We are watching a paradigm shift.

We are watching a paradigm shift.

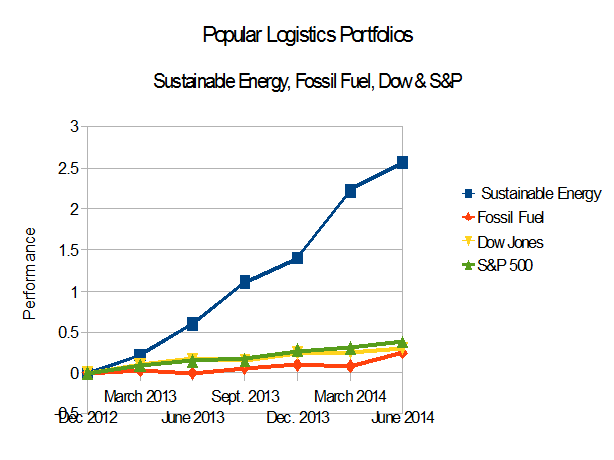

How else can we explain the dramatic rise of the Sustainable Energy portfolio, the equally dramatic underperformance of the Fossil Fuel portfolio, compared to the Dow Industrials and the S&P 500 since I started this experiment on Dec. 21, 2012? The data are in my post of June 24, 2014, Energy Portfolios, 18 Months: Sustainable up 257%, Fossil Fuels up 24.6%.

Consider these questions:

- Which companies are Disruptive or Subject to Disruption?

- Which companies are Evolving and which are doing what worked for the last 20/30/50/80 years?

- Can management execute?

- Is management asking for government subsidies?

- What about the long term side effects? What are the Economic Externalities?

If the answers to “1” and “2” are “Subject to Disruption” or “Doing what worked 50 or 80 years ago”, then a disruptive technology will come along. If the answer to “3” is “Management can’t execute” then the idea, no matter how brilliant, will fizzle like a wet firecracker.

If management is asking for government subsidies, is it because they need help building the foundation of a new industry or because they are depleting resources? (Is it a good idea to consume resources, that once consumed are essentially gone forever?)

And if the economic externalities, the side effects, are Climate Change, Floods, Droughts, Severe Storms … find a disruptive alternative.

Whaling, which was lucrative 150 years ago, was disrupted by fossil fuels. Over the next few years the fossil fuel and support industries may be disrupted by companies in the “Nega-Watt”, “Nega-Fuel-Watt” and “Nega-Waste” industries, such as those in the Sustainable Energy portfolio.

The Portfolios

Sustainable Energy Portfolio

Cree and Lighting Sciences in the LED space, GTAT, which in Dec. 2012 focused on ovens for cooking PV wafers, and today is diversifying, First Solar and Sunpower in the solar space, Vestas, a wind company, Solazyme, a biofuel company and Next Era, a utility. These along with Tesla and Solar City offer disruptive technology.

Fossil Fuel Portfolio

BP, Chevron Texaco, Conoco Phillips, Exxon Mobil and Royal Dutch Shell, the coal company Peabody Energy, and Haliburton and Transocean, in the offshore oil and oil and gas drilling service industries are tech that stands to be disrupted. BP, with BP Solar, the abandoned business unit, tried to market itself as “Beyond Petroleum,” but that was before the Deepwater Horizon. These, like other companies in the fossil fuel space are subject to disruption.

The stock price data are in tables 1, 1a, and 2, below.

| Sustainable Energy Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 06/20/14 | Delta | Delta % |

| 1 | Cree | CREE | 34.0 | 48.8 | 14.77 | 43.44% |

| 2 | First Solar | FSLR | 31.0 | 68.9 | 37.90 | 122.26% |

| 3 | GT Adv. Tech. | GTAT | 3.0 | 18.3 | 15.30 | 510.00% |

| 4 | Lighting Science | LSCG | 0.8 | 0.4 | -0.39 | -52.53% |

| 5 | Next Era Energy | NEE | 70.0 | 100.0 | 29.99 | 42.84% |

| 6 | Sun Power | SPWR | 5.4 | 40.3 | 34.84 | 641.62% |

| 7 | Solazyme | SZYM | 8.3 | 11.8 | 3.48 | 41.73% |

| 8 | Vestas | VWS | 6.3 | 50.9 | 44.62 | 707.13% |

| Table 1 | ||||||

| Sustainable Energy – Solar City and Tesla – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 06/20/14 | Delta | Delta % |

| 9 | Solar City | SCTY | 10.73 | 69 | 58.27 | 543.06% |

| 10 | Tesla Motors | TSLA | 34 | 229.59 | 195.59 | 575.26% |

| Table 1a | ||||||

| Fossil Fuel Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 06/20/14 | Delta | Delta % |

| 1 | BP | BP | 42.1 | 52.8 | 10.66 | 25.31% |

| 2 | Chevron Texaco | CVX | 109.7 | 132.3 | 22.63 | 20.63% |

| 3 | Conoco Philips | COP | 58.6 | 85.4 | 26.76 | 45.67% |

| 4 | Exxon Mobil | XOM | 87.2 | 103.8 | 16.60 | 19.03% |

| 5 | Royal Dutch Shell | RDS.A | 69.3 | 82.4 | 13.06 | 18.85% |

| 6 | Haliburton | HAL | 34.7 | 70.2 | 35.53 | 102.36% |

| 7 | Transocean | RIG | 45.6 | 45.4 | -0.26 | -0.57% |

| 8 | Peabody Coal | BTU | 26.4 | 17.0 | -9.40 | -35.67% |

| Table 2 | ||||||

–

Posts in this series

- L. Furman, 12/21/12, Popular Logistics Sustainable Energy Portfolio,

- L. Furman, 2/8/13, Nega-Watts, Nega-Fuel-Watts, Mega-Bucks,

- L. Furman, 2/9/13, Gold Bricks and Sink-Holes – The Risk & Reward of Fossil Fuel, Solar & Wind,

- L. Furman, 3/2/13, Sustainable Energy Portfolio UP 16% & Fossil Fuel Portfolio Up 1.7% – Since Dec.21, 2012..

- L. Furman, 3/23/13, Portfolio Simulation At 3 Months: Sustainable Energy: Up 22%. Fossil Fuels: 3%.

- L. Furman, 4/26/13, Earth Day, 2013. Oil Spills, Explosions, Fracking Business As Usual & The Stock Market Response

- L. Furman, 5/13/13, Popular Logistics Energy Portfolios: The Trend Continues.

- L. Furman, 6/24/13, Popular Logistics Energy Portfolios: At 6 months

- L. Furman, 7/22/13, Popular Logistics Energy Portfolios: Sustainable Energy Doubles. Fossil Fuels increase 5.4%

- L. Furman, 8/22/13, Popular Logistics Energy Portfolios: An Exercise in Climate Capitalism

- L. Furman, 9/20/13, Energy Portfolios – Investing for the Future

- L. Furman, 10/21/13, Sustainable Investing – Green Energy, Green Economy

- L. Furman, 11/22/13, Energy Portfolios: Minor Corrections, Overall Results In Line With the Trend

- L. Furman, 12/23/13, Energy Portfolios at One Year Sustainable Energy up 140%. Fossil Fuels up 9.85%.

- L. Furman, 12/26/13, Energy Portfolios and Reference Indices, 2013 Summary.

- L. Furman, 1/22/14, Energy Portfolios: 13 Months, Sustainable Energy up 167.4%, Fossil Fuels up 9.44%.

- L. Furman, 2/24/14, Energy Portfolios: 14 Months: Sustainable Energy up 184.4%, Fossil Fuels up 8.7%

- L. Furman, 3/23/14, Energy Portfolios: 15 Months: Sustainable Energy up 222.6, Fossil Fuel up 7.3%

- L. Furman, 4/22/14, Energy Portfolios, 16 Months: Sustainable Energy up 204.25%, Fossil Fuel up 15.38%

- L. Furman, 5/21/14, Energy Portfolios, 17 Months: Sustainable Energy up 211.6%, Fossil Fuels up 18.5%

- L. Furman, 6/24/14, Energy Portfolios, 18 Months: Sustainable Energy up 257%, Fossil Fuels up 24.6%

- L. Furman, 6/26/14, Energy Portfolios: 18 Months, Analysis

–

I, Larry Furman, an analyst with Popular Logistics, hold a BS and an MBA, am available for consulting in various domains and can be reached at “lfurman97” at G Mail. My goal in these posts is to present and discuss a phenomena I find “interesting” in a scientific sense. Investments in equities of various companies are risky. I am NOT a licensed stock broker, investment adviser or financial adviser and this should n0t be considered “Financial Advice” or “Investment Advice.”