Back in December, 2012 I started this experiment in sustainable investing. I took $16 million imaginary dollars and invested them, in imaginary $1.0 Million chunks, in 8 sustainable energy companies and 8 fossil fuel companies. The results are:

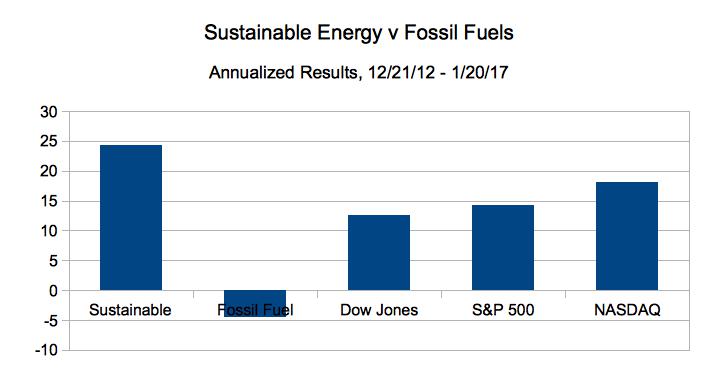

- The Fossil Fuel portfolio is down 18.29% overall, from $8.0 Million to $6.54 Million. This is a collapse of -4.48% on an annualized basis. However, please note that my model does not account for dividends.

- The Market Capitalization of the five big oil companies of the Fossil Fuel portfolio has decreased by 4.95%

- The Sustainable Energy portfolio has essentially doubled in stock price since Dec. 2012. Up 98.98% overall and 24.24% on an annualized basis, from $8 Million to $15.92 Million.

- The Market Capitalization of the Sustainable Energy portfolio has increased by 87.21% in this period.

- The Dow Jones Industrial Average is up 51.43% overall and 12.60% on an annualized basis from 13.091 on Dec. 21, 2012 to 19,824 on Jan. 20, 2017.

- The S&P 500 is up 57.97% overall and 14.20% on an annualized basis, from 1,430 to 2,259.

- The NASDAQ is up 74.54% overall and 18.20% on an annualized basis, from 3,021 to 5,251.

The Sustainable Energy portfolio is composed of Cree (CREE) and Lighting Sciences (LSCG) in the LED space, GT Advanced Tech (GTAT), which at the time made solar ovens for cooking PV wafers. First Solar (FSLR) and Sunpower Corp. (SPWR) in the solar space, Vestas (VWSYF), a wind company, Solazyme (SZYM) a biofuel company and Next Era Energy (NEE), a utility. I did not include Tesla (TSLA) in this portfolio.

The fossil fuel companies are the oil companies British Petroleum (BP), Chevron Texaco (CVX), Conoco Phillips (COP), Exxon Mobil (XOM) and RD Shell (RDS.A), the coal company Peabody Coal (BTU), and Haliburton (HAL) and Transocean (RIG), companies in the offshore oil and oil and gas drilling service industries.

The data are summarized beginning in Table 1, below.

| Summary Data | |||||

| Portfolio | 12/21/12 | 01/20/17 | Delta | Delta % | Annualized |

| Sustainable Energy | 8,000,000 | 15,918,539 | 7,918,539 | 98.98% | 24.24% |

| Fossil Fuel | 8,000,000 | 6,536,989 | -1,463,011 | -18.29% | -4.48% |

| DJI | 13,091 | 19,824 | 6,733 | 51.43% | 12.60% |

| S&P 500 | 1,430 | 2,259 | 829 | 57.97% | 14.20% |

| NASDAQ | 3,012 | 5,251 | 2,239 | 74.34% | 18.20% |

| Table 1 | |||||

The stock price data for the Sustainable Energy portfolio are in Table 2, below.

| Sustainable Energy Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 01/20/17 | Delta | Delta % |

| 1 | Cree | CREE | 34.0 | 28.1 | -5.95 | -17.50% |

| 2 | First Solar | FSLR | 31.0 | 34.8 | 3.75 | 12.10% |

| 3 | GT Adv. Tech. | GTAT | 3.0 | 0.0 | -2.98 | -99.28% |

| 4 | Lighting Science | LSCG | 0.8 | 0.0 | -0.71 | -94.27% |

| 5 | Next Era Energy | NEE | 70.0 | 119.3 | 49.26 | 70.37% |

| 6 | Sun Power | SPWR | 5.4 | 7.0 | 1.56 | 28.73% |

| 7 | Solazyme | SZYM | 8.3 | 2.2 | -6.19 | -74.22% |

| 8 | Vestas | VWS | 6.3 | 67.3 | 60.95 | 965.93% |

| Note that GTAT is currently in bankruptcy protection. | ||||||

| Table 2 | ||||||

The stock price data for the Fossil Fuel Portfolio are in Table 3, below.

| Fossil Fuel Portfolio – Stock Prices | ||||||

| Item | Company | Symbol | 12/21/12 | 01/20/17 | Delta | Delta % |

| 1 | BP | BP | 42.1 | 36.8 | -5.28 | -12.54% |

| 2 | Chevron Texaco | CVX | 109.7 | 115.6 | 5.89 | 5.37% |

| 3 | Conoco Philips | COP | 58.6 | 50.7 | -7.87 | -13.43% |

| 4 | Exxon Mobil | XOM | 87.2 | 85.9 | -1.34 | -1.54% |

| 5 | Royal Dutch Shell | RDS.A | 69.3 | 54.9 | -14.42 | -20.81% |

| 6 | Haliburton | HAL | 34.7 | 56.5 | 21.75 | 62.66% |

| 7 | Transocean | RIG | 45.6 | 15.3 | -30.33 | -66.45% |

| 8 | Peabody Coal | BTU | 395.3 | 1.7 | -393.55 | -99.57% |

| Table 3 | ||||||

The valuation data for the Sustainable Energy Portfolio are in Table 4, below.

| Sustainable Energy Portfolio – Valuation | ||||||

| Value | Delta | |||||

| Item | Company | Symbol | 12/21/12 | 01/20/17 | Delta | Delta % |

| 1 | Cree | CREE | 1,000 | 825 | -175 | -17.50% |

| 2 | First Solar | FSLR | 1,000 | 1,121 | 121 | 12.10% |

| 3 | GT Adv. Tech. | GTAT | 1,000 | 7 | -993 | -99.28% |

| 4 | Lighting Science | LSCG | 1,000 | 57 | -943 | -94.27% |

| 5 | Next Era Energy | NEE | 1,000 | 1,704 | 704 | 70.37% |

| 6 | Sun Power | SPWR | 1,000 | 1,287 | 287 | 28.73% |

| 7 | Solazyme | SZYM | 1,000 | 258 | -742 | -74.22% |

| 8 | Vestas | VWS | 1,000 | 10,659 | 9,659 | 965.93% |

| total | 8,000 | 15,919 | 7,919 | 98.98% | ||

| Values in thousands. | ||||||

| Table 4 | ||||||

The valuation data for the Fossil Fuel Portfolio are in Table 5, below.

| Fossil Fuel Portfolio – Valuations | ||||||

| Value | Delta | |||||

| Item | Company | Symbol | 12/21/12 | 01/20/17 | Amount | Per Cent |

| 1 | BP | BP | 1,000 | 875 | -125 | -12.54% |

| 2 | Chevron Texaco | CVX | 1,000 | 1,054 | 54 | 5.37% |

| 3 | Conoco Philips | COP | 1,000 | 866 | -134 | -13.43% |

| 4 | Exxon Mobil | XOM | 1,000 | 985 | -15 | -1.54% |

| 5 | Royal Dutch Shell | RDS.A | 1,000 | 792 | -208 | -20.81% |

| 6 | Haliburton | HAL | 1,000 | 1,627 | 627 | 62.66% |

| 7 | Transocean | RIG | 1,000 | 335 | -665 | -66.45% |

| 8 | Peabody Coal | BTU | 1,000 | 4 | -996 | -99.56% |

| total | 8,000 | 6,537 | -1463 | -18.29% | ||

| Values in thousands. | ||||||

| Table 5 | ||||||

The market capitalization data for the Sustainable Energy Portfolio are in Table 6.

| Sustainable Energy Portfolio | |||||

| Market Capitalization (Billions) | |||||

| Item | Company | 12/21/12 | 01/20/17 | Delta | Delta % |

| 1 | Cree | 3.90 | 0.82 | -3.08 | -78.97% |

| 2 | First Solar | 2.69 | 2.65 | -0.04 | -1.49% |

| 3 | GT Adv. Tech. | 0.36 | 0.00 | -0.35 | -98.88% |

| 4 | Lighting Science | 0.15 | 0.00 | -0.15 | -100.00% |

| 5 | Next Era Energy | 29.60 | 55.37 | 25.77 | 87.06% |

| 6 | Sun Power | 0.88 | 0.98 | 0.1 | 11.06% |

| 7 | Solazyme | 0.52 | 0.18 | -0.34 | -64.72% |

| 8 | Vestas | 1.48 | 14.09 | 12.61 | 852.03% |

| total | 39.58 | 74.09 | 34.52 | 87.21% | |

| Table 6 | |||||

The market capitalization data for the Fossil Fuel Portfolio are in Table 7.

| Fossil Fuel Portfolio – Market Capitalization | |||||

| Market Capitalization (Billions) | |||||

| Item | Company | 12/21/12 | 01/20/17 | Delta | Delta % |

| 1 | BP | 133.8 | 118.90 | -14.9 | -11.14% |

| 2 | Chevron Texaco | 214.7 | 217.59 | 2.89 | 1.35% |

| 3 | Conoco Philips | 71.2 | 63.43 | -7.77 | -10.91% |

| 4 | Exxon Mobil | 397.7 | 354.55 | -43.15 | -10.85% |

| 5 | Royal Dutch Shell | 216.8 | 228.55 | 11.75 | 5.42% |

| 6 | Haliburton | 32.2 | 49.97 | 17.77 | 55.19% |

| 7 | Transocean | 16.4 | 5.60 | -10.8 | -65.85% |

| 8 | Peabody Coal | 6.37 | 0.03 | -6.34 | -99.53% |

| total | 1089.2 | 1038.62 | -50.55 | -4.64% | |

| Table 7 | |||||

The market capitalization data for the Big Oil portion of the Fossil Fuel Portfolio are in Table 8.

| Big Oil Portfolio – Market Capitalization | |||||

| Market Capitalization (Billions) | |||||

| Item | Company | 12/21/12 | 01/20/17 | Delta | Delta % |

| 1 | BP | 133.8 | 118.9 | -14.9 | -11.14% |

| 2 | Chevron Texaco | 214.7 | 217.6 | 2.89 | 1.35% |

| 3 | Conoco Philips | 71.2 | 63.4 | -7.77 | -10.91% |

| 4 | Exxon Mobil | 397.7 | 354.6 | -43.15 | -10.85% |

| 5 | Royal Dutch Shell | 216.8 | 228.6 | 11.75 | 5.42% |

| total | 1034.2 | 983.0 | -51.18 | -4.95% | |

| Table 8 | |||||

–

Posts in this series:

- L. Furman, 12/21/12, Popular Logistics Sustainable Energy Portfolio

- L. Furman, 2/8/13, Nega-Watts, Nega-Fuel-Watts, Mega-Bucks

- L. Furman, 2/9/13, Gold Bricks and Sink-Holes – The Risk & Reward of Fossil Fuel, Solar & Wind

- L. Furman, 3/2/13, Sustainable Energy Portfolio UP 16% & Fossil Fuel Portfolio Up 1.7% – Since Dec.21, 2012

- L. Furman, 3/23/13, Portfolio Simulation At 3 Months: Sustainable Energy: Up 22%. Fossil Fuels: 3%

- L. Furman, 4/26/13, Earth Day, 2013. Oil Spills, Explosions, Fracking Business As Usual & The Stock Market Response

- L. Furman, 5/13/13, Popular Logistics Energy Portfolios: The Trend Continues.

- L. Furman, 6/24/13, Popular Logistics Energy Portfolios: At 6 months

- L. Furman, 7/22/13, Popular Logistics Energy Portfolios: Sustainable Energy Doubles. Fossil Fuels increase 5.4%

- L. Furman, 8/22/13, Popular Logistics Energy Portfolios: An Exercise in Climate Capitalism

- L. Furman, 9/20/13, Energy Portfolios – Investing for the Future

- L. Furman, 10/21/13, Sustainable Investing – Green Energy, Green Economy

- L. Furman, 11/22/13, Energy Portfolios: Minor Corrections, Overall Results In Line With the Trend

- L. Furman, 12/23/13, Energy Portfolios at One Year Sustainable Energy up 140%. Fossil Fuels up 9.85%

- L. Furman, 12/26/13, Energy Portfolios and Reference Indices, 2013 Summary.

- L. Furman, 1/22/14, Energy Portfolios: 13 Months, Sustainable Energy up 167.4%, Fossil Fuels up 9.44%

- L. Furman, 2/24/14, Energy Portfolios: 14 Months: Sustainable Energy up 184.4%, Fossil Fuels up 8.7%

- L. Furman, 3/23/14, Energy Portfolios: 15 Months: Sustainable Energy up 222.6, Fossil Fuel up 7.3%

- L. Furman, 4/22/14, Energy Portfolios, 16 Months: Sustainable Energy up 204.25%, Fossil Fuel up 15.38%

- L. Furman, 5/21/14, Energy Portfolios, 17 Months: Sustainable Energy up 211.6%, Fossil Fuels up 18.5%

- L. Furman, 6/24/14, Energy Portfolios, 18 Months: Sustainable Energy up 257%, Fossil Fuels up 24.6%

- L. Furman, 6/26/14, Energy Portfolios: 18 Months, Analysis

- L. Furman, 7/22/14, Energy Portfolios: 19 Months: Sustainable Energy up 222%, Fossil Fuels up 25%

- L. Furman, 8/23/14, Energy Portfolios: 20 Months: Sustainable Energy up 229%, Fossil Fuels up 18.4%

- L. Furman, 8/29 /14, Energy Portfolios: 20 Months: Conclusion & Observations

- L. Furman, 10/1/14, The Paradigm Is Shifting; Fossil Fuels Are Becoming Fossils

- L. Furman, 10/7/14, Cree: Strong Financials, But …

- L. Furman, 10/21/14, Energy Portfolios: 22 Months: Sustainable Energy Up But Dropping.

- L. Furman, 11/27/14, Energy Portfolios: 23 Months: Sustainable Energy DOUBLED, Fossil Fuel Down (slightly).

- L. Furman, 12/28/14, Energy Portfolios: 24 Months: Sustainable Energy Up 91%, Fossil Fuel DOWN 10%.

- L. Furman, 1/27/15, Energy Portfolios: 2 Years, 1 Month, Sustainable Up 85%, Fossil Fuels DOWN 15%

- L. Furman, 2/23/15, Energy Portfolios: 2 Years, 2 Months, Sustainable Up 109%, Fossil Fuels DOWN 12%.

- L. Furman, 3/21,15, Energy Portfolios, 2 Years 3 Months: Sustainable up 128%, Fossil Fuel DOWN 16%.

- L. Furman, 4/21/15, Energy Portfolios, 2 Years 4 Months: Sustainable up 138%, Fossil Fuel DOWN 12%.

- L. Furman, 5/21/15, Energy Portfolios, 2 Years 5 Months: Sustainable up 137%, Fossil Fuel DOWN 13.7%.

- L. Furman, 6/21/15, Energy Portfolios, 2 Years 6 Months: Sustainable up 128%, Fossil Fuel DOWN 18%.

- L. Furman, 7/23/15, Energy Portfolios, 2 Years 7 Months: Sustainable up 121%, Fossil Fuel DOWN 24%.

- L. Furman, 8/22/15, Energy Portfolios, 2 Years 8 Months: Sustainable up 102%, Fossil Fuel DOWN 34.3%.

- L. Furman, 8/26/15, Energy Portfolios and “The Correction“.

- L. Furman, 10/1/15, Energy Portfolios, 2 Years 9 Months: Sustainable up 111.3%, Fossil Fuels DOWN 33.5%.

- L. Furman, 10/22/15, Energy Portfolios, 2 Years 10 Months: Sustainable Energy Up 125%, Fossil Fuel DOWN 27%.

- L. Furman, 11/23/15, Energy Portfolios, 2 Years 11 Months: Sustainable Energy Up 129%, Fossil Fuel DOWN 29.6%.

- L. Furman, 12/22/15, Energy Portfolios, 3 Years: Sustainable Energy up 166.6%, Fossil Fuel DOWN 36.2%

- L. Furman, 1/26/16, Energy Portfolios, 3 Years, 1 Month: Sustainable Energy UP 135.6%, Fossil Fuels DOWN 42.8%.

- L. Furman, 2/22/16, Energy Portfolios, 3 Years, 2 Months: Sustainable Energy Up 139.5%, Fossil Fuels DOWN 40.7%.

- L. Furman, 3/24/16, Energy Portfolios, 3 Years, 3 Months: Sustainable Energy Up 159.7%, Fossil Fuels DOWN 33.2%.

- L. Furman, 4/22/16, Energy Portfolios, 3 Years, 4 Months: Sustainable Energy Up 139%, Fossil Fuels DOWN 29.3%.

- L. Furman, 5/22/16, Energy Portfolios, 3 Years, 5 Months, Sustainable Energy Up 122%, Fossil Fuels Down 30%.

- L. Furman, 8/20/16, Energy Portfolios, 3 Years, 6 Months: Sustainable Energy Up 139%, Fossil Fuels DOWN 29.3%.

- L. Furman, 8/20/16, Energy Portfolios, 3 Years, 7 Months: Sustainable Energy Up 125%, Fossil Fuels DOWN 26%.

- L. Furman, 8/22/16, Energy Portfolios, 3 Years, 8 Months: Sustainable Energy Up 138%, Fossil Fuels DOWN 27%.

- L. Furman, 9/26/16, Energy Portfolios, 3 Years, 9 Months: Sustainable Energy up 133.5%, Fossil Fuels Down 31%.

- L. Furman, 10/23/16, Energy Portfolios, 3 Years, 10 Months: Sustainable Energy up 130%, Fossil Fuels Down 26%

- L. Furman, 11/25/16, Energy Portfolios, 3 Years, 11 Months: Sustainable Energy up 93%, Fossil Fuels Down 20%

- L. Furman, 1/1/17, Energy Portfolios, 4 Years: Sustainable Energy up 130%, Fossil Fuels Down 26%

- L. Furman, 1/23/17, Energy Portfolios 4 Years, 1 Month: Sustainable Energy Effectively Doubled, Fossil Fuels Down 18.3%.

–

A co-founder of Popular Logistics, I hold a BS and an MBA in “Managing for Sustainability” from Marlboro College, and over 20 years experience in Information Technology. Available as a speaker and consultant, I can be reached at “Popular Logistics . com” as “L Furman.”