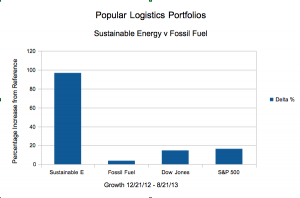

In December, 2012 I created two portfolios, a “Sustainable Energy” portfolio comprised of Cree, First Solar, GT Advanced Technology, Lighting Sciences, Next Era Energy, Sunpower Solar, Solazyme and Vestas, 8 stocks in the solar, LED lighting, wind and biofuel sectors, and a “Fossil Fuel” portfolio, comprised of BP, Chevron Texaco, Conoco Philips, Exxon Mobil, RD Shell, Haliburton, Transocean, and Peabody Coal, 8 stocks in the coal, oil, and fracking sectors. The results, after eight months, as illustrated above:

The Sustainable Energy portfolio, is now up 96.55%

The Reference Fossil Fuel portfolio is up 3.78%

The Dow Jones Industrial Average is up 14.66%

The S&P 500 is up 16.36%.

In a trend clearly evident in February, the Sustainable Energy portfolio has significantly outperformed the Dow Jones Industrials and the S&P 500, and the Fossil Fuel portfolio, which has significantly underperformed the indices.

These data are summarized in table 1 and below.

| Summary Data | ||||

| Portfolio | 12/21/12 | 08/21/13 | Delta | % |

| Sustainable Energy | $8,000,000 | $15,724,266 | $7,724,266 | 96.55% |

| Fossil Fuel | $8,000,000 | $8,302,069 | $302,069 | 3.78% |

| DJI | 13,091 | 15,010 | 1,919 | 14.66% |

| S&P 500 | 1,430 | 1,664 | 234 | 16.36% |

| Table 1 | ||||

The details are below the fold.

Here are the details on the Sustainable Energy Portfolio

| Sustainable Energy Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 08/21/13 | Delta | Delta % |

| 1 | Cree | CREE | 34.0 | 57.0 | 23.00 | 67.65% |

| 2 | First Solar | FSLR | 31.0 | 39.0 | 7.97 | 25.71% |

| 3 | GT Adv. Tech. | GTAT | 3.0 | 6.7 | 3.69 | 123.00% |

| 4 | Lighting Science | LSCG | 0.8 | 0.4 | -0.34 | -44.67% |

| 5 | Next Era Energy | NEE | 70.0 | 81.4 | 11.41 | 16.30% |

| 6 | Sun Power | SPWR | 5.4 | 23.0 | 17.52 | 322.65% |

| 7 | Solazyme | SZYM | 8.3 | 11.9 | 3.58 | 42.93% |

| 8 | Vestas | VWS | 6.3 | 20.1 | 13.81 | 218.86% |

| Table 2 | ||||||

Here are the details on the Fossil Fuel Portfolio

| Fossil Fuel Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 08/21/13 | Delta | Delta % |

| 1 | BP | BP | 42.1 | 41.5 | -0.61 | -1.45% |

| 2 | Chevron Texaco | CVX | 109.7 | 119.5 | 9.82 | 8.95% |

| 3 | Conoco Philips | COP | 58.6 | 66.6 | 7.95 | 13.57% |

| 4 | Exxon Mobil | XOM | 87.2 | 87.5 | 0.29 | 0.33% |

| 5 | Royal Dutch Shell | RDS.A | 69.3 | 64.4 | -4.87 | -7.03% |

| 6 | Haliburton | HAL | 34.7 | 48.7 | 14.00 | 40.33% |

| 7 | Transocean | RIG | 45.6 | 46.9 | 1.23 | 2.70% |

| 8 | Peabody Coal | BTU | 26.4 | 17.9 | -8.50 | -32.26% |

| Table 3 | ||||||

Posts in this series

- L. Furman, 12/21/12, Popular Logistics Sustainable Energy Portfolio,

- L. Furman, 2/8/13, Nega-Watts, Nega-Fuel-Watts, Mega-Bucks,

- L. Furman, 2/9/13, Gold Bricks and Sink-Holes – The Risk & Reward of Fossil Fuel, Solar & Wind,

- L. Furman, 3/2/13, Sustainable Energy Portfolio UP 16% & Fossil Fuel Portfolio Up 1.7% – Since Dec.21, 2012..

- L. Furman, 3/23/13, Portfolio Simulation At 3 Months: Sustainable Energy: Up 22%. Fossil Fuels: 3%.

- L. Furman, 4/26/13, Earth Day, 2013. Oil Spills, Explosions, Fracking Business As Usual & The Stock Market Response

- L. Furman, 5/13/13, Popular Logistics Energy Portfolios: The Trend Continues.

- L. Furman, 6/24/13, Popular Logistics Energy Portfolios: At 6 months

- L. Furman, 7/22/13, Popular Logistics Energy Portfolios: Sustainable Energy Doubles. Fossil Fuels increase 5.4%

- L. Furman, 8/22/13, Popular Logistics Energy Portfolios: An Exercise in Climate Capitalism

–

I, Larry Furman am a candidate for General Assembly (Site / Join / Contribute) to represent NJ Legislative District 12, which stretches from Matawan to New Hanover and includes Old Bridge, Manalapan, Englishtown, Roosevelt, Millstone, Jackson, and various other towns (click here). He is also an analyst with Popular Logistics.

I holds a Bachelor’s in Biology, and an MBA in “Managing for Sustainability” from Marlboro College, Vermont. I also have experience in information technology.

I am available for consulting in various domains and can be reached at “lfurman97” at G Mail. My goal in these posts is to present and discuss phenomena which I find interesting and which appear indicative of systemic shifts in the economy. Investments in equities of various companies are risky. I do NOT hold a “Series 6” or “Series 7” license from the SEC or any similar licensing body. I am NOT a licensed stock broker, investment adviser or financial adviser and this should n0t be considered “Financial Advice” or “Investment Advice.”