The Nuclear Regulatory Commission, NRC, has voted to allow Georgia Power to spend $14 Billion of ratepayer monies to build two reactors, Vogtle 3 and 4 near Waynesboro, Georgia. These would be the first new nuclear plants in the US in 35 years. Opponents say “we don’t need the power, but the utility wants the revenue stream.” Supporting this allegation Georgia Power plans to charge ratepayers – customers – for the costs of construction WHILE BUILDING THE PLANTS – BEFORE THE ARE ONLINE. see Georgia Power – Nuclear – Recovering Financing Costs.

Scott Peterson, of the Nuclear Energy Institute, was quoted on Morning Edition on Friday, 2/10/12, here, ” saying,

Nuclear plants, because they are very large, 24/7 power producers, really anchor the entire U.S. grid for electricity,”

He also said,

“Gas prices are unpredictable, and so is energy from wind and solar.”

He’s wrong on all three counts.

- Gas prices are rising. They may be difficult to predict on a day to day basis, but the trend is upward.

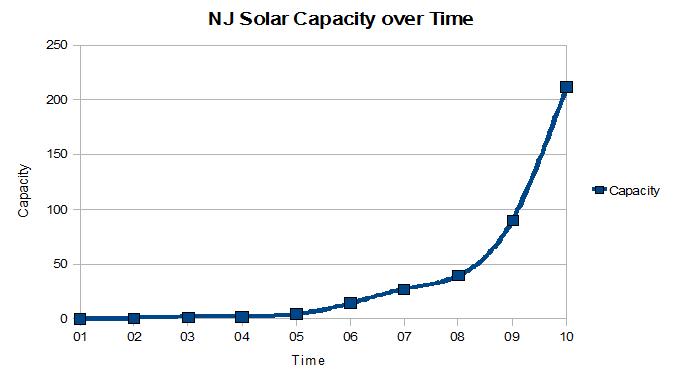

- Similarly, solar and wind are also predictable. The Department of Energy, DoE, knows precisely how much wind and sun passes over every square inch of the United States, and how much sunlight hits every square inch of the United States over the course of a year. And how much electricty a wind turbine or a photovoltaic solar energy system will produce anywhere in the US. The PVWatts solar calculator, for example,here, http://www.nrel.gov/rredc/pvwatts/, tells you how much power a solar array will produce over the course of a year.

- And nuclear is not 24 x 7. While the waste is 24 hours by 7 days per week by 365 days per year by ten thousand years, nuclear plants are not 24 by 7 days by 365. They are more like 24 by 7 by 350; they are shut down for about a month for refueling every 18 months. Nuclear plants are also shut down unexpectedly due to events like hurricanes, earthquakes, floods.

The Fort Calhoun reactor, on the Missouri River in Nebraska was shut down for refueling in May, 2011 . It stayed shut down due to flooding. It was offline throughout the summer and fall, (my coverage here and here) and as far as I know it is still offline. According to David Lochbaum, of the Union of Concerned Scientists, the shutdown cost the plant’s owners $1 million per day – $100 million if it was brought back online in September, $250 million if it is still offline. And I would hazard a guess that the owners asked for and received permission to charge the ratepayers those $1.0 million per day. (As far as I know the plant is still offline. I will update this post when I have more information.)

Regarding the Vogtle plants … the plan is to build two Westinghouse AP 1000 pressurized water reactors, here. Theses are 1154 MWe plant, that, according to Westinghouse,

“use the forces of nature and simplicity of design to enhance plant safety and operations and reduce construction costs.”

They are forecast to cost $14 Billion. $14 Billion divided by 2,308 MWe is $6.065 per MWe. That does not include the costs of security, fuel or waste management

Solar and wind costs less, takes a lot less time to deploy, do not require fuel, do not produce dangerous toxic wastes, do not present a target to terrorists and do not require special security infrastructures.