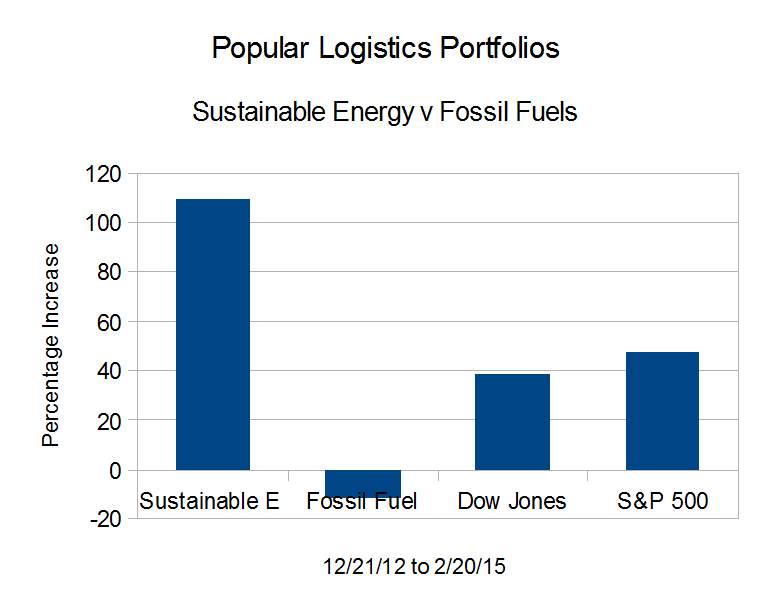

On Dec. 21, 2012, I put $16 Million imaginary dollars in equal imaginary investments in 16 real energy companies; $8.0 in the Sustainable Energy space and $8.0 in the fossil fuel space. Excluding the value of dividends and transaction costs,

- Fossil Fuel portfolio: from $8.0 M to $7.06 Million, down 11.76%.

- Sustainable Energy portfolio: from $8.0 M to $16.73 Million, up 109.18%.

- Dow Jones Industrial Average: from 13,091 to 18,140, up 34.15 %,

- The S&P 500: from 1,430 to 2,110, up 42.10%.

The Sustainable Energy portfolio is composed of Cree (CREE) and Lighting Sciences (LSCG) in the LED space, GT Advanced Tech (GTAT), which at the time made solar ovens for cooking PV wafers. First Solar (FSLR) and Sunpower Corp. (SPWR) in the solar space, Vestas (VWSYF), a wind company, Solazyme (SZYM) a biofuel company and Next Era Energy (NEE), a utility.

The fossil fuel companies are the oil companies British Petroleum (BP), Chevron Texaco (CVX), Conoco Phillips (COP), Exxon Mobil (XOM) and RD Shell (RDS.A), the coal company Peabody Coal (BTU), and Haliburton (HAL) and Transocean (RIG), companies in the offshore oil and oil and gas drilling service industries.

The data are summarized beginning in Table 1, below.

| Summary Data | ||||

| Portfolio | 12/21/12 | 02/20/15 | Delta | % |

| Sustainable Energy | 8,000,000 | 16,734,352 | 8,734,352 | 109.18% |

| Fossil Fuel | 8,000,000 | 7,058,816 | -941,184 | -11.76% |

| DJI | 13,091 | 18,140 | 5,049 | 38.57% |

| S&P 500 | 1,430 | 2,110 | 680 | 47.55% |

| Table 1 | ||||

The stock price data for the Sustainable Energy portfolio are in Table 2, below.

| Sustainable Energy Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 02/20/15 | Delta | Delta % |

| 1 | Cree | CREE | 34.0 | 39.2 | 5.19 | 15.26% |

| 2 | First Solar | FSLR | 31.0 | 49.0 | 18.02 | 58.13% |

| 3 | GT Adv. Tech. | GTAT | 3.0 | 0.4 | -2.65 | -88.33% |

| 4 | Lighting Science | LSCG | 0.8 | 0.1 | -0.61 | -81.33% |

| 5 | Next Era Energy | NEE | 70.0 | 105.6 | 35.60 | 50.86% |

| 6 | Sun Power | SPWR | 5.4 | 28.0 | 22.60 | 416.21% |

| 7 | Solazyme | SZYM | 8.3 | 2.6 | -5.78 | -69.30% |

| 8 | Vestas | VWS | 6.3 | 42.4 | 36.09 | 571.95% |

| Note that these data are old. GTAT is currently in bankruptcy protection. | ||||||

| Table 2 | ||||||

The stock price data for the Fossil Fuel Portfolio are in Table 3, below.

| Fossil Fuel Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 02/20/15 | Delta | Delta % |

| 1 | BP | BP | 42.1 | 41.3 | -0.84 | -1.99% |

| 2 | Chevron Texaco | CVX | 109.7 | 108.6 | -1.11 | -1.01% |

| 3 | Conoco Philips | COP | 58.6 | 67.4 | 8.78 | 14.98% |

| 4 | Exxon Mobil | XOM | 87.2 | 89.9 | 2.69 | 3.08% |

| 5 | Royal Dutch Shell | RDS.A | 69.3 | 65.8 | -3.49 | -5.04% |

| 6 | Haliburton | HAL | 34.7 | 43.4 | 8.65 | 24.92% |

| 7 | Transocean | RIG | 45.6 | 17.0 | -28.63 | -62.73% |

| 8 | Peabody Coal | BTU | 26.4 | 7.7 | -18.69 | -70.93% |

| Table 3 | ||||||

The valuation data for the Sustainable Energy Portfolio are in Table 4, below.

| Sustainable Energy Portfolio – Valuation | ||||||

| Value | Delta | |||||

| Item | Company | Symbol | 12/21/12 | 02/20/15 | Delta | Delta % |

| 1 | Cree | CREE | 1,000 | 1,153 | 153 | 15.26% |

| 2 | First Solar | FSLR | 1,000 | 1,581 | 581 | 58.13% |

| 3 | GT Adv. Tech. | GTAT | 1,000 | 117 | -883 | -88.33% |

| 4 | Lighting Science | LSCG | 1,000 | 187 | -813 | -81.33% |

| 5 | Next Era Energy | NEE | 1,000 | 1,509 | 509 | 50.86% |

| 6 | Sun Power | SPWR | 1,000 | 5,162 | 4,162 | 416.21% |

| 7 | Solazyme | SZYM | 1,000 | 307 | -693 | -69.30% |

| 8 | Vestas | VWS | 1,000 | 6,719 | 5,719 | 571.95% |

| total | 8,000 | 16,734 | 8,734 | 109.18% | ||

| Note that the values are in thousands. | ||||||

| Table 4 | ||||||

The valuation data for the Fossil Fuel Portfolio are in Table 5, below.

| Fossil Fuel Portfolio – Valuations | ||||||

| Value | Delta | |||||

| Item | Company | Symbol | 12/21/12 | 02/20/15 | Amount | Per Cent |

| 1 | BP | BP | 1,000 | 980 | -20 | -1.99% |

| 2 | Chevron Texaco | CVX | 1,000 | 990 | -10 | -1.01% |

| 3 | Conoco Philips | COP | 1,000 | 1,150 | 150 | 14.98% |

| 4 | Exxon Mobil | XOM | 1,000 | 1,031 | 31 | 3.08% |

| 5 | Royal Dutch Shell | RDS.A | 1,000 | 950 | -50 | -5.04% |

| 6 | Haliburton | HAL | 1,000 | 1,249 | 249 | 24.92% |

| 7 | Transocean | RIG | 1,000 | 373 | -627 | -62.73% |

| 8 | Peabody Coal | BTU | 1,000 | 295 | -705 | -70.54% |

| total | 8,000 | 7,017 | -983 | -12.29% | ||

| Note that the values are in thousands. | ||||||

| Table 5 | ||||||

The market capitalization data for the Sustainable Energy Portfolio are in Table 6.

| Sustainable Energy Portfolio | |||

| Market Capitalization (Billions) | |||

| Item | Company | 12/21/12 | 02/20/15 |

| 1 | Cree | 3.9 | 4.4 |

| 2 | First Solar | 2.69 | 4.9 |

| 3 | GT Adv. Tech. | 0.36 | 0.0 |

| 4 | Lighting Science | 0.15 | 0.0 |

| 5 | Next Era Energy | 29.6 | 46.9 |

| 6 | Sun Power | 0.88 | 3.7 |

| 7 | Solazyme | 0.52 | 0.2 |

| 8 | Vestas | 1.48 | 9.5 |

| total | 39.58 | 69.64 | |

| Table 6 | |||

The market capitalization data for the Fossil Fuel Portfolio are in Table 7.

| Fossil Fuel Portfolio – Market Capitalization | |||

| Market Capitalization (Billions) | |||

| Item | Company | 12/21/12 | 02/20/15 |

| 1 | BP | 133.8 | 125.5 |

| 2 | Chevron Texaco | 214.7 | 205.3 |

| 3 | Conoco Philips | 71.2 | 82.9 |

| 4 | Exxon Mobil | 397.7 | 377.8 |

| 5 | Royal Dutch Shell | 216.8 | 210.7 |

| 6 | Haliburton | 32.2 | 36.8 |

| 7 | Transocean | 16.4 | 6.3 |

| 8 | Peabody Coal | 6.37 | 2.1 |

| total | 1089.2 | 1047.5 | |

| Table 7 | |||

Posts in this series

- L. Furman, 12/21/12, Popular Logistics Sustainable Energy Portfolio

- L. Furman, 2/8/13, Nega-Watts, Nega-Fuel-Watts, Mega-Bucks

- L. Furman, 2/9/13, Gold Bricks and Sink-Holes – The Risk & Reward of Fossil Fuel, Solar & Wind

- L. Furman, 3/2/13, Sustainable Energy Portfolio UP 16% & Fossil Fuel Portfolio Up 1.7% – Since Dec.21, 2012

- L. Furman, 3/23/13, Portfolio Simulation At 3 Months: Sustainable Energy: Up 22%. Fossil Fuels: 3%

- L. Furman, 4/26/13, Earth Day, 2013. Oil Spills, Explosions, Fracking Business As Usual & The Stock Market Response

- L. Furman, 5/13/13, Popular Logistics Energy Portfolios: The Trend Continues.

- L. Furman, 6/24/13, Popular Logistics Energy Portfolios: At 6 months

- L. Furman, 7/22/13, Popular Logistics Energy Portfolios: Sustainable Energy Doubles. Fossil Fuels increase 5.4%

- L. Furman, 8/22/13, Popular Logistics Energy Portfolios: An Exercise in Climate Capitalism

- L. Furman, 9/20/13, Energy Portfolios – Investing for the Future

- L. Furman, 10/21/13, Sustainable Investing – Green Energy, Green Economy

- L. Furman, 11/22/13, Energy Portfolios: Minor Corrections, Overall Results In Line With the Trend

- L. Furman, 12/23/13, Energy Portfolios at One Year Sustainable Energy up 140%. Fossil Fuels up 9.85%

- L. Furman, 12/26/13, Energy Portfolios and Reference Indices, 2013 Summary.

- L. Furman, 1/22/14, Energy Portfolios: 13 Months, Sustainable Energy up 167.4%, Fossil Fuels up 9.44%

- L. Furman, 2/24/14, Energy Portfolios: 14 Months: Sustainable Energy up 184.4%, Fossil Fuels up 8.7%

- L. Furman, 3/23/14, Energy Portfolios: 15 Months: Sustainable Energy up 222.6, Fossil Fuel up 7.3%

- L. Furman, 4/22/14, Energy Portfolios, 16 Months: Sustainable Energy up 204.25%, Fossil Fuel up 15.38%

- L. Furman, 5/21/14, Energy Portfolios, 17 Months: Sustainable Energy up 211.6%, Fossil Fuels up 18.5%

- L. Furman, 6/24/14, Energy Portfolios, 18 Months: Sustainable Energy up 257%, Fossil Fuels up 24.6%

- L. Furman, 6/26/14, Energy Portfolios: 18 Months, Analysis

- L. Furman, 7/22/14, Energy Portfolios: 19 Months: Sustainable Energy up 222%, Fossil Fuels up 25%

- L. Furman, 8/23/14, Energy Portfolios: 20 Months: Sustainable Energy up 229%, Fossil Fuels up 18.4%

- L. Furman, 8/29 /14, Energy Portfolios: 20 Months: Conclusion & Observations

- L. Furman, 10/1/14, The Paradigm Is Shifting; Fossil Fuels Are Becoming Fossils

- L. Furman, 10/7/14, Cree: Strong Financials, But …

- L. Furman, 10/21/14, Energy Portfolios: 22 Months: Sustainable Energy Up But Dropping.

- L. Furman, 11/27/14, Energy Portfolios: 23 Months: Sustainable Energy DOUBLED, Fossil Fuel Down (slightly)

- L. Furman, 12/28/14, Energy Portfolios: 24 Months: Sustainable Energy Up 91%, Fossil Fuel DOWN 10%

- L. Furman, 1/27/15, Energy Portfolios: 2 Years, 1 Month, Sustainable Up 85%, Fossil Fuels DOWN 15%

- L. Furman, 2/23/15, Energy Portfolios: 2 Years, 2 Months, Sustainable Up 109%, Fossil Fuels DOWN 12%

An analyst with Popular Logistics, I hold a BS and an MBA and over 20 years experience in Information Technology. Available as a speaker and consultant, I can be reached at “LFurman . MBA” at G Mail. The goal in these posts is to present and discuss phenomena which I find interesting and which appear indicative of systemic shifts in the economy. Investments in equities of various companies are risky. I do NOT hold a “Series 6″ or “Series 7″ license from the SEC or any similar license from any other licensing body. I am NOT a licensed stock broker, investment adviser or financial adviser and this should n0t be considered “Financial Advice” or “Investment Advice.”