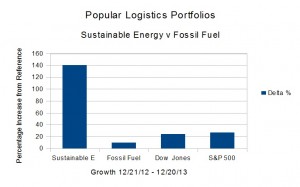

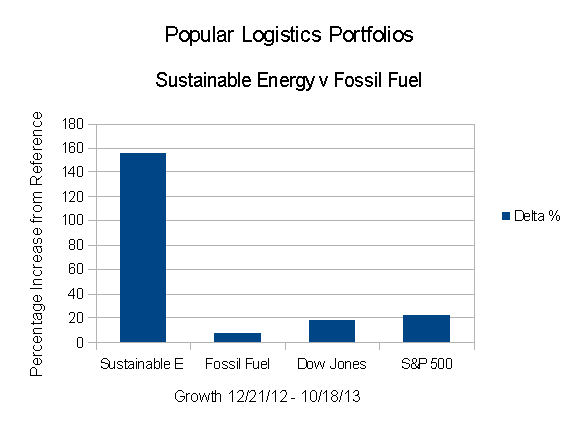

The Dow Jones Industrial Average is up 26.29% from 12/21/12.

The Dow Jones Industrial Average is up 26.29% from 12/21/12.

The S&P 500 is up 32.03%.

The Fossil Fuel Portfolio is up 18.52% from Dec. 21, 2012.

The Sustainable Energy Portfolio is up 211.6% from Dec. 21, 2012. Continue reading

Tag Archives: Solar Power

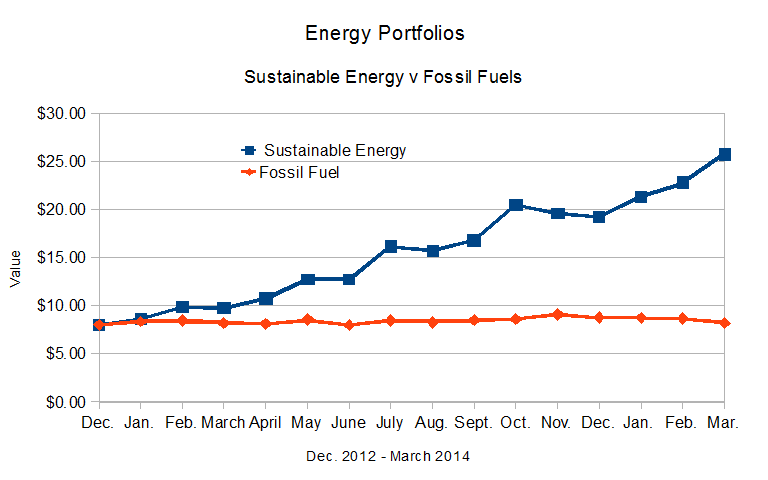

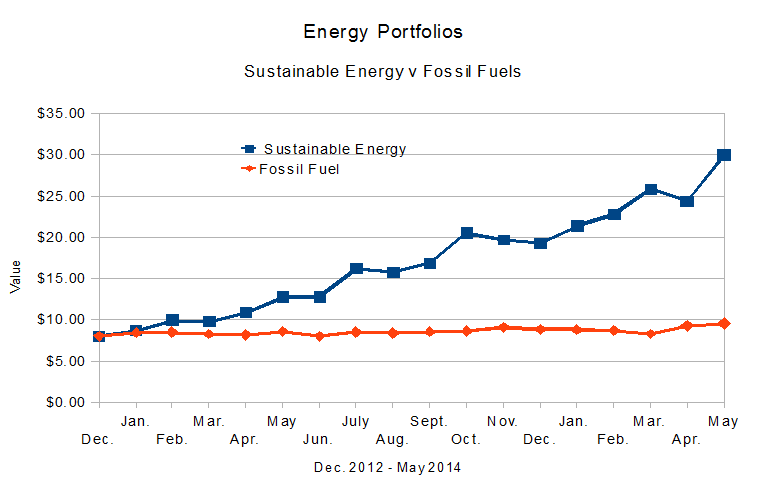

Energy Portfolios, 16 Months: Sustainable Energy up 204.25%, Fossil Fuel up 15.38%

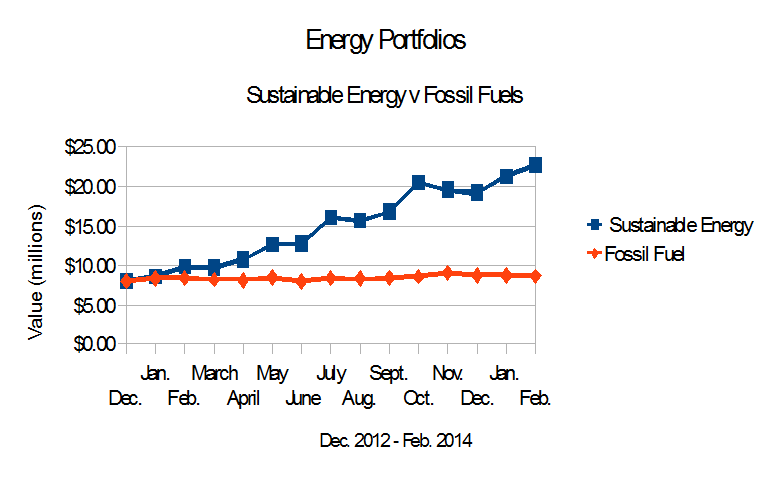

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; Eight in the Sustainable Energy space and eight in the fossil fuel space. The results:

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; Eight in the Sustainable Energy space and eight in the fossil fuel space. The results:

- The Dow Jones Industrial Average is up 24.54% from Dec. 21, 2012.

- The S&P 500 is up 30.56% from Dec. 21, 2012.

- The Fossil Fuel Portfolio had a great month, however, it continues to dramatically underperform the reference indices. It is up 15.38% from Dec. 21, 2012.

- The Sustainable Energy portfolio had a bad month, however, it continues to dramatically outperform the averages, and is up 204.25% from Dec. 21, 2012

Energy Portfolios: 15 Months: Sustainable up 222.6%: Fossil Fuel up 7.3%

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; Eight in the Sustainable Energy space and eight in the fossil fuel space. The Sustainable Energy portfolio is composed of Cree and Lighting Sciences in the LED space, GTAT, which at the time made solar ovens for cooking PV wafers, and today is diversifying, First Solar and Sunpower in the solar space, Vestas, a wind company, Solazyme a biofuel company and Next Era, a utility. The fossil fuel companies are the oil companies BP, Chevron Texaco, Conoco Phillips, Exxon Mobil and RD Shell, the coal company Peabody Coal, and Haliburton and Transocean, companies in the offshore oil and oil and gas drilling service industries.

Energy Portfolios: 14 Months: Sustainable up 184.4%: Fossil Fuel up 8.7%

The Dow Jones Industrial Average is up 23.01% from 12/21/12 to 2/21/14.

The Dow Jones Industrial Average is up 23.01% from 12/21/12 to 2/21/14.- The S&P 500 is up 28.39%.

- The Fossil Fuel Portfolio continues to dramatically underperform the reference indices. It is up 8.7% from Dec. 21, 2012.

- The Sustainable Energy portfolio continues to dramatically outperform the averages, and is up 184.41% from Dec. 21, 2012.

Note that the Sustainable Energy portfolio does not include Solar City, SCTY, or Tesla Motors, TSLA. Solar City’s stock price is up 713.0%, from 10.73 on December 21, 2012 to 75.86 at the close of trading Feb. 21, 2014. Tesla is up 614.5% from 34 to 209.60.

Energy Portfolios: 13 Months: Sustainable up 167.4%: Fossil Fuel up 8.92%

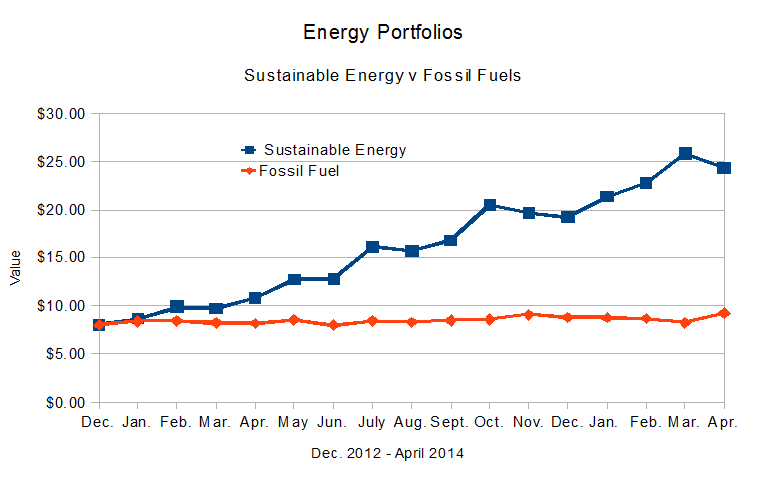

Figure 1, above, shows the relative performance of my hypothetical investments in sustainable Energy and Fossil Fuels, since Dec. 21., 2012.

Figure 1, above, shows the relative performance of my hypothetical investments in sustainable Energy and Fossil Fuels, since Dec. 21., 2012.

- The Dow Jones Industrial Average is up25.38% from 12/21/12.

- The S&P 500 is up28.95%.

- The Fossil Fuel Portfolio continues to dramatically underperform the reference indices. It is up 9.44% from Dec. 21, 2012, and down slightly from Dec. 20, 2013.

- The Sustainable Energy portfolio continues to dramatically outperform the fossil fuel portfolio and the averages, and is up 167.37% from Dec. 21, 2012.

As described in the earlier posts in this series, in Dec., 2012, I read that MidAmerican Energy was buying large scale solar electric generating stations being built by First Solar and Sunpower, and being financed by GE. This got me thinking … Continue reading

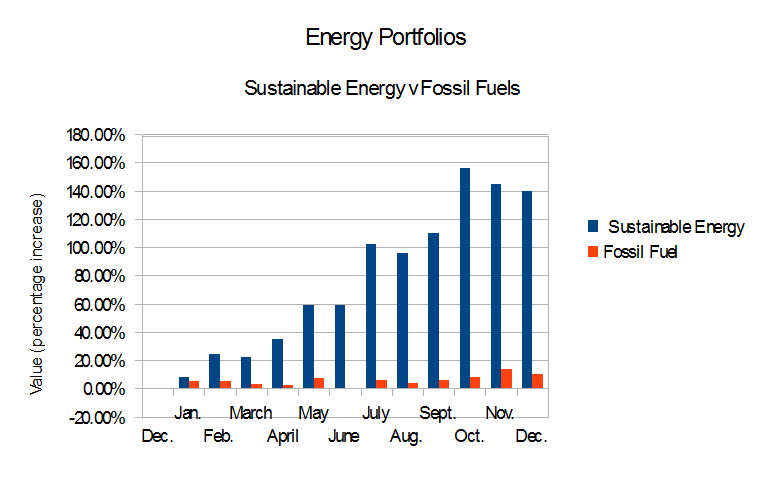

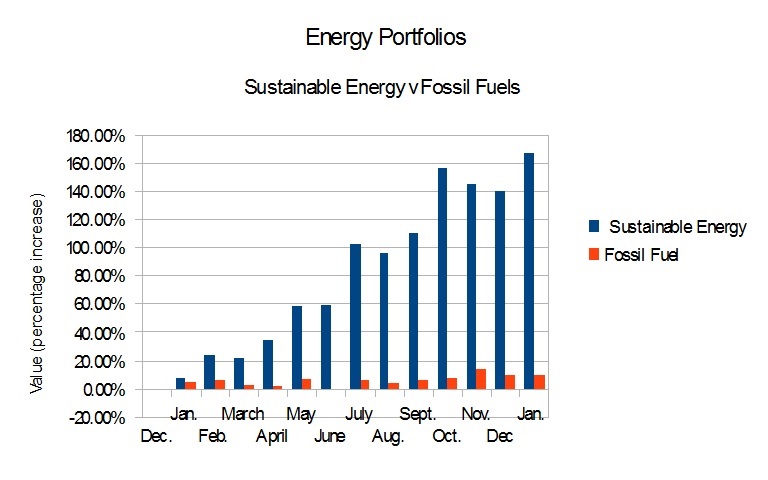

Energy Portfolios & Reference Indices, 2013 Summary

If a picture is worth a thousand words …

here are two thousand words on Sustainable Investing in 2013.

While the data may suggest that a “correction” may be in progress for the “Sustainable Energy” portfolio, and while the actions or inactions of various governments can dramatically effect performance of these portfolios, the Sustainable Energy Portfolio outperformed the Dow Jones Industrials and the S&P 500, both of which outperformed the Fossil Fuel Portfolio.

As the professional say, “Past performance is no guarantee of future performance.”

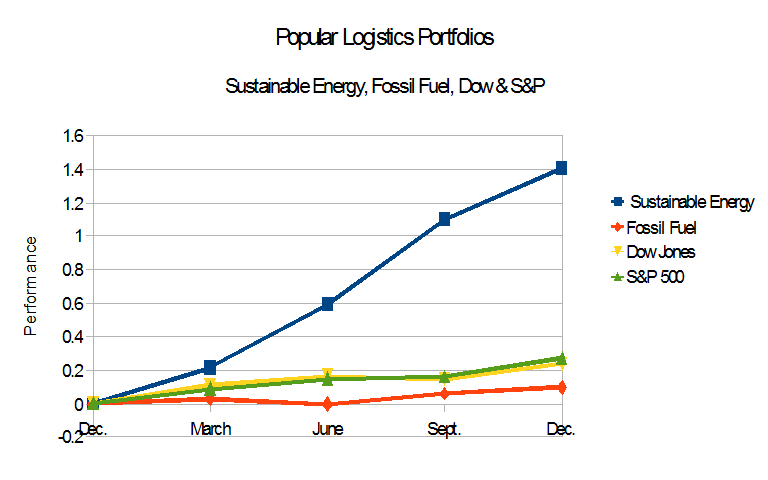

Energy Portfolios At One Year: Sustainable Energy up 140%, Fossil Fuel up 9.85%

On Dec. 21, 2011, reading that MidAmerican Energy was investing in utility scale solar energy generation, I looked at First Solar and Sunpower. Then I looked at six other companies in the sustainable energy world. I created a model portfolio. To make things interesting, I looked at eight companies in the fossil fuel industy and invested $16 Imaginary Million in these 16 companies, $1.0 Imaginary Million in each. As of the close of trading one year later, Friday, Dec. 20, 2013,

- The Dow Jones Industrial Average is up 23.91% from 12/21/12.

- The S&P 500 is up 27.13%.

- The Fossil Fuel Portfolio continues to dramatically underperform the reference indices. It is up 9.85% from Dec. 21, 2012.

- The Sustainable Energy portfolio continues to dramatically outperform the averages, and is up 140.31% from Dec. 21, 2012.

The data are summarized beginning in Table 1, below.

Energy Portfolios: Minor Corrections, Overall Results In Line with the Trend

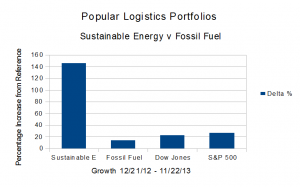

On Dec. 21, 2011, with $16 Imaginary Million, I created an investment simulation. I invested $1.0 Million in imaginary money in each of eight fossil fuel companies and eight sustainable energy companies. As of the close of trading 11 months later, Friday, Nov. 22, 2013, the trend, clearly evident after three months, in March of this year, continues.

On Dec. 21, 2011, with $16 Imaginary Million, I created an investment simulation. I invested $1.0 Million in imaginary money in each of eight fossil fuel companies and eight sustainable energy companies. As of the close of trading 11 months later, Friday, Nov. 22, 2013, the trend, clearly evident after three months, in March of this year, continues.

- The Dow Jones Industrial Average is up 22.72% from 12/21/12.

- The S&P 500 is up 26.22%.

- The Fossil Fuel Portfolio, dramatically underperforming the reference indices, is up 13.37% from Dec. 21, 2012.

- The Sustainable Energy portfolio is up 145.37% from Dec. 21, 2012.

- The Sustainable Energy Portfolio is also down 4.39% from October 18, 2013.

Note that this represents a retreat of 4.39% from the high of 156.14%, in October, 2013.

As discussed in September and October, last month, in Septermber, 2013, in “Investing for the Future,” and October, in “Sustainable Investing: Green Energy, Green Economy,” the important question is: Is this a trend or a bubble? As I wrote, I think it’s a trend.

The 2,000 pound question, after Typhoon Haiyon, Hurricanes Sandy, Irene and Katrina, after the fires of 2012 and 2013, the Missouri River Floods of 2011 – which knocked out the Fort Calhoun nuclear plant – the super-tornadoes of 2013 – one with a two mile wide contact point on land, which tore through Oklahoma (CNN / National Geographic / Zerohedge) is will we survive to make the transition to clean sustainable energy?

or rather:

- “How many of us survive to make this transition?”

- “What will be the carrying capacity of earth for humans?”

The data are summarized beginning in Table 1, below.

Oyster Creek & Nuclear Power After Fukushima

A public hearing will take place October 28, 2013, at the Clarion Hotel, 815 Route 37 West, Toms River, NJ. The subject of the hearing will be the National Academy of Sciences, NAS, study on nuclear power plants and cancer and “Lessons Learned from Fukushima.”

As I see it, the most important lessons from Fukushima are:

- Three of the Fukushima Dai’ichi nuclear reactors withstood the earthquake, the tsunami and the aftershocks. We can engineer systems that will withstand various scenarios, but this raises the cost such that nuclear cannot compete in a de-regulated energy market – see The Economist, here – and we cannot engineer against all possible events.

- The radioactive plume reached across the Pacific to North America, just as the plume from Chernobyl reached across the Atlantic to North America. An accident anywhere, when it involves dispersion of toxic materials, is an accident everywhere,

- We have seen four (4) meltdowns in the 54 years between the passage of the Price Anderson Act and the disasters at Chernobyl and Fukushima. The risk of a catastrophic accident such as a melt-down may be low, but a catastrophic accident, is by definition, catastrophic.

- The losses from Fukushima are estimated in the Trillions of Dollars. The economic value of the electricity produced by the six nuclear reactors is probably less than $100 Billion. Generating electricity from nuclear power is like taking heroin for a headache: The cure is worse than the disease.

There is a fifth lesson to be learned; this from the NJ Clean Energy Program in New Jersey and Vestas, the wind company. As noted on the NJ Clean Energy Program – Project Activity Pages, we in New Jersey now have have 1,117.5 Megawatts (MW) of grid tied photovoltaic solar electric generating capacity, almost double the 636 MW of Oyster Creek. Vestas is offering 8 MW wind turbines.

WE HAVE WIND and SOLAR: WE DON’T NEED OYSTER CREEK OR OTHER NUCLEAR POWER PLANTS.

Sustainable Investing: Green Energy, Green Economy

On Dec. 21, 2012, with $16 Imaginary Million, I created an investment simulation. I invested $1.0 Million in imaginary money in each of eight fossil fuel companies and eight sustainable energy companies. As of the close of trading 10 months later, Friday, Oct. 18, 2013, the trend, clearly evident after three months, in March of this year, continues.

- The Dow Jones Industrial Average is up 17.64% from 12/21/12.

- The S&P 500 is up 22.03%.

- The Fossil Fuel Portfolio, dramatically underperforming the reference indices, is up 7.47%.

- The Popular Logistics Sustainable Energy portfolio is up 156.14%.

As discussed last month, in “Investing for the Future,” the important question is: Is this a trend or a bubble? As I wrote, I think it’s a trend.

Jeremy Grantham, the “G” in GMO, invests with the expectation that all things being equal, a company’s valuation tends toward their arithmetic mean values. (Note that Mr. Grantham has not been contacted for this study.) But note that disruptive technologies are, by definition, game changers. Disruptive tech alters the landscape. If you looked at the airline, automobile and railroad industries over the 20th Century, automobiles and airlines waxed while railroads waned.

The future may be similar for Fossil Fuels and Sustainable Energy. The Market Capitalization of the Fossil Fuel portfolio is $1.13 Trillion. The Market Capitalization of the Sustainable Energy Portfolio is $0.06 Trillion ($60 Billion). The value of the companies of the Sustainable Energy portfolio is roughly 5.3% of the market capitalization of the companies of the Fossil Fuel portfolio. It can almost be described as a rounding error compared to the value of the Fossil Fuel portfolio. But if Mr. Grantham’s analysis is valid, and you aggregate the portfolios into one called “Energy” as opposed to a “Fossil Fuel” portfolio and a “Sustainable Energy” portfolio, then the shareholders of these various companies are in for an interesting few years.

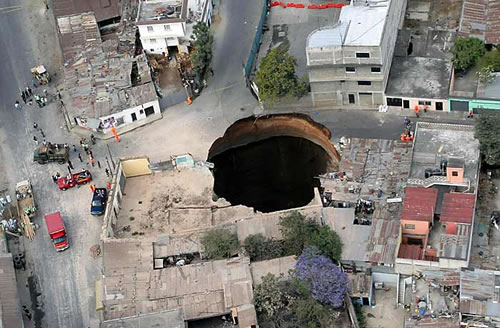

Gold Bricks and Sink-Holes – The Risk & Reward of Fossil Fuel, Solar & Wind

On Dec. 21, 2012, with virtual portfolios of 7 sustainable energy and 7 fossil fuel companies, I launched the Popular Logistics Sustainable Energy simulation, here.

On Dec. 21, 2012, with virtual portfolios of 7 sustainable energy and 7 fossil fuel companies, I launched the Popular Logistics Sustainable Energy simulation, here.

On Feb. 8, 2013, after 6 weeks, after exercising virtual options to invest in 2 additional companies at 12/21/12 prices, I reported the results, here.

- The Sustainable Energy portfolio is up 12.6%

- The Fossil Fuel portfolio is up 5.09%.

- The Dow Jones Industrial Average is up 6.52%

- The S&P 500 is up 5.52%.

- The Sustainable Energy Portfolio is up significantly more than the Fossil Fuel Portfolio, and the major indices.

- The Fossil Fuel Portfolio is up, but lags the major indices.

These results are not that surprising. Continue reading

Barbara Buono will Win, Apple will Grow, Assad will Die and other forecasts for 2013

In “The World Will Not End and Other Predictions for 2012,” I developed a set of predictions for 2012, the accuracy of which were described by me in 2012 Revisited. Here are my predictions for 2013. As noted last year, I am extrapolating from patterns that I see – also known as reading tea leaves.

- New Jersey’s Governor Chris Christie will lose his re-election campaign to NJ Senator Barbara Buono, pictured with me, above. The Tea Party Republicans will not compromise with President Obama, Democrats in the House and Senate, or the Republican Leadership in the House and Senate. They will, again, threaten to shut-down the U. S. government.

- A major hurricane will batter the Gulf Coast or the Eastern Seaboard, causing $25 to $80 Billion worth of damage. FEMA will be there to help.

- Apple will continue to report record sales and record profits. It will close out the year with a market capitalization around $650 Billion, up from today’s level of $470 Billion. If HP‘s Board doesn’t fire CEO Meg Whitman, HP may return to profitability. Dell‘s market share and market capitalization will fall.

- The wind and solar industries will increase in the US and globally, particularly Japan, which is now planning to have 100% renewable energy by 2040, and India, which is learning from the mistakes being made in China, Japan, and the West.

- Large industrial conglomerates will continue to design and sell wind turbines, LED lighting, PV solar modules and more energy efficient medical devices, etc.

- Assad will fall – and will die – by the end of 2014.

- Mohammed Morsi and the Moslem Brotherhood will consolidate power in Egypt, but will not abandon the Egypt – Israel peace treaty.

- Iran will provide weapons and support to Islamists in the Middle East, North Africa, and Central Asia.

- Israel, feeling threatened, and very concerned regarding Iran, Syria and Egypt, will ignore pressure to negotiate with the Palestinians.

- Roger Saillant and RP Siegel will not win any awards for their novel, Vapor Trails.

For an overview of the details see below.

Fort Calhoun Nuclear Plant, Update.

Back in April, 2011, the Fort Calhoun nuclear power plant, on the banks of the Missouri River about 19 miles north of Omaha, was shut down for refueling. The timing was perfect because in June, 2011, the Missouri River flooded. As pictured above, the plant that had been on the shore of the river was suddenly in the middle of the river.

THE PLANT IS STILL SHUT-DOWN – 20 Months after the incident.

Erin Golden, of the Omaha World News, told me on Dec. 19, 2012,

The plant is expected to be $129 million over budget in 2012. The OPPD [Omaha Public Power District] has set a target for the First Quarter of 2013 to bring the plant back on line. And the people at OPPD are optimistic that they will get the plant back on-line. The NRC, however, is not optimistic.

Nuclear Power – or Un Clear Power

The Nuclear Regulatory Commission, NRC, has voted to allow Georgia Power to spend $14 Billion of ratepayer monies to build two reactors, Vogtle 3 and 4 near Waynesboro, Georgia. These would be the first new nuclear plants in the US in 35 years. Opponents say “we don’t need the power, but the utility wants the revenue stream.” Supporting this allegation Georgia Power plans to charge ratepayers – customers – for the costs of construction WHILE BUILDING THE PLANTS – BEFORE THE ARE ONLINE. see Georgia Power – Nuclear – Recovering Financing Costs.

Scott Peterson, of the Nuclear Energy Institute, was quoted on Morning Edition on Friday, 2/10/12, here, ” saying,

Nuclear plants, because they are very large, 24/7 power producers, really anchor the entire U.S. grid for electricity,”

He also said,

“Gas prices are unpredictable, and so is energy from wind and solar.”

He’s wrong on all three counts.

- Gas prices are rising. They may be difficult to predict on a day to day basis, but the trend is upward.

- Similarly, solar and wind are also predictable. The Department of Energy, DoE, knows precisely how much wind and sun passes over every square inch of the United States, and how much sunlight hits every square inch of the United States over the course of a year. And how much electricty a wind turbine or a photovoltaic solar energy system will produce anywhere in the US. The PVWatts solar calculator, for example,here, http://www.nrel.gov/rredc/pvwatts/, tells you how much power a solar array will produce over the course of a year.

- And nuclear is not 24 x 7. While the waste is 24 hours by 7 days per week by 365 days per year by ten thousand years, nuclear plants are not 24 by 7 days by 365. They are more like 24 by 7 by 350; they are shut down for about a month for refueling every 18 months. Nuclear plants are also shut down unexpectedly due to events like hurricanes, earthquakes, floods.

The Fort Calhoun reactor, on the Missouri River in Nebraska was shut down for refueling in May, 2011 . It stayed shut down due to flooding. It was offline throughout the summer and fall, (my coverage here and here) and as far as I know it is still offline. According to David Lochbaum, of the Union of Concerned Scientists, the shutdown cost the plant’s owners $1 million per day – $100 million if it was brought back online in September, $250 million if it is still offline. And I would hazard a guess that the owners asked for and received permission to charge the ratepayers those $1.0 million per day. (As far as I know the plant is still offline. I will update this post when I have more information.)

Regarding the Vogtle plants … the plan is to build two Westinghouse AP 1000 pressurized water reactors, here. Theses are 1154 MWe plant, that, according to Westinghouse,

“use the forces of nature and simplicity of design to enhance plant safety and operations and reduce construction costs.”

They are forecast to cost $14 Billion. $14 Billion divided by 2,308 MWe is $6.065 per MWe. That does not include the costs of security, fuel or waste management

Solar and wind costs less, takes a lot less time to deploy, do not require fuel, do not produce dangerous toxic wastes, do not present a target to terrorists and do not require special security infrastructures.

The World Will Not End & Other Predictions for 2012

Here are my top 10 predictions for 2012. These are less readings of the tea leaves or the entrails of goats and chickens and more simple extrapolations of patterns in progress. Altho that may be the way effective oracles. They just masked their observations with hocus pocus, mumbo-jumbo, and guts.

This list runs a gamut from business and technology to energy, instability in the Middle East, micro-economics in the United States, politics, and not-yet-pop culture.

- Apple and IBM will continue to thrive. Microsoft will grow, slightly. Dell and HP will thrash. A share of Apple, which sold for $11 in December, 2001, and $380 in Dec. 2011, will sell for $480 in Dec. 2012.

- The Price of oil will be at $150 to $170 per barrel in Dec., 2012. The price of gasoline will hit $6.00 per gallon in NYC and California.

- There will be another two or three tragic accidents in China. 20,000 people will die.

- There will be a disaster at a nuclear power plant in India, Pakistan, Russia, China, or North Korea.

- Wal-Mart will stop growing. Credit Unions, insurance co-ops and Food co-ops, however, will grow 10% to 25%.

- The amount of wind and solar energy deployed in the United States will continue to dramatically increase.

- The government of Bashar Al Assad will fall.

- Foreclosures will continue in the United States.

- Arizona Sheriff Joe Arpaio will resign. Calls for Clarence Thomas to recuse himself from matters involving his wife’s clients will become louder, but Justice Thomas will ignore them. A prominent politician who says “Marriage is between a man and a woman,” or her husband, will be “outed” as gay. President Obama will be re-elected.

- The authors of Vapor Trails will not win a Nobel Prize for literature. They will not win a “MacArthur Genius Award.” Nor will I despite my work on this blog or “Sunbathing in Siberia” and the XBColdFingers project.

Here are the details … Continue reading