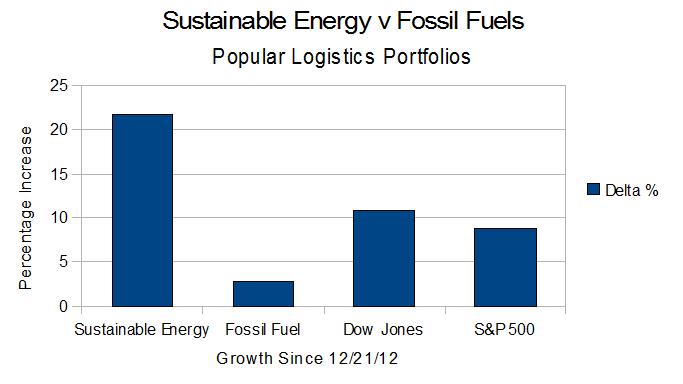

As of the close of trading on March 22, 2013, excluding the effects of dividends, the Sustainable Energy reference portfolio I created on 12/21/12 is up 21.67%, from $8.0 Million to $9.73 Million. Excluding the effects of dividends, the Fossil Fuel Reference Virtual Portfolio is up 2.7%, from $8.0 Million to $8.221 Million in the same time frame. The Dow Jones Industrial Average is up 10.85% and the S&P 500 is up 8.88%. Note that this is a simulation. Note also that this doesn’t take into account the effects of dividends.

Tag Archives: First Solar

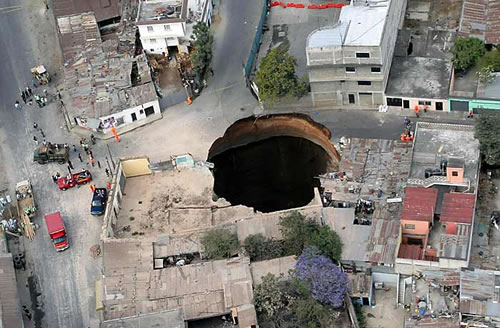

Gold Bricks and Sink-Holes – The Risk & Reward of Fossil Fuel, Solar & Wind

On Dec. 21, 2012, with virtual portfolios of 7 sustainable energy and 7 fossil fuel companies, I launched the Popular Logistics Sustainable Energy simulation, here.

On Dec. 21, 2012, with virtual portfolios of 7 sustainable energy and 7 fossil fuel companies, I launched the Popular Logistics Sustainable Energy simulation, here.

On Feb. 8, 2013, after 6 weeks, after exercising virtual options to invest in 2 additional companies at 12/21/12 prices, I reported the results, here.

- The Sustainable Energy portfolio is up 12.6%

- The Fossil Fuel portfolio is up 5.09%.

- The Dow Jones Industrial Average is up 6.52%

- The S&P 500 is up 5.52%.

- The Sustainable Energy Portfolio is up significantly more than the Fossil Fuel Portfolio, and the major indices.

- The Fossil Fuel Portfolio is up, but lags the major indices.

These results are not that surprising. Continue reading

Popular Logistics Sustainable Energy Portfolio

Popular Logistics announces the Popular Logistics Sustainable Energy Portfolio Simulation.

This portfolio is composed of companies in the solar, biofuel and LED lighting industries.

I think these are disruptive technologies, like personal computers and workstations and client server software architecture in the 1980s and aircraft in the mid-20th and automobiles in the early 20th Century. We may be approaching, or may have recently crossed a “tipping point” in the Wind, Solar, LED lighting and Bio Fuel industries.

As points of reference, this “Sustainable Energy Portfolio” will be compared to an “UnSustainable Energy Portfolio,” composed of oil industry stocks, and the Dow Jones Industrial Average and the S&P 500.