Meltdowns at Fukushima. It didn’t. However, something much less serious may be bringing the market – and the economy – to it’s knees. Politics. The Voice of America reported here that Standard & Poors downgraded US debt from AAA to AA+. Click here for the S&P’s Special Report and here for the full report.

S&P’s analysts wrote:

The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.

It is clear that the emphasis on cutting government spending, eliminating government jobs, eliminating benefits to unemployed citizens, rather than raising revenues and developing infrastructure is not in the long term or short term interests of the United States. As the 512 point drop in the Dow Jones Average, and the downgrade of US debt indicate, Republicans and the Tea Party should be careful for what they wish for – they just might get it.

In the discussions over the debt ceiling, John Boehner said something to the effect that if a family or a business is borrowing too much it simply must tighten it’s belt. Continue reading

As any freshman economics student should know, the Gross Domestic Product, GDP, is a measure of spending, derived from the Gross National Product, GNP, defined by Simon Kuznets during the Depression (click here for econlib). GDP is, at best, an indirect measure of wealth. The Genuine Progress Indicator, GPI, defined by Think Progress in 1995, measures genuine progress.

Consider the case of Joeseph Q. Bloggs, MBA, J.D., Esq., an investment banker. Bloggs has a J.D. from Harvard or Yale, an undergrad degree from Princeton, Dartmouth, Cornell, or another ivy league school, and a high school diploma from the Citadel or an acclaimed private school. As with his colleagues on Wall Street, he is self-proclaimed “Master of the Universe.” He leaves work one night after negotiating a highly leveraged hostile takeover, buys a Lamborghini, and rents the time of an expensive “friend.” He buys her an expensive outfit, and takes her to dinner at an the Four Seasons, or a similar expensive restaurant. He has a few drinks before dinner, a bottle of wine with dinner, and a glass or two of port after dinner. On the way to the Hamptons, he crashes his Lamborghini into a Ferrari driven by another lawyer / banker / actor / “Master of the Universe.”

Tweet ![]() During the Great Depression the Classical Economists said “Unemployment is voluntary. Business owners will not voluntarily keep the means of production idle.” While he had been a student of classical economics, John Maynard Keynes observed that the data didn’t fit the theory. And, he reasoned, if the observable data don’t fit the theory, the theory must be flawed. “Business owners are risk averse,” he saw. “A employee needs to be productive, needs to make widgets. But if no one is buying widgets, then contrary to classical theory, factory owners will fire workers and keep capital idle rather than hire workers to create excess inventory. That’s just common sense.”

During the Great Depression the Classical Economists said “Unemployment is voluntary. Business owners will not voluntarily keep the means of production idle.” While he had been a student of classical economics, John Maynard Keynes observed that the data didn’t fit the theory. And, he reasoned, if the observable data don’t fit the theory, the theory must be flawed. “Business owners are risk averse,” he saw. “A employee needs to be productive, needs to make widgets. But if no one is buying widgets, then contrary to classical theory, factory owners will fire workers and keep capital idle rather than hire workers to create excess inventory. That’s just common sense.”

We see this today.

When unemployment was low, for example in the United States during the tech boom of the 1990’s, people acted on the premise that “There is so much work that we could hire and good people and train them.” Today hiring managers seem to be acting on the premise that “There are so many people looking for work that they can wait for the perfect candidate.” Perfection being unattainable, jobs go unfilled. This is ok, in this context, because

Keynes also observed that the government is an employer that does not need to worry about going out of business. Building infrastructure is government employment that is investment for the future. These observations are as valid today as they were 80 years ago.

Earth from Space, courtesy of the American taxpayer. Reto Stöckli, Nazmi El Saleous, and Marit Jentoft-Nilsen, NASA GSFC

Tweet

![]()

Earth Day, 2010, I looked to the future on Popular Logistics. In 2009, I wrote about water pollution and agricultural waste in the Chesapeake. Today I am looking at the present and recent past. While a comprehensive look at where we are can be found on the web pages of the World Watch Institute, the New York Times, and the World Factbook of the Central Intelligence Agency, I want to make a few points.

Our energy policy is “when you flip a switch, the juice gotta flow.” It ain’t magic. It’s engineering and classical physics, with an understanding of radioactive fission and decay and a profound lack of long term thinking. It ain’t magic, but it might as well be. But we really need to base our energy policy on an understanding of ecological economics and sustainability.

We’ve had a few problems with nuclear power and fossil fuel in the last few years. Yet, there’s some light on the horizon.

First in a series on the systems dynamics of nuclear power in the light of the ongoing catastrophe at Fukushima.

Radioactive waste and melt downs are intrinsic properties of nuclear power. Before / After Gallery.

Current Assessment: 3/27/11 3:00 PM. 10,668 dead, 16,574 missing. Radiation levels spike, drop. (Gather). Silver lining in the cloud – radioactive substances will wind up in the Great Pacific Garbage Patch and trigger mutations in bacteria and plankton, creating “Plasticovores” – critters that chow down on plastic.

Eighth Assessment: 3/24/11 11:30 PM. 10,035 dead. 17,443 missing. Market Watch. Earlier in the day AP, Courtesy of the Star, Bloomberg. reported slightly lower numbers. We have seen a natural disaster of earthquake, tsunami, and aftershocks. While the the damage is tremendous, it could have been much worse. There are 10,035 tragedies, and 17,443 people are missing. It seems likely that many of them will never be found. Yet The nuclear plants have not yet undergone a full meltdown. This speaks volumes about American and Japanese engineering. The nuclear plants were built pretty well. Yet it also suggests that it is not prudent to build nuclear power plants in earthquake zones. Radioactive waste and meltdown are not intrinsic properties of solar, wind, geothermal, and conservation.

As we consider the Centennial of President Reagan’s birth, it is important to note that while he cut taxes on some taxpayers, he raised taxes on other taxpayers. As the graph, presented by Barry Ritholtz at Business Insider, shows, the deficit shot up under President Reagan, as it did under Presidents Woodrow Wilson, Herbert Hoover, Franklin Roosevelt, George H. W. Bush, and George W. Bush.

See also CNN Money Report.

New Jersey taxpayers could net $36.9 million per year, $369 million over 10 years, with the installation of 152.5 megawatts (MW) of photovoltaic (PV) solar electricity systems on public schools, community colleges, and each of the public universities in the state.

The systems would pay for themselves within the first 8 years. At 2010 values of electricity and Solar Renewable Energy Certificates (SRECs), these systems would generate electricity worth approximately $300 Million and SRECs worth $1.2 Billion over the first 10 years, approximately $369 Million in excess of the cost of the systems, and provide virtually free electricity over the remainder of their 35 to 40 year lifespan.

Widespread deployment of solar energy increases the resilience of the electric grid, strengthens national security and can enhance local emergency response capabilities.

These are the conclusions of a feasibility study by Lawrence J. Furman, principal of Furman Consulting Group, LLC during the course of his studies for an MBA in Managing for Sustainability at Marlboro College Graduate School.

Robert F. Kennedy, in a speech at the University of Kansas, March 18, 1968, said:

“Our Gross National Product, now, is over $800 billion dollars a year, but that Gross National Product – if we judge the United States of America by that – that Gross National Product counts air pollution and cigarette advertising, and ambulances to clear our highways of carnage. It counts special locks for our doors and the jails for the people who break them. It counts the destruction of the redwood and the loss of our natural wonder in chaotic sprawl. It counts napalm and counts nuclear warheads and armored cars for the police to fight the riots in our cities. It counts Whitman’s rifle and Speck’s knife, and the television programs which glorify violence in order to sell toys to our children. Yet the gross national product does not allow for the health of our children, the quality of their education or the joy of their play. It does not include the beauty of our poetry or the strength of our marriages, the intelligence of our public debate or the integrity of our public officials. It measures neither our wit nor our courage, neither our wisdom nor our learning, neither our compassion nor our devotion to our country, it measures everything in short, except that which makes life worthwhile. And it can tell us everything about America except why we are proud that we are Americans.”

As Donella Meadows explains in Thinking In Systems, ISBN: 978-1-60358-055-7, “The GNP lumps together goods and bads. (If there are more car accidents and medical bills and repair bills, the GNP goes up.) It counts only marketed goods and services. (If all parents hired people to bring up their children, the GNP would go up.) … It measures effort rather than achievement, gross production and consumption rather than efficiency. New light bulbs that give the same light with one-eighth the electricity and that last ten times as long make the GNP go down.”

“GNP,” Professor Meadows said, “is a measure of throughput – flow of stuff made and purchased in a year – rather than capital stocks, the houses and cars and computers and stereos that are the source of real wealth and real pleasure. It could be argued that the best society would be one in which capital stocks can be maintained with the lowest possible throughput, rather than the highest.”

The Giant Pool of Money is an outstanding radio documentary which explains, in

large part, our current economic woes. If we have the chronology right, this episode of This American Life – now rebroadcast as “Return To The Giant Pool of Money” led to NPR’s creation of the blog Planet Money.

Click here for other economic coverage by This American Life.

Why is this subject relevant at Popular Logistics? Because widespread poverty – or its effects, fear, limits on health care, housing, and food – constitute disasters, whether caused by a hurricane, indusstrial accident or by failure.

The hand is quicker than the eye – especially when the hand is invisible and the eye is closed or blind. The heavy hands of wisdom and authority must guide the invisible hand of desire without limits, just as a parent stops a child from grabbing too many cookies before dinner and a shop-keeper stops a thief from grabbing cookies it is neither entitled to nor willing to pay for.

Some call this Regulation. I call it Common Sense. (Click Here for “Why Economists Failed to Predict the Financial Crisis from “Knowledge @ Wharton.”)

Back in 1931, John Maynard Keynes wrote:

“Assuming no important wars, and no important increase in population, the economic problem may be solved, or at least within sight of a solution, within a hundred years. This means that the economic problem is not – if we look into the future – the permanent problem of the human race.” – John Maynard Keynes, “Economic possibilities for our grand-children.’ In Essays in Persuasion, 1931.

Keynes wrote that wealth would grow because of compounded interest, and we would live off of the interest. This would fuel technical inventions and dramatically increase the standard of living for a stable, peace-loving world. He thought boredom would become the permanent problem of the human race.

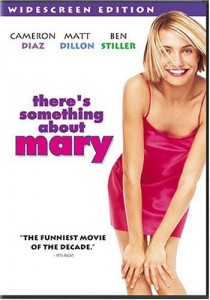

We would become a world populated by dilettantes flitting from party to party; a world of people like Prince Charles and Paris Hilton, although most, presumably, would not be famous and very few could become king. While some would work a few hours per week, most would have a life of leisure. People would live like the physician played by Cameron Diaz in the 1998 film “There’s Something About Mary.” They would work more on “lifestyle” issues like their golf swing than their profession.

Four factors, Keynes wrote, would effect this transition: